CrowdStreet is one of the original real estate crowdfunding platforms, launching in 2012 to offer commercial real estate investments to accredited investors. With a stringent deal review process and high-caliber sponsors that manage each project, CrowdStreet has separated itself as a high-quality real estate investing platform.

Since 2012, CrowdStreet has realized an over 18% internal rate of return (IRR), with an equity multiple of almost 1.5x. This performance is largely due to investing only in institutional-grade commercial real estate projects in a wide range of markets, netting high returns in a short amount of time. With an average holding period of 2.5 years, CrowdStreet projects are fully-realized (sold) to complete deals fairly quickly.

CrowdStreet maintains a high-level of transparency, with a plethora of deal details and updates available while investments are open, and full investment summaries on closed deals. This allows investors to dig deep into a deal before choosing an investment, and even connect directly with the deal sponsors to get questions answered.

Overall, CrowdStreet offers strong returns from well-researched commercial real estate deals, offering online access for accredited investors to diversify their holdings into a new asset class.

Do People Make Money on CrowdStreet?

CrowdStreet, which is one of our best real estate crowdfunding sites for 2022, offers one of the highest IRRs for crowdfunded real estate investments. These returns are a combination of rents collected, capital improvements, and market appreciation. While some properties offer monthly or quarterly distributions, others offer no regular distribution, with profits realized after the deal is completed.

Crowdstreet investors earn money in several ways, with each investment offering different payout options.

Distributions

Some property deals offer regular distributions from the deal’s cash flow, including rents collected. These payments may be monthly, quarterly, or annual, with intervals set at the discretion of the project sponsor.

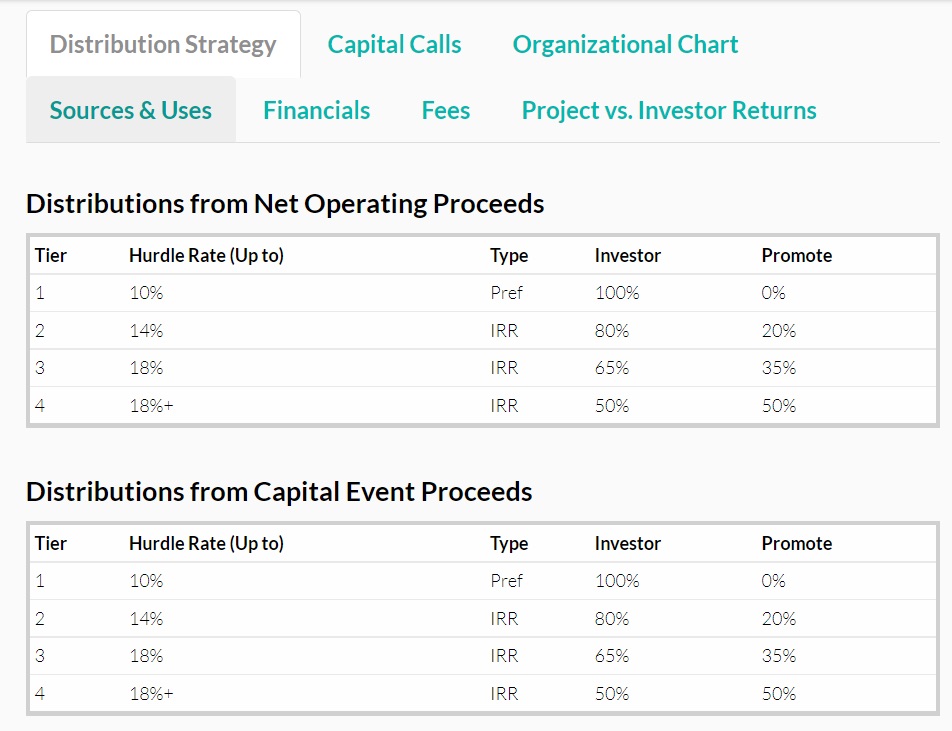

These distributions are not available for every project and may vary from project to project, so you will need to review the project details to find more information. For example, the project shown below offers full distribution on up to 10% IRR to investors from operating proceeds (rents, etc.), and then reduced distributions as returns rise. It follows the same distribution path for capital gains (upon sale of property).

