On the surface, Fundrise and REITs seem like similar investments. In many respects they are, but there are enough differences to make each unique in the real estate investment space. For example, both center around real estate investment trusts (REITs) and invest in real estate projects or properties.

But the main differences between the two asset classes is in how they invest, what they invest in, and their availability to the general public.

In this article, most uses of the term 'REITs' will reference publicly traded REITs. A publicly-traded REIT is one that trades on popular stock exchanges, and is therefore available to the general public.

Fundrise vs REITs: How Are They Similar?

The two primary similarities between Fundrise and REITs are that 1) the investment focus of each is real estate, and 2) each uses real estate investment trusts.

Both investment types often center on commercial real estate assets, though REITs can also be focused on single-family residential properties. That can include office buildings, retail space, large apartment complexes, warehouses, hotels, student housing and senior housing, among other property types. Each has the potential to generate a combination of ongoing income, through regular distributions of net rental income, as well as capital appreciation upon the sale of individual properties within the fund.

REITs are like mutual funds, except they hold real estate rather than stocks and bonds. They are required to be registered with the Securities and Exchange Commission (SEC), and regularly report to the agency. Legally, they're required to distribute at least 90% of their taxable income directly to investors in the trust. That can make them an excellent sources of regular income. However, keep in mind REITs can lower their taxable income through depreciation.

But the 90% distribution has another advantage. Since its income passed directly through to investors, it's not subject to tax at the corporate level. This avoids the double taxation trap that occurs with common stock, where net income is first taxed as profit to the company, then distributed to investors as taxable dividends.

Since the primary investment is real estate, REITs have a tax advantage coming from depreciation. Since depreciation is a non-cash expense, investors will have the benefit of deducting this 'cost' from the income received from the trust. And as an owner in a REIT, investors each own a pro rata share of all properties held within the trust.

| Feature / Investment | Fundrise | REITs |

| Minimum Investment | $10 | The price of a REIT share |

| Investment Type | Public non-traded REITs (eREITs) | Publicly-traded REITs |

| Accredited Investor Requirement | No | No |

| Fees | 1% annual fee, + 1% redemption fee within the first five years | Expense ratios, generally ranging from 0.6%-1%+ |

| Average Annual Return | 7.31% to 22.99% net of fees | 11.51%* |

| Liquidity | Quarterly redemption option (not guaranteed) | High |

| Available for Retirement Accounts | Self-Directed IRAs (SDIRAs) only | Standard IRA, 401(k), 403(b) and 457 plans |

What Are the Differences Between REITs and Fundrise?

The single biggest difference between REITs and Fundrise is in the availability of their investments. Fundrise REITs and eFunds are available only through the Fundrise platform. For this reason, Fundrise REITs are referred to as non-traded REITs. This is typical of real estate crowdfunding services, which offer their investments only through online real estate platforms.

On the other hand, traditional REITs are publicly-traded REITs because they trade through public markets, like stock exchanges. Examples of popular REITs include the Vanguard Real Estate ETF (VNQ), the iShares U.S. Real Estate ETF (IYR), and the Schwab US REIT ETF (SCHH).

Since they are publicly traded, REITs are much more liquid than Fundrise investments. Investors can buy and sell shares in REITs on any day the financial markets are open.

Still another significant difference between the two investments are the variety of commercial properties they invest in. For example, while Fundrise invests primarily in residential real estate, like multifamily apartment complexes and even individual property deals, REITs offer a wider variety of commercial property types.

REITs also invest in apartment complexes, office buildings, warehouse space, retail shopping centers, single-family homes, and a variety of other property types.

REITs may also have different investment methodologies. While Fundrise investments are in real estate equity, traditional REITs also invest in real estate debt, like commercial mortgages. Unlike equity investments, which provide a combination of net rental income and capital appreciation, debt REITs earn only steady income from the interest earned on the mortgages they hold. Though there is no potential for capital appreciation, debt - or mortgage - REITs provide stable income.

Want more? Check out our Arrived Homes vs Fundrise comparison.

