What Is the Ex Dividend Date?

Some stocks pay cash (or additional stock) dividends to their investors throughout the year. Also referred to as “ex-date”, the ex-dividend date is important for investors because it determines whether they’re entitled to a dividend.

In order to receive a dividend, you need to be the holder (on record) of a given stock no later than the day before its ex-dividend date. If you buy a stock on/after the ex-dividend date, you won't be entitled to receive the company's next upcoming dividend payment.

The Four Important Dividend Dates

The ex-dividend date is one of four important dates in the dividend distribution process:

1. Declaration Date

The declaration date is the day a company’s board of directors announces the next dividend for shareholders. This announcement sets the dividend payment amount, the ex-dividend date, and the payable date.

2. Ex-Dividend Date

As mentioned above, the ex-dividend date is a marking point for whether or not you’re entitled to a dividend. If you buy stock prior to the ex-dividend date, you are then entitled to the next dividend payment. Buyers of stock on or after this date will NOT receive the dividend.

3. Record Date

The record date is one business day after the ex-dividend date and determines who the shareholders on the record are. They must be on the company books at this time to receive a dividend.

4. Payable Date

The payable date is when shareholders on record receive the dividend.

Ex-Dividend Date vs. Record Date

When a company declares a dividend, it sets a record date. This date is when you must be on the company's books as a shareholder to receive the dividend.

After the record date has been determined, the stock exchange assigns the ex-dividend date. The ex-dividend date is normally set one business day before the record date.

In summary, the ex-dividend date is set based on stock exchange rules. This date determines who receives the dividend.

How Does an Ex-Dividend Date Work?

The ex-dividend date is crucial to shareholders because it determines whether you are paid or not. If an investor buys a stock before the ex-dividend date, then they will receive the next dividend payment. If they purchase the stock on or after the ex-dividend date, they won't receive that dividend.

Dividends take money out of the company. While they pay investors, dividends also have an impact on the company stock prices. This shift in stock price typically occurs on the ex-dividend date.

For example, if a stock is trading at $100 and pays a quarterly dividend of $3 per share, then the stock will open on the ex-dividend date at roughly $97.Of course, the stock prices move and up and down based on other factors besides the dividends being paid. What’s important to note is that the stock prices do change based on the dividend payments.

Ex-Dividend Date Calendar

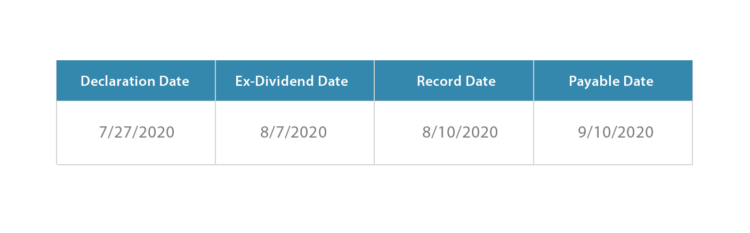

Let’s look at a hypothetical example to better understand the dividend date structure.

- On July 27, 2020, Company X declared a dividend payable on September 10, 2020 to shareholders on record (declaration date).

- Company X also announced that shareholders who were on the company books on/before August 10, 2020 were entitled to the dividend (record date).

- The stock ex-dividend date is one business day before the record date. On this date, stock prices typically drop, according to the paid dividend.

Where Can I Find Ex-Dividend Dates?

To determine the ex-dividend date calendar for specific companies, go to the NASDAQ website or the NYSE website. If you have questions about specific ex-dividend dates, consult your financial advisor.

Ex-Dividend Key Takeaways

In a nutshell, if you buy a stock before the ex-dividend date, you’ll receive the next upcoming dividend payment. If you purchase the stock on or after the ex-dividend date, you won’t receive the dividend.

As the ex-dividend date approaches, the price of a stock may move up by the dollar amount of the dividend, then fall by that amount after the ex-dividend date. A stock that has “gone ex-dividend” is marked with an 'x' in publications on that day.