Capital Gains

Capital gains are paid out upon the sale of a property, making it a “fully realized” deal. While some projects allow investors to share in operating income as well as capital gains, other projects just pay out capital gains distributions, re-investing operating income back into the property to boost overall capital gains.

These amounts will vary per project, but are generally considered long-term capital gains, as most properties are held for longer than one year.

CrowdStreet Returns: Quick Facts

- 18.4% IRR since 2012. Crowdstreet has averaged over 18% IRR on its closed deals since inception, giving investors an average annual return of 18.4%.

- Over 560 deals funded. CrowdStreet has funded over 560 deals since 2012, partnering with top commercial real estate sponsors to select the highest-quality investment properties around the U.S.

- Over $2.6 billion invested. CrowdStreet investors have invested billions of dollars into commercial real estate opportunities on the platform since 2012.

- 76 deals have been realized. CrowdStreet sponsors have sold 76 properties since 2012, capturing market appreciation and paying out capital gains to investors.

- Over $360 million in distributions. CrowdStreet has paid out hundreds of millions in distributions to investors since 2012. In addition to rental income, this includes capital gains on fully realized deals.

- 1.48x equity multiple. Crowdstreet has had a 1.48x equity multiple since inception, which is the ratio of the total cash distributions received from an investment to the total equity invested.

- 2.5 year average holding period. The average holding period of a CrowdStreet investment is 2.5 years. Holding periods vary per project.

- Stringent review process. CrowdStreet only selects 5 deals out of every 100 reviewed.

Need more? Check out: What Is CrowdStreet and How Does CrowdStreet Make Money?

Performance on Closed Deals

CrowdStreet is very transparent about its performance, and gives detailed insight into its closed deals. Here’s a summary of deal performance on CrowdStreet:

| Metric | CrowdStreet Performance (fully-realized deals) |

| Internal Rate of Return (IRR) | 18.6% |

| Equity Multiple | 1.48x |

| Hold Period | 2.5 years |

Here are some details of closed deals in each CrowdStreet investment option:While this performance is much higher than most crowdfunded real estate platforms, it’s important to understand the different types of investments and how they perform over time.

Opportunistic Deal Performance

These deals are characterized by high upside potential, but higher risk profile. These projects include ground-up development, start with little or no cash flow, and may take longer to realize a profit.

Since inception, CrowdStreet investors have invested in 165 opportunistic deals, with 13 deals having been fully realized with an average IRR of 11.8%. The highest return project had an 88.4% IRR.

Here are the details of a few fully-realized opportunistic deals.

Burnside

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 22.0% | 49.9% |

| Equity Multiple | 1.93x | 1.73x |

| Hold Period | 4.0 years | 1.3 years |

Alpha Wave Residential Fund II

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 22.0% | 88.4% |

| Equity Multiple | 1.5x | 1.49x |

| Hold Period | 5.0 years | 0.46 years |

RREAF Gulf Coast Portfolio II

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 34.6% | 25.7% |

| Equity Multiple | 2.7x | 2.0x |

| Hold Period | 3.0 years | 3.2 years |

Addison Corporate Center

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 34.9% | -29.1% |

| Equity Multiple | 2.46x | 0.27x |

| Hold Period | 3.0 years | 3.6 years |

Value-Add Deal Performance

These deals are characterized by improving the property (capital improvements, etc.) to increase cash flow and market appreciation.

Since inception, CrowdStreet investors have invested in 257 value-add deals; 42 deals have been fully realized with an average IRR of 20.2%. The highest return project had a 42.8% IRR.

Here are the details of a few fully-realized value-add deals.

