What is Liability Matching?

Liability matching is an investing strategy for investors who need to fund a series of future liabilities.

How Does Liability Matching Work?

Buy-and-hold and indexing strategies are about generating steady rates of return in a portfolio. But a structured portfolio strategy (also called a dedicated-portfolio strategy) is for investors who need to make sure their portfolios are worth a specific amount at a certain point in the future, usually because they need to fund future liabilities such as tuition or retirement. Liability matching is one of two kinds of structured portfolio strategies (the other is immunization), and it is intended for investors who need to fund a series of future liabilities (the immunization strategy is generally for investors who need to fund one lump-sum future liability).

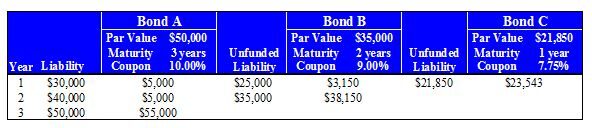

To apply the liability matching strategy, the investor first purchases an instrument with a face value or eventual maturity that is equal to the amount of the last liability in his time horizon. The investor then reduces the remaining liabilities in the liability stream by this bond’s coupon payments and purchases another bond to fund the next-to-last liability equal to the amount of the liability less any coupon payment from the first bond. The investor goes backward in time using this approach until all the liabilities are matched by interest and principal payments from the portfolio. Below is an example for an investor with three years of liabilities.

Liability matching requires the investor to calculate and time his or her future liabilities, which isn’t always easy or accurate. However, liability matching does not require the investor to set the duration of the portfolio equal to the investor's time horizon (this is called duration matching), nor must he constantly buy and sell to rebalance the portfolio unless a particular bond’s credit risk becomes unacceptable. Thus the liability matching approach generally has a lower sensitivity to changes in interest rates than the immunization approach. These are great advantages, but it is important to note that liability matching can be more expensive than immunizing because it often requires overfunding in order to ensure that the future liabilities are covered.

Why Does Liability Matching Matter?

When executed well, liability matching can provide terrific returns (and tremendous peace of mind) to investors. After all, the intended result is an income portfolio that has an assured return for a specific time horizon. One vulnerability in this strategy is that it assumes there are no defaults. But as is almost always the case, the lower the quality of securities the investor purchases, the higher the risk those securities carry and the higher the possible return (or loss). Further, using callable securities or those with embedded options may add return potential, but if these securities are called before they mature, this can eliminate some of the coupon payments.