Fundrise vs REITs: Fees and Volatility

Fundrise charges what may be referred to as 'external fees' to their investors. As an investor, you'll pay an annual management fee equal to 1% of the value of your holdings. And if you liquidate your position within the first five years, you'll pay an early redemption fee of 1%.

Popular REITs, on the other hand, typically don’t charge external fees. They have internal fees, commonly referred to as expense ratios. For example, one popular REIT, the Vanguard Real Estate ETF (VNQ), has an annual expense ratio of 0.12% of your investment. But since this fee is charged within the REIT, it often goes unnoticed by investors.

REITs experience considerably more volatility, since they are publicly traded and subject to greater trading activity. The higher level of trading activity results in greater price fluctuations.

In addition, while REITs are not completely correlated with the stock market, they often react in concert with it. For example, if stocks experience a significant decline, REIT prices may fall as well. This is especially true when the same factor causing stocks to fall also negatively impacts REITs. For example, rising interest rates. Since rising rates increase financing costs for both corporations and REITs, they're likely to cause both to decline at the same time.

Volatility is different with Fundrise. Since its eREITs are not publicly traded, they're not subject to frequent price fluctuations. And because redemptions only occur on a quarterly basis, eREIT shares are not subject to daily price swings the way publicly-traded REITs are.

Don't Miss: Fundrise Review: Best Real Estate Crowdfunding Site for Beginners

Who Can Invest in Fundrise?

Much like publicly-traded REITs, Fundrise investments are available for all investors, in all 50 states. Unlike many real estate crowdfunding platforms, Fundrise does not have an accredited investor requirement, though they do have investments available that require accredited investor status.

Virtually anyone with at least $10 and a desire to expand their portfolios to include a position in commercial real estate can invest with Fundrise. But to accommodate the largest number of investors, Fundrise offers five different plans, each designed for progressively more advanced investors. (We'll discuss the specifics of Fundrise investments under How to Invest in Fundrise below).

Are REITs Better for Most Investors?

For most investors, REITs are likely a better choice than Fundrise. They have the advantage of greater liquidity and availability through public stock exchanges, and through brokers and fund families. That means not only greater liquidity, but also the ability to hold REITs in a balanced investment portfolio.

They also offer greater investment variety, holding real estate investments in a wider range of commercial properties, including a debt option, if you prefer income over capital appreciation. You'll also enjoy the convenience of holding REITs in an online brokerage account.

Fundrise is a better choice for investors specifically seeking residential real estate investment opportunities. This is particularly true of the eFunds, which invest in single-family property development and redevelopment, and often not available through REITs. At the same time, it's important to be aware that Fundrise has an average advisory fee of 1% charged each year, compared with an average expense ratio of 0.12% for REITs.

What Is a Fundrise eREIT?

Fundrise eREITs work much like traditional REITs, except they're non-traded REITs, and therefore not available for trading on public exchanges. Since there is no accredited investor requirement with Fundrise REITs, they're open to the average investor.

Though Fundrise eREITs may invest in different real estate markets, the primary focus is on residential properties, like large apartment complexes. The overall investment strategy centers on income producing real estate that offers individual investors a focus on income (from net rental income), capital appreciation, or a balance of both. Unlike traditional REITs, eREITs are equity based, and do not hold debt investments, like mortgages. Investment offerings are available with a low minimum investment of no more than $10.

Investors should be aware that, unlike many competing real estate crowdfunding platforms, Fundrise does not offer investment opportunities in private real estate deals.

Since there is no public market for Fundrise eREITs (or eFunds), each is considered to be a highly illiquid asset. However, Fundrise offers quarterly redemption of your shares on at least a limited basis. Redemption availability will depend on market conditions and cash flows, and may not always be available. For that reason, Fundrise investors should be committed to a long-term investment process.

What Is a Fundrise eFund?

Fundrise eFunds are available through Plus plans through the Advanced and Premium plan levels. The objective of eFunds is to provide greater overall diversification, as well as access to more sophisticated real estate investments. They do this by focusing on a different niche in the residential real estate market, giving investors direct access to single-family properties.