1924 Franklin

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 18.1% | 18.9% |

| Equity Multiple | 1.6x | 1.59x |

| Hold Period | 3.0 years | 2.6 years |

Willow Creek GSO Portfolio

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 19.9% | 16.3% |

| Equity Multiple | 2.23x | 1.6x |

| Hold Period | 5.0 years | 3.3 years |

Silver Star Portfolio

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 14.9% | 26.8% |

| Equity Multiple | 1.86x | 2.1x |

| Hold Period | 5.0 years | 3.4 years |

Old Taylor Road Cottages

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 20.8% | 103.% |

| Equity Multiple | 2.31x | 1.17x |

| Hold Period | 5.0 years | 1.6 years |

Core-Plus Deal Performance

These deals are characterized as high-quality properties that are mostly (or fully) occupied, but set aside funds for maintenance and property improvement, lowering annual income payouts to investors.

Since inception, CrowdStreet investors have invested in 90 core-plus deals, with 6 deals having been fully realized with an average IRR of 12.6%. The highest return project had a 19.7% IRR.

Here are the details of a few fully-realized core-plus deals.

Allen Medical Office

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 13.0% | 18.6% |

| Equity Multiple | 2.0x | 1.68x |

| Hold Period | 8.0 years | 3.2 years |

Bay Tec & Airport Corporate Center

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 13.1% | 19.7% |

| Equity Multiple | 1.73x | 1.52x |

| Hold Period | 5.0 years | 2.4 years |

Mainstreet Bloomington

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 14% | 12.1% |

| Equity Multiple | 1.3x | 1.14x |

| Hold Period | 2.0 years | 1.2 years |

Fairfield Inn & Suites

| Details | Target | Actual |

| Internal Rate of Return (IRR) | 10.0% | 7.5% |

| Equity Multiple | 1.22x | 1.1x |

| Hold Period | 2.2 years | 1.4 years |

Core Deal Performance

These deals are characterized by stable income and fully occupied properties that are in major markets with no substantial maintenance or improvements needed.

CrowdStreet investors have invested in only 11 core deals, and none have been fully-realized as of yet.

CrowdStreet’s Ongoing Deals

CrowdStreet offers a wide selection of ongoing deals to choose from, within four types of investment properties (opportunistic, value-add, core-plus, core). Here are a few current investment options on CrowdStreet:

Opportunistic Current Deal: Park Place Nashville

| Details | Target |

| Internal Rate of Return (IRR) | 23.9% |

| Equity Multiple | 2.0x |

| Hold Period | 6.0 years |

Value-Add Current Deal: The Link Apartments

| Details | Target |

| Internal Rate of Return (IRR) | 17.0% |

| Equity Multiple | 2.0x |

| Hold Period | 5.0 years |

There are no current Core-Plus or Core deals available, but may be added at any time. Check out more from CrowdStreet.

What Is IRR in Real Estate?

The internal rate of return (IRR) in real estate refers to the expected annual return over the life of a real estate investment. This includes comparing the initial investment to the expected returns over time. This helps investors understand the average annual return of a real estate investment, not just the yearly income.

It is also important to know the projected IRR of a deal to ensure the cost of capital is worth it. For example, a 20% expected IRR may sound like a good investment, but if the cost of capital is 21%, then the deal will not turn a profit. Overall, IRR helps investors understand the average annual returns expected, even if those returns are not realized until the deal is completed.

Summary

CrowdStreet offers high returns for accredited investors in a unique asset class, though the minimum investment is higher than some crowdfunded real estate platforms. With a list of high-quality sponsors that manage each deal, to a detailed review process for picking investments, CrowdStreet is our top overall pick for accredited investors, as well as the No. 1 overall pick for crowdfunded real estate platforms.

Want to learn more? Check out our full CrowdStreet review.

References:

https://www.crowdstreet.com/deal-review/

https://www.crowdstreet.com/marketplace-performance/

https://www.crowdstreet.com/invest/