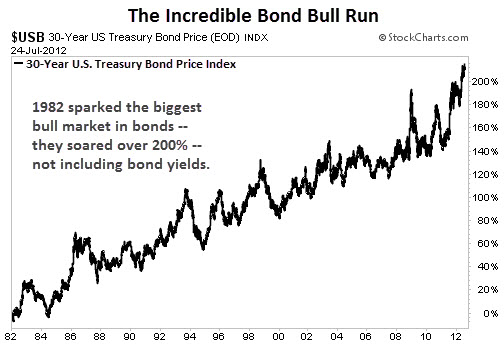

1982 was a great year to become a U.S. bond investor.

At the time, energy prices were high and the economy was in shambles. To make matters worse, the U.S. adopted a tight monetary policy due to high inflation in the 1970s.

The outlook for bonds was bleak. Yields were at all-time highs and prices were at historic lows. At one point the 10-year treasury yielded north of 14%.

While no one realized it at the time, this was the starting point for the biggest bull market in bonds the world has ever known...

Thanks to easing monetary policy, over the next 30 years U.S. treasuries would go on to return 246% in capital gains. Add in the 14% yield that investors would have received over that time, and the total return for government bonds from 1982 to 2012 was 667%.

That translates to an annual return of 22%... and that's from boring, safe bonds, mind you. To give you an idea of how incredible that is, hedge funds generally target a return of 11-12% a year.

Unfortunately, as we told in you a previous StreetAuthority Daily issue, the opportunity in U.S. debt has long since evaporated. The Federal Reserve has used its printing press to push prices to all time highs. Buying bonds now would be suicide. They simply have nowhere to go but down.

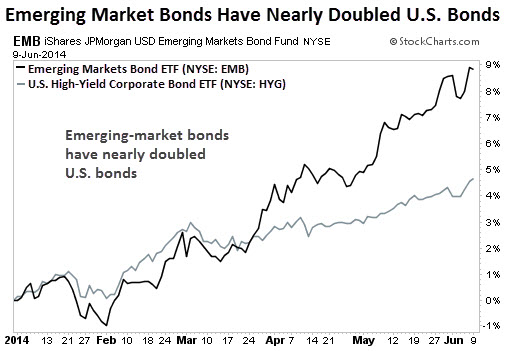

But it's a different story in emerging markets. In fact, right now these countries could be setting up the biggest bond trade since 1982. And like back then, conditions are ripe for incredible returns.

Here's what you need to know...

According to a research report by Goldman Sachs, emerging-market economies will grow from just $2 trillion in 2012 to $80 trillion by 2040. They go on to predict that emerging markets will account for more than 75% of global economic growth over that time.

As emerging-market economies grow into global leaders, their credit ratings will improve. And as a result, they'll benefit from lower borrowing costs -- which should drive bond prices higher. What's more, given the state of emerging-market interest rates, there is a ton of upside in emerging-market debt right now.

The question, of course, is when should investors get in? And how?

StreetAuthority analyst Michael Vodicka answers that question in his June issue of High-Yield International. In his essay, he tells readers why he's growing increasingly bullish on emerging-market bonds...

We're already seeing this trend play out in the bond market. Since the beginning of the year, the iShares JPMorgan USD Emerging Markets Bond (NYSE: EMB) ETF has outperformed its sister U.S. bond fund, iShares Investment Grade Corporate Bond (NYSE: LQD) ETF, while also carrying a higher yield.

But Michael thinks this rally may just be getting started. As he goes on to say...

Now out of fairness to High-Yield International subscribers, I can't show you exactly how Michael and his readers are investing in this trend. But one thing is clear: Emerging-market bonds are on the cusp of a bullish cycle -- similar to the one U.S. Treasury Bonds experienced from 1982 to 2012. If history is any indicator, then there's a big opportunity for investors in emerging-market debt.