Last week, I told you about a simple strategy that's never lost money.

In case you missed it, I argued that the longer you hold an investment, the better your chances of making a profit. The S&P 500 has never had a losing 20-year span, going all the way back to the 1950s.

The key is finding a handful of companies that enjoy huge (and lasting) advantages over the competition... companies that pay their investors each and every year by dishing out fat dividends... and companies buying back massive amounts of their own stock.

Once you find them, the strategy is simple -- just buy their shares and hold forever.

But if you want to see the best reason why 'Forever' investing is the smartest way to let the market make you wealthy, pay attention to the table below...

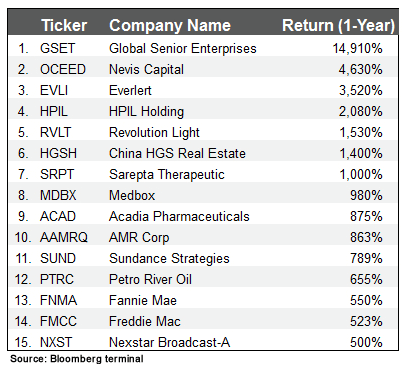

I recently ran a simple stock screen on my research team's Bloomberg terminal. I asked this piece of research software to show me all the stocks in the United States that have returned more than 500% in the past year. And to weed out the fly-by-night micro-cap stocks, I had it return only stocks with a market cap above $250 million. You can see the results for yourself.

It's just 15 stocks out of more than 3,000 traded on U.S. exchanges. That's the definition of trying to find a needle in a haystack.

In fact, I bet you've never even heard of any of these stocks, save for once-troubled Fannie Mae and Freddie Mac... much less own any of them. Most are pink-sheet stocks that are traded over-the-counter rather than on public exchanges.

In other words, out of thousands of stocks, you probably don't have a remote chance of finding a stock that returns over 500% in one year -- much less one that you'd want to risk a good portion of your hard-earned money on.

But there is still a way to more realistically earn returns of 500%, 1,000% or more on your money. And it's much less risky and easier than you would ever think possible.

With this in mind, I ran the exact same screen... only I changed the time period to the past 10 years. The results are like night and day.

Over the last 10 years, 280 stocks returned more than 500%... More than 18 times as many as the past year. It's also worth mentioning that many of these are established companies -- more than half paid a dividend.

That's because the market's greatest stocks -- not the extremely risky plays that skyrocket and crash seemingly overnight -- take years to reach their full potential.

They won't do it in one year... or even two or three years. But in the meantime, investors who hold these stocks are able to steadily compound their gains year in and year out.

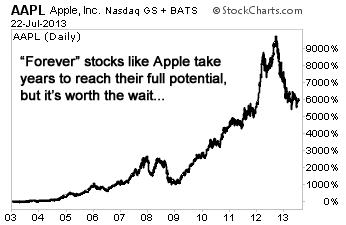

Take a well-known case -- Apple (Nasdaq: AAPL). Apple has been one of the market's best performers for years.

Even in the stock's best one-year period, investors made 202%.

I wouldn't sneeze at a 202% gain, but anyone who bought for a year... or an even shorter time... sold themselves short.

You can see from my chart that Apple wasn't done after six months or a year...

Sure, Apple has pulled back recently, but those who held forever are still up big time.

Since 2003, Apple has gained over 6,000%, including dividends. That's an average annual gain of 49% and enough to turn every $100 invested into $12,000.

Now you can see why buying the right stocks and holding forever is the best way I've found to earn four-digit gains.

Investing for a short period in a stock like Apple is like ordering a 7-course meal and only sticking around for the appetizer. Sure you get a taste... but wouldn't you rather have the whole meal?

And yet, as I told you last week, the average holding period for a stock is now down to just seven months.

I think that's a mistake. I'm not saying you should buy and hold every investment for decades. But what I've discovered -- and wish I had realized sooner -- is that it's the few investments you simply buy and hold forever that make the biggest difference to your long-term wealth.

It's one of the reasons my Top 10 Stocks staff and I started researching the best stocks we think investors can hold forever.

What we found was that many of the stocks we tagged as 'Forever' ideas were already owned by many of the world's richest investors, politicians, and businessmen -- including Warren Buffett, George Soros, and John Kerry.

It's also no surprise that eight out of 10 of these 'Forever' stocks pay a dividend -- with yields from 3.8% to 6% or higher. Readers who have followed me for a long time know that I rarely invest in stocks that don't pay a dividend.