How Does the Passive Income Calculator Work?

The passive income calculator starts by asking you how much you already have saved and when you want to begin making monthly contributions to your passive income investment strategy.

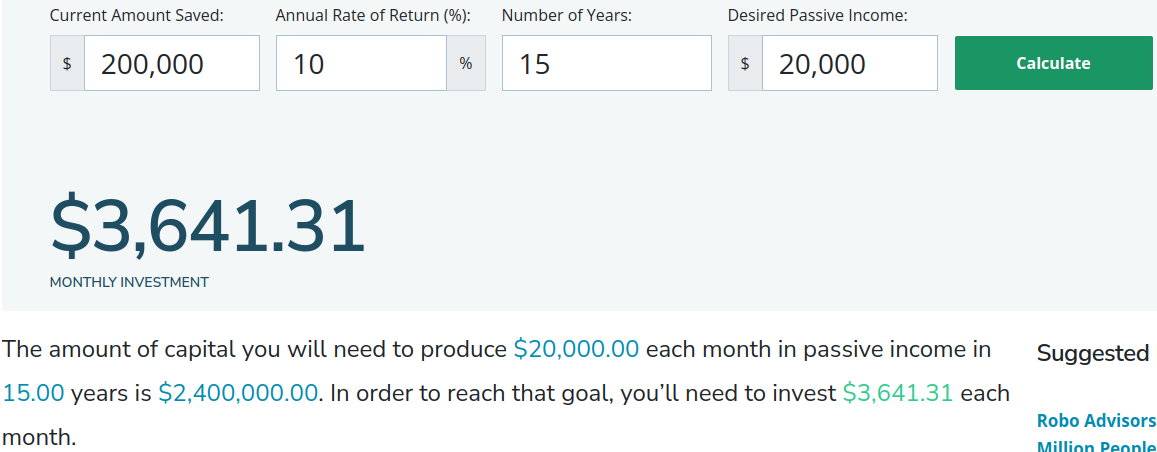

You’ll then select a projected annual rate of return and the number of years you plan to leave the funds untouched. Finally, you’ll decide how much passive income you’ll desire each month in the future.

Once you provide this information, the calculator will show you how much capital you’ll need to build up in the time you indicated. Plus, how much you’ll need to contribute monthly and the total amount of interest your investments will earn.

Additionally, you’ll find a helpful graph that shows how your investment capital will grow over time. Within the graph, you’ll see variations that fall 10% above or below the projected annual rate of return. It can be useful to see how minor variations in your projected annual return can significantly impact your financial goals.

Example of Passive Income Calculator

Let’s say you want to start building your passive income investments on January 1st, 2022. At the moment, you have $10,000 in initial savings to start. You plan to leave the funds invested for 25 years and are hoping for a 7% annual rate of return.

The goal of your passive income generation is to produce $5,000 per month in the future to fund your retirement. With these parameters, the amount of capital you will need to produce $5,000 each month in passive income in 25 years is $857,142.86. In order to reach that goal, you’ll need to invest $987.43 each month. Along the way, you will earn $550,914.01 in interest.

Finally, you will see a graph of this information to see your progression towards your passive income goal.

What is Passive Income?

Passive income is a way to generate money from an activity that doesn’t require your active involvement. The goal is to produce an income that doesn’t take up too much of your time. However, it can take an upfront investment of time or money to create passive income streams.

For example, royalties from a book’s sales qualify as passive income. But it will obviously take time and effort to create a book in the first place.

If you don’t have time to spare, then you’ll need to commit a large amount of capital to your passive income investments. It can take a significant amount of capital to produce worthwhile amounts of passive income. As we saw in the example above, it would take $857,142.86 to produce $5,000 in monthly passive income with a 7% annual rate of return.

How to Get Passive Income

The ways to earn passive income are seemingly endless, but here are some of the most popular ways you may want to consider:

Dividend Stocks

A dividend is a payment that is paid out from a company to the shareholders. In exchange for your ownership of shares, you can be rewarded with these recurring dividends. With that, dividend investing is a great way to build a passive income stream.

Want to learn more about dividend stocks? Check out these top four reasons to love this passive income investment strategy.

Rental Real Estate

Rental real estate can generate a passive income when the tenants pay their rent to a landlord. Of course, managing a rental property is not entirely passive. But with the help of a property manager, you can make this investment vehicle more passive.

If you want to cut out the headache of owning an individual property altogether but still want to invest in real estate, then crowdfunding platforms could be the right option for you. Take some time to explore the 10 best real estate crowdfunding platforms, including Fundrise and Crowdstreet.

https://www.youtube.com/watch?v=6zfDRd45nhI

Robo advisors

A robo advisor can help you build an investment portfolio with minimal effort on your part. You can even tailor your robo advisor experience to prioritize passive income generation. Keep in mind that portfolios built for income generation are usually most appropriate for older or retired investors looking to reduce volatility,, while younger investors normally favor growth, which comes with more volatility and risk but typically higher returns.

Want to enlist the help of a robo advisor? Here are the best robo advisors to start your search.

Summary

Passive income could completely transform your life. After all, it is not difficult to imagine that your life would improve without a pressing need to earn an active income. There are several ways to build passive income streams. It’s important to do the research and pick strategies that work the best for your financial goals and situation.

RELATED: The Best Online Brokers and How They Help You Build Wealth