What Is a Short Sale?

In investing, a short sale occurs when an investor sells a stock they don’t own yet. They borrow the stock from a broker-dealer and ideally sell it at a high price. Later, they have an obligation to buy the stock back (ideally at a lower price than what they borrowed for). The investor’s goal is to make a profit between the sale and purchase price if they feel that the stock price will decline.

In real estate, if a homeowner cannot make their payments, they may receive permission from the lender to list their house for sale at a lower price than what’s owed on the home (therefore avoiding foreclosure). During troubling times when unemployment levels are high, you may find a short sale right in your own neighborhood.

How Does a Short Sale Work?

With a short sale order, investors sell borrowed securities because they feel that the stock price will decline. Afterward, they must return the same number of shares to the broker-dealer they initially borrowed them from. They ideally profit from the difference between the sale price and the price the stock declined to.

In the real estate industry, a short sale may be a choice for homeowners who fall behind on their mortgage payments. If approved by the lender, they can sell their property (via short sale) for less than they owe on their loan to avoid foreclosure. All of the proceeds will go to the lender who can either forgive the remaining amount owed or require the borrower to pay it back.

Who Benefits from a Short Sale?

From an investing standpoint, traders can capitalize on a declining market by selling high and buying low. This strategy can strengthen the market by identifying which firms are overvalued or have questionable accounting/operational practices. Additionally, brokers benefit through charging interest and commission on the loaned stock shares as well as receiving dividends.

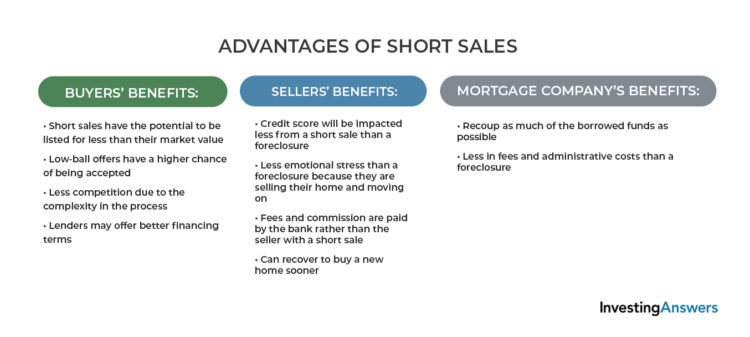

Buyers, sellers, and mortgage companies can all benefit from a short sale. Buyers have the opportunity to get a great deal on a home while sellers can avoid the detrimental effects of foreclosure. Mortgage companies are also able to collect on their investment in the property.

What Is Short Sale Stock?

Short sale stock refers to when an investor borrows a stock, sells the stock, and then repurchases the stock to return it to the lender. In this case, the lender is the broker-dealer. Through this process, the investor is essentially betting that the stock will drop in price. However, there are restrictions on this type of transaction (e.g. margin requirements).

When many investors do this all at once, it is called a short-squeeze.

Short Sale Stock Example

An investor wants to short Stock A because they feel that the stock will decline in value. To do so, they borrow 1,000 shares at $20 each (or $20,000) from their broker-dealer. Stock A then falls to $15 per share. To close the position, the investor purchases 1,000 shares at $15 each (or $15,000) to pay back to the broker-dealer. By completing the stock short sale, the investor realizes a gain of $5,000 (excluding applicable commission costs).

Investors should keep in mind that there are risks to each trade and there may not be a gain each time. A stock price could appreciate in value which would decrease an investor’s overall profit. The lender could also call the borrowed securities back at any time.

Margin Requirements of Short Sales

When considering short sale of stock, investors need to adhere to margin requirements. This means that an investor can make money on their trades without actually paying for it. To do so, they initially need to keep 150% of the value of the shares they are shorting in their account.

For example, if a trader shorts $10,000 worth of shares, the initial margin requirement would be $15,000. This protects the broker-dealer by ensuring that the trader pays them back before using the proceeds to short more stock.

Short Sale Example in Real Estate

The Smiths have fallen behind on their mortgage but understandably don’t want to be forced into foreclosure. They receive permission from their lender to conduct a short sale, and list the home for $200,000 (with a total of $225,000 remaining on the mortgage).

They sell the home for $200,000 with the sum going straight to the lender. The remaining $25,000 is considered a deficiency. The lender requires that the Smiths pay this amount (minus any closing and selling costs).

After fulfilling their obligation, the Smiths move on with minimal damage to their credit score and purchase a home that better fits their budget. Even though they receive quotes at a higher interest rate than before, the effects are much better than if they had allowed a foreclosure to occur.