The common investment objective of eFunds is investing in the development and rehabilitation of for-sale housing. This strategy centers on single-family real estate investments, like detached homes, townhomes, and condominiums. Properties are specifically located in high demand urban infill locations and close in suburbs.

Though eFund real estate investments, like eREITs, do have some emphasis on providing dividend income, the primary focus is on maximizing long-term appreciation. Investing in eFunds may require participation by accredited investors only.

What Is the Fundrise IPO?

The Fundrise IPO is available to participants on all plan levels, except the Starter plan. It gives investors an advanced participation in Fundrise stock before it goes public, and is available to other investors outside the platform. Investors will be purchasing shares of Fundrise parent, Rise Companies Corp., rather than in Fundrise itself.

For those enrolled in the eligible plans, the minimum initial investment in the IPO is $1,000. The maximum investment in the IPO is limited to no more than 50% of your real estate principal invested.

No date has been specified as to the public availability of the stock on the stock market. As well, no dividends will be paid to investors in the IPO, and redemption may be limited, suspended, or completely unavailable. The public offering itself is not guaranteed to ever take place, so this investment is a true speculation.

The two heavyweights: CrowdStreet vs Fundrise: How Do You Choose?

Fundrise vs REITs: Which Is Better for Historical Performance?

As reported by the National Association of Real Estate Investment Trusts, or NAREIT (and shown in the comparison table above), the average annual return on publicly-traded REITs is 11.51% over a span of 40 years*.

Fundrise returns are a bit more complicated, since they are derived from a combination of both eREITs and eFunds. In addition, returns are calculated as a combination of dividends, which are paid quarterly, and capital appreciation. Maximum return is achieved with an investment time horizon of at least five years.

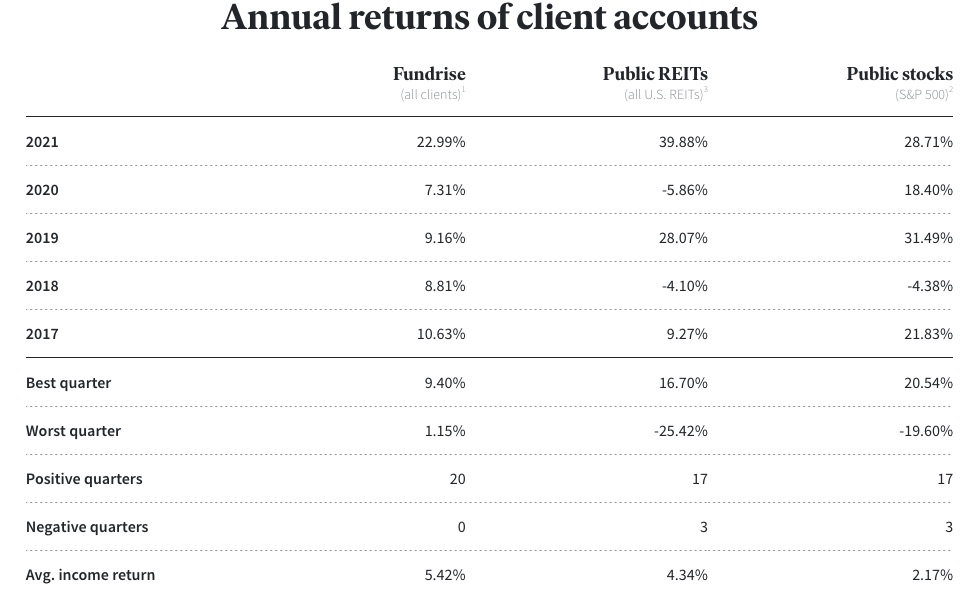

According to the table below – provided by Fundrise – annual investment returns between 2017 and 2021, ranged between a low of 7.31% and a high of 22.99%**. It's difficult to make a direct comparison between Fundrise and REITs based on a five-year performance record, especially since REITs have an average annual return of 11.51% over 40 years.

