What Are Shares Outstanding?

Shares outstanding (or outstanding shares) are the total number of shares currently owned by a company’s shareholders. This number includes the number of shares that the public can buy and sell, as well as restricted shares that require special permission before being traded.

What Does Shares Outstanding Tell You?

Shares outstanding tell you how many shares a company has issued that are still owned by shareholders. This amount will fluctuate over time. Shares outstanding will either increase if a company decides to issue additional shares or decrease due to a share repurchase (which means the company has bought back its shares).

Where to Find Outstanding Shares

Shares outstanding are located on a company’s balance sheet and listed under the shareholders’ equity section. They can also be found on the company’s annual report in the capital section. The number of outstanding shares may also be used to calculate the company’s market capitalization: the current stock price multiplied by the number of shares outstanding.

Can You Buy Shares Outstanding?

Yes. Unless they are restricted and require special permission, outstanding shares can be freely bought and sold by the public.

Who Owns Shares Outstanding?

Investors of the company own the outstanding shares. Investors include either the public or corporate affiliates (such as executives and directors).

Number of Shares Outstanding Formula

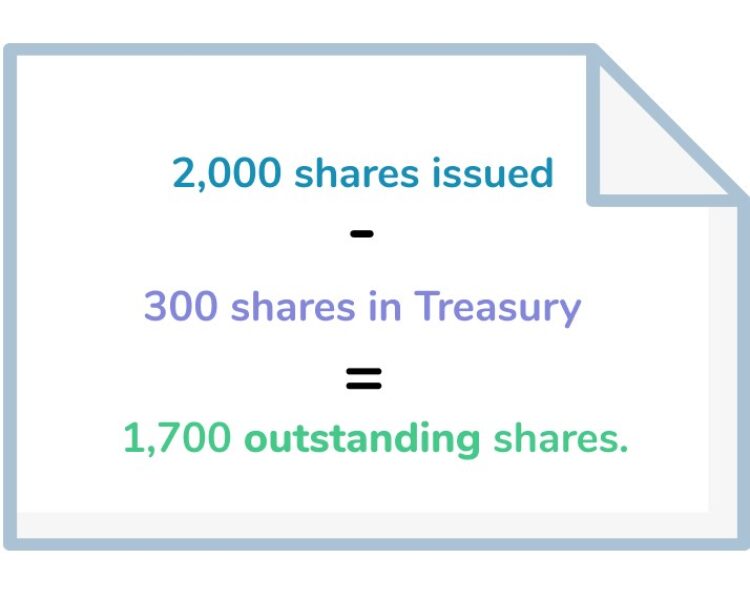

You can calculate the shares outstanding by taking the total shares issued minus the number of treasury shares that have been repurchased by the company. This number also represents the number of available shares on that company’s open market.

.jpg)

How Many Outstanding Shares Can a Company Have?

A company can’t have more shares outstanding than the authorized total number of shares. This amount is laid out in the company’s articles of incorporation. The initial number of shares outstanding is determined when the investment bank sets the company’s initial public offering (IPO).

Example of Calculating Outstanding Shares

Company ABC’s balance sheet indicates a total of 2,000 issued shares and the company keeps 300 shares as treasury shares. To calculate shares outstanding:

Take the total shares (2,000) and subtract the shares in its treasury (300). The total number of outstanding shares is 1,700.

Are Outstanding Shares Stable?

The number of outstanding shares is not stable and regularly fluctuates, depending on the transactions executed by the company. If a company buys shares back, it will decrease the number of outstanding shares. If the company issues more shares, the total number of outstanding shares will increase. This fluctuation will also affect the price and earnings per share.

Outstanding Shares vs. Floating Shares

While outstanding shares represent shares held by both the public and company affiliates, floating shares represent the number of shares available to trade. When you subtract the restricted shares from the total amount of shares outstanding, floating shares is the result. Floating shares provide a narrowed view of the company’s active shares.

Are Outstanding Shares Diluted?

Outstanding shares can be diluted. Fully diluted shares represent the total number of common shares that would be available to trade on the open market after all sources of conversion are executed. These sources of conversion include convertible bonds and employee stock options.

Are Subscribed Shares Outstanding?

Subscribed shares are not considered outstanding because they have yet to be issued. They represent the number of shares investors have committed to purchasing and are usually part of an initial public offering (IPO). Once these subscribed shares are issued, they become outstanding shares.

Ask An Expert About Outstanding Shares

Are Outstanding Shares Good or Bad?

Outstanding shares can be either good or bad, depending on how the total number affects share prices, earnings, and availability. Increasing the amount of outstanding shares can lead to share dilution and negatively affect existing investors. Simultaneously, increasing the total number of outstanding shares may also increase the company’s capital and provide resources for further growth.

Can Outstanding Shares Be Negative?

Sometimes, a company will buy back the number of shares outstanding in order to increase the stock’s value and improve financial statements. This buyback is called a share repurchase. A share repurchase will cause the number of outstanding shares to decrease. A company can only buy back the number of shares that are available. Therefore, shares outstanding can not be negative.