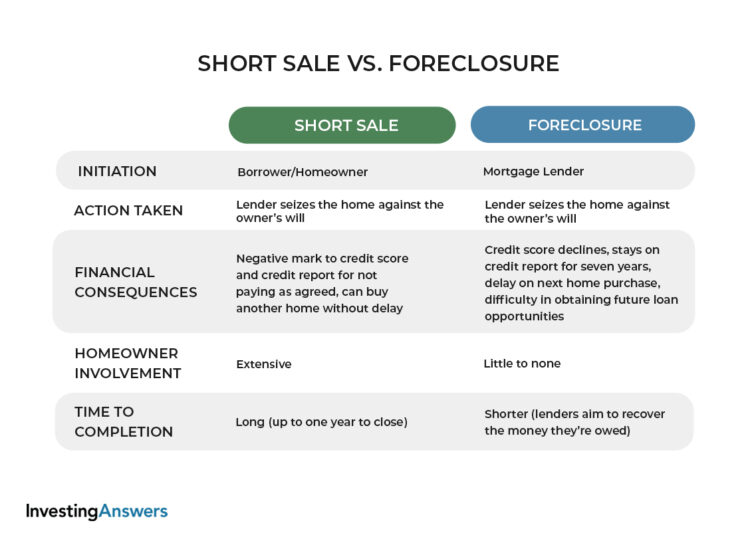

Short Sale vs. Foreclosure

If they are behind on their mortgage payments (or their loan amount is greater than the value of their home), a homeowner may find themself facing a short sale or foreclosure. Both options have different benefits and consequences.

Short Sale Effects on Finances

The homeowner initiates a short sale as a way to offload their home and satisfy their obligation to the mortgage lender. The process of selling their home takes a lot of effort but can save a person’s financial future. It typically has minimal damage to their credit score and credit report. While they’ll be able to buy another home immediately afterward, it can take up to one year to close.

Foreclosure Effects on Finances

Foreclosure is initiated by the lender and is the last option available for collecting payment on the loan. If the owner hasn’t already abandoned it, the home is seized through eviction and the lender’s goal is to liquidate it as quickly as possible. Auctions are typically the quickest process.

While the homeowner can simply walk away from their home during a foreclosure, they will have to wait at least five years to purchase another home. The incident will also stay on their credit report for seven years.

Advantages of Short Sales

All parties involved in a short sale have advantages to consider. While it may not be an ideal situation, some highlights make the complicated process more manageable.

Disadvantages of Short Sales

Selling your home by short sale may seem like a positive option for both buyers, sellers, and lenders. However, there are risks:

Lengthy Process

If you need to leave your current home and purchase another one quickly, a short sale may not be a good option. It can take up to one year to be finalized, depending on several factors involving the lender.

Need Mortgage Lender’s Approval

Your lender must sign-off on putting your home through short sale. They must also approve any offer that you would like to accept. They’re usually not in a rush to accept the quickest offer because they would like to recoup as much of their initial investment as possible.

The process is further complicated if there are multiple liens or lenders that need to approve each step of the process. Buyers should always verify that the home has been approved for short sale to avoid wasting their time.

Lender Responsiveness

It’s possible that your lender may reject or counter (or not even respond to) an offer that you receive.

Opportunity Cost

You may lose out on another home you’re interested in due to the lengthy process of a short sale. Negotiations can go on for months, and your financial resources will be tied up the entire time. Additionally, if you’re hoping to complete a short sale and FHA loan within a short period of time, you may not meet HUD requirements.

Property As-Is

If the home needs maintenance, cosmetic upgrades, or has more serious structural, plumbing, or electrical issues, you’ll need to accept the home as-is to buy a short sale. A proper home inspection is crucial, but the lender is not likely to negotiate based on the findings because they are already losing money on the property.

Lender Payment Preferences

A buyer may be in competition with all-cash offers or someone who can put down a large down payment.

Short Sale Alternatives for Homeowners

If you’re considering short selling your home, you may be going through financial difficulties. It’s important to understand all of your options in order to stay in your home. Your first step should be speaking with your lender. They may be able to offer a revised payment plan or loan modification.

Another possibility involves private mortgage insurance (PMI). If you did not purchase your home with a 20% downpayment, you’re paying PMI with each mortgage payment. The PMI company may advance funds to your lender so that you can catch up on your payments. However, they will only take this step if they believe that your financial situation could improve in the future.

Can Short Sales Be Financed?

A mortgage company can finance your short sale purchase. Before making an offer on the home, you can get a pre-approval for financing, just like any other home.

Are Short Sales Cash-Only?

Short sales are not cash-only. You can purchase the home with cash or with mortgage financing. However, because it’s less risky, lenders favor those who can make a large down payment or buy the home in cash.