What we can determine from the table, however, is public REITs outperformed Fundrise in the peak years of 2019 and 2021. But at the opposite end of the spectrum, Fundrise outperformed public REITs in 2018 and 2020. Public REITs had negative performances in both years, while Fundrise investments turned in respectable returns.

Based on the performance of Fundrise investments during down years in the commercial real estate market, it may be the better choice in lowering the costly risk of losing money in market declines.

How Do I Invest in Fundrise or REITs?

The main difference in how to invest in either Fundrise or REITs is in where you buy them. Fundrise investments are available only on the Fundrise real estate crowdfunding platform, while REITs can be purchased through a financial institution, including investment brokers and fund families.

Ready to compare? Check out our Diversyfund vs Fundrise head-to-head comparison.

How to Invest in Fundrise

To participate in Fundrise investments you must register for membership on the platform. When you sign up, you can fund your account by linking a bank account to your Fundrise account, using ACH transfers.

The investments you make will be determined by the specific Fundrise plan you select. For example, you can invest directly in eREITS with the Core, Advanced and Premiums plans, and in the Fundrise eFund with the Advanced and Premium plans.

The five plans offered by Fundrise are as follows:

- Starter. This plan is designed for new and small investors, who can begin investing with as little as $10. Participants can set up a limited number of investment goals, and take advantage of dividend reinvestment. The eREIT mix is determined by Fundrise.

- Basic. Offers all the features of the Starter plan, but has a minimum investment requirement of $1,000. The eREIT mix is determined by Fundrise. The plan enables investors to have access to the Fundrise IPO.

- Core. Has all the features of the first two plans, but enables participants to create a customized portfolio strategy, as well as to directly allocate funds within that portfolio. It requires a minimum investment of $5,000.

- Advanced. With a minimum required investment of $10,000, this version offers all the features of the Core plan, but also adds optional access to Plus plans. These are more advanced investment strategies, with both higher risk and rewards, and are made available through Fundrise eFunds. Those funds are invested in the development and rehabilitation of single-family homes. It's the type of investing more closely related to the 'fix-and-flip' renovations on many TV shows.

- Premium. This is the plan level designed for accredited investors. The minimum investment is $100,000. It has all the features of the Advanced plan, but also provides access to private equity funds specializing in less common commercial real estate deals.

How to Invest in REITs

REITs can be purchased either through investment brokers or directly through the fund families that issue them. The minimum investment required for a REIT ETF is the amount necessary to purchase a single share in the trust. For example, if the current share price of a specific REIT is $45, that will be the minimum required investment. REIT mutual funds can have much larger minimums. For example, the Vanguard Real Estate Index Fund Admiral Shares has a $3,000 minimum.

Beyond the minimum initial investment, you can choose the dollar amount you want. For example, you can invest $1,000 in several shares of the same REIT. If you invest through an investment broker, you'll generally be able to purchase fractional shares as well.

Naturally, you'll need to open an account with either an investment broker or a fund family. To fund your account, you'll typically link your bank account and transfer funds by ACH.

One of the advantages of investing in REITs through either a broker or a fund family is that you'll also be able to purchase other investments. You'll be able to create a diversified portfolio that can include stocks, bonds, and various investment funds.

Don't Miss: REITs vs Real Estate Crowdfunding: Which Is Best?

Summary

Real estate is an excellent diversification in a balanced portfolio. Whether you choose to do that using REITs or real estate crowdfunding will depend on your own investment preference and risk tolerance. One thing is certain, there are several real estate crowdfunding platforms to help you accomplish your financial goals. Check out the 10 Best Real Estate Crowdfunding Sites for 2022.

You can learn more about Fundrise here!

References:

*https://www.reit.com/what-reit

https://investor.vanguard.com/etf/profile/VNQ

https://www.investor.gov/introduction-investing/general-resources/news-a...

https://fundrise.com/education/reits-101-a-beginners-guide-to-real-estat...

**https://fundrise.com/track-record