As you might expect, gold has been the single-biggest beneficiary of the recent market turmoil.

With prices racing to $1,800 an ounce, the metal has lived up to its reputation as a reliable hedge in turbulent times -- delivering an average year's worth of gains in less than 30 days.

Normally, this would mean good news for the companies that actually dig the stuff out of the ground. As the prices of precious metals rise, the stock prices of the companies that mine those metals often move in lockstep.

But gold miners haven't been as fortunate. As gold prices rose, most gold-mining stocks were sucked into the same black hole that ensnared other equities, providing a temporary situation that investors can profit from.

The divergence of gold prices and gold miner prices is an example of a classic market disconnect. Historically, the two move in lockstep -- when gold prices rise, gold miner prices rise proportionally. When gold prices fall, gold miner prices fall right alongside.

The logic is simple: When gold prices rise, the mining companies sell their gold for higher prices, and make more money. The opposite is also true: When gold prices fall, gold miners make less for every ounce of gold they mine, and the company suffers.

We've seen the prices of gold bullion and gold equities get completely out of whack several times in recent years. And when the market regains confidence, the divergence tends to correct itself.

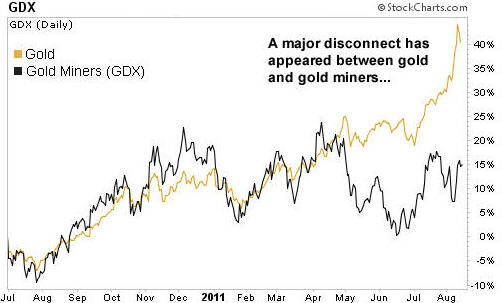

After marching together for most of the past year, notice the divergence that has opened up between gold stocks and gold bullion:

This chart shows the return of gold versus the Market Vectors Gold Miners ETF (NYSE: GDX), a proxy for gold mining stocks. If you look back over a five-year period, the difference is even more striking.

This situation looks remarkably similar to November 2008. Much like today, stocks of all shapes and sizes were plummeting amid the financial crisis, with mining stocks suffering an overdone 60% selloff. But gold stood its ground.

However, these imbalances usually don't last long. As you can see from the chart below, once the crisis abated, gold-mining stocks came racing back:

That's because the market is very logical, and doesn't like to be out of whack. So when you see a market disconnect, you can almost always count on a correction.

In this case, there are two ways for that to happen: (1) Gold bullion is overpriced and will fall to match gold miners. (2) Gold miners are undervalued and will pop up to match gold prices.

Since we know that the dip in mining stocks was caused by the recent waves of market volatility -- and not a major change in their fundamentals -- it's much more likely that they're undervalued and will see a rise in their prices in the coming months. That makes now the perfect opportunity for a major upside.

Fortunately, I recommended that readers of my Market Advisor newsletter start accumulating shares of GDX in November 2008, when most other investors were still running for the exits. The shares bottomed shortly thereafter and doubled in price in the following seven months. I collected my profits in June 2009, once the gap narrowed.

Now, I'm not necessarily saying we'll see a repeat of that performance; the disconnect was more pronounced back then. But for those of you looking for some exposure to gold, then mining stocks may be your best bet.

The Investing Answer: If history is any indicator, then gold stocks are ready for a rebound, making right now a potential buying opportunity for mining companies.