What is Beta?

Beta is a measure of a stock's volatility relative to the overall market. It is most often calculated using a stock's movements relative to the S&P 500 Index over the trailing 12-month period.

How Does Beta Work?

A stock's beta is determined by analyzing how much its return fluctuates in relation to the overall market return. A stock with a beta of 1.0 will tend to move higher and lower in lockstep with the overall market. Stocks with a beta greater than 1.0 tend to be more volatile than the market, and those with betas below 1.0 tend to be less volatile than the underlying index. Stocks with betas of zero generally move independently of the broader market. And finally, stocks with negative betas tend to move in the opposite direction relative to the broader market. When the S&P tumbles, stocks with negative betas will move higher, and vice versa.

For example, a stock with a beta of 2.0 is usually twice as volatile as the broader market. If the S&P 500 were to fall by -10% next year, then the stock would be expected to fall about -20% (assuming that the stock behaves similar to how it has in the past). The stock would also be expected to gain more in an up market.

Beta is a measure of systematic risk.

Why Does Beta Matter?

Individual stock betas are extremely important when putting together a portfolio of assets. A diversified portfolio consisting of assets with different betas lowers the overall risk of the portfolio.

Investors should note that beta is calculated using past price fluctuations and does not ensure that a security will behave the same going forward. Beta is used (most frequently in the Capital Asset Pricing Model, or CAPM) to forecast expected return of a stock or portfolio, not the actual return.

Stock Beta Meaning

Looking to understanding how beta works for individual stocks?

Perhaps no sectors embody the notion of beta like the technology and utility sectors. An electric utility company such as New York-based Con Ed (NYSE: ED) is the proverbial tortoise in the race against the hares, with a beta of 0.18. Its dividend grows just 1% every year but is as predictable as the sunrise. That is not necessarily a virtue to younger investors who seek stocks capable of robust share price gains.

Younger investors may prefer tech stocks, which are famous for surging and crashing. Perhaps the most popular high-beta stock of the past decade has been Apple (Nasdaq: AAPL), which rose more than +1,000% from 2010 through 2020, but has experienced multiple declines of -25% or more over that timeframe. Although the company's overall returns have been impressive, those types of pullbacks are often hard to stomach for conservative investors who are nearing retirement.

But wait: Why can't aging investors latch on to a fast-moving high-beta stock like Apple? They can and do. Indeed, it's wise to hold a few high-beta stocks in an otherwise low-beta portfolio. They can add some growth to a portfolio that is otherwise mostly focused on income.

How to Calculate Beta for Your Portfolio

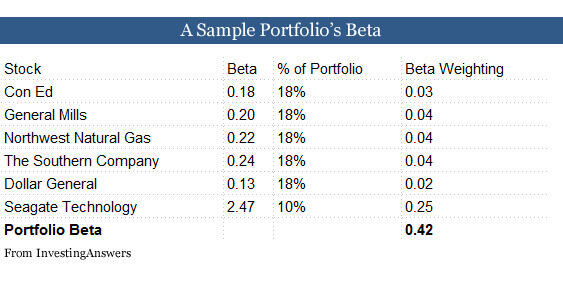

The key is to know the beta of your portfolio, and calculating it is quite simple. Let's presume you own five low-beta stocks (which account for 90% of your portfolio), with the remainder of your portfolio in computer component maker Seagate Technology, which has a beta of 2.47.

Simply multiply each stock's beta by the percentage it is in your portfolio, and then add up the figures. Here's an example.

Even with the addition of a high-beta stock, this portfolio still has a total beta of only 0.42, which is quite low.

It may be helpful to first establish what kind of portfolio you want to have. Perhaps you would like it to be neither too risky nor too conservative, and therefore seek a portfolio of a beta of 1.0. If your current portfolio is above or below that figure, you can sell certain stocks and replace them with others that help bring the beta toward the 1.0 mark.

Investors tend to buy and sell stocks without paying attention to the broader risk profile. By tracking the beta of your portfolio, you'll develop a very clear sense of whether you are too tilted toward growth or risk aversion.