Let's be honest. When you hear about a stock that yields 12% or more, your first thought should be that the company is probably a basket case that can't even turn a profit. If it's offering a yield that sounds too good to be true, it probably is.

And you'd be right most of the time. Usually, yields are this high because a company's share price is falling -- signaling underlying problems in its business. A lower share price gives a higher dividend yield. That means profitable companies paying yields this high should be rare.

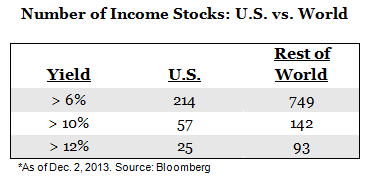

In fact, my staff and I recently ran the numbers. When we looked only at the companies that turned a profit over the past year, we found just 25 U.S. common stocks paying yields of more than 12%.

Here, you can see the 10 highest yields for yourself:

But did you know there are actually 93 other stocks that yield 12% or more out there from profitable companies? The difference is that many investors just don't know where to find them.

That's because the majority of the world's highest yields aren't being paid by U.S. companies. My recent search found 93 additional stocks out there yielding 12% or more... all coming from international companies.

That means many income investors are essentially missing out on 79% of the highest yields before they even get started.

I've researched this topic for years. And the fact is, foreign companies are simply paying higher yields across the board.

?Take a look at the table to the right.

You can see the difference between what we get from U.S. companies and what's available from international companies. Keep in mind that I only looked at the common stocks of companies that were profitable over the past year.

As Judy Sarayan, a fund manager at mega-investment firm Eaton Vance explained, 'There's a much stronger dividend culture abroad... individual investors play a larger role in those markets, and they have always demanded more dividends.'

On a macro scale, the difference is striking. While the average yield for all stocks in the S&P 500 is less than 2.0%, Canada's average yield is 3.0%... Brazil's average yield is 4.4%... the United Kingdom yields 3.8%... Australia yields 4.3%... New Zealand pays 4.5%.

But where you really start to see a dramatic difference is when you look at some individual examples of higher yields abroad.

Take banks, for instance. Here at home, Bank of America (NYSE: BAC) used to pay investors $2.56 per share before the financial crisis. That represented a yield of more than 6.0%.

Of course, we all know what happened next. Today, BAC pays a laughable $0.01 (yes, one penny) each quarter.

But it's a completely different story outside the United States.

Spanish bank Banco Santander (NYSE: SAN) is a perfect example.

Santander is among the world's largest banks -- it's even ranked in the top 50 of Forbes' list of the world's largest companies. In total, Santander takes in a staggering $80 billion in revenue each year.

Today, the company pays dividends that total $0.79 per share each year. That gives the stock a yield of over 7% at recent prices.

It's the same thing for utilities. They are one of the best places to search for yields in the U.S. North Carolina's Duke Energy (NYSE: DUK) pays a yield of about 4.5%. But that is topped by international utility stocks like Brazil's AES Tiete (OTC: AESAY).

AES Tiete is one of Brazil's largest independent power producers engaged in the generation and sale of electric power through hydroelectric plants.

The company paid investors $1.06 in 2013, for a trailing yield of 14%. Compare that to the Dow Jones Utility Average, an index that tracks 15 U.S. utility stocks, which yields just under 4%.

Still, most U.S. investors are simply unaware that they're missing out on high yields like these.

I want to make something clear, though. I don't think you should drop everything and put every dollar you have into international high-yielders. Truth is, the size and scope of the U.S. market makes it a great place to search for income investments.

But limiting yourself to only U.S. stocks is like going to a restaurant and limiting your options to just one side of the menu. Sure you can find something you like... but wouldn't you rather see all the options?

And one more thing -- not every one of the 93 stocks is available stateside, but don't worry, you can buy many of these without even leaving the U.S. markets.

I have more details -- including several names and ticker symbols -- in a presentation I recently put together. You can visit this link to read it now.

This article originally appeared on Dividend Opportunities as: 10 Stocks Yielding 12%-Plus