How Does the 40 Year Mortgage Calculator Work?

The InvestingAnswers 40-year mortgage calculator involves several variables, including the mortgage amount, your term of 40 years, the annual interest rate, any initial interest-only period and the interest rate for an initial interest-only period.

To get started, you’ll need three numbers - your mortgage balance, the annual interest rate attached to the loan and the term of 40 years.

At that point, you may be ready to calculate your estimated monthly mortgage payment. But suppose you are pursuing a 40-year mortgage with an initial interest-only period. In that case, you’ll need to add two more numbers into your calculation - the length of the initial interest-only period and the interest rate attached to that initial period.

With all of the numbers accounted for, you can hit the ‘calculate’ button. The calculator will show you how much you can expect to pay each month over the course of your mortgage.

Additionally, you’ll see an amortization schedule that shows how much of your payment will be put towards the loan principal and how much will be used to cover interest charges. If there is an initial interest-only period, you’ll notice that your regular payments will not be put towards the loan principal. With that, it will take longer for you to build equity in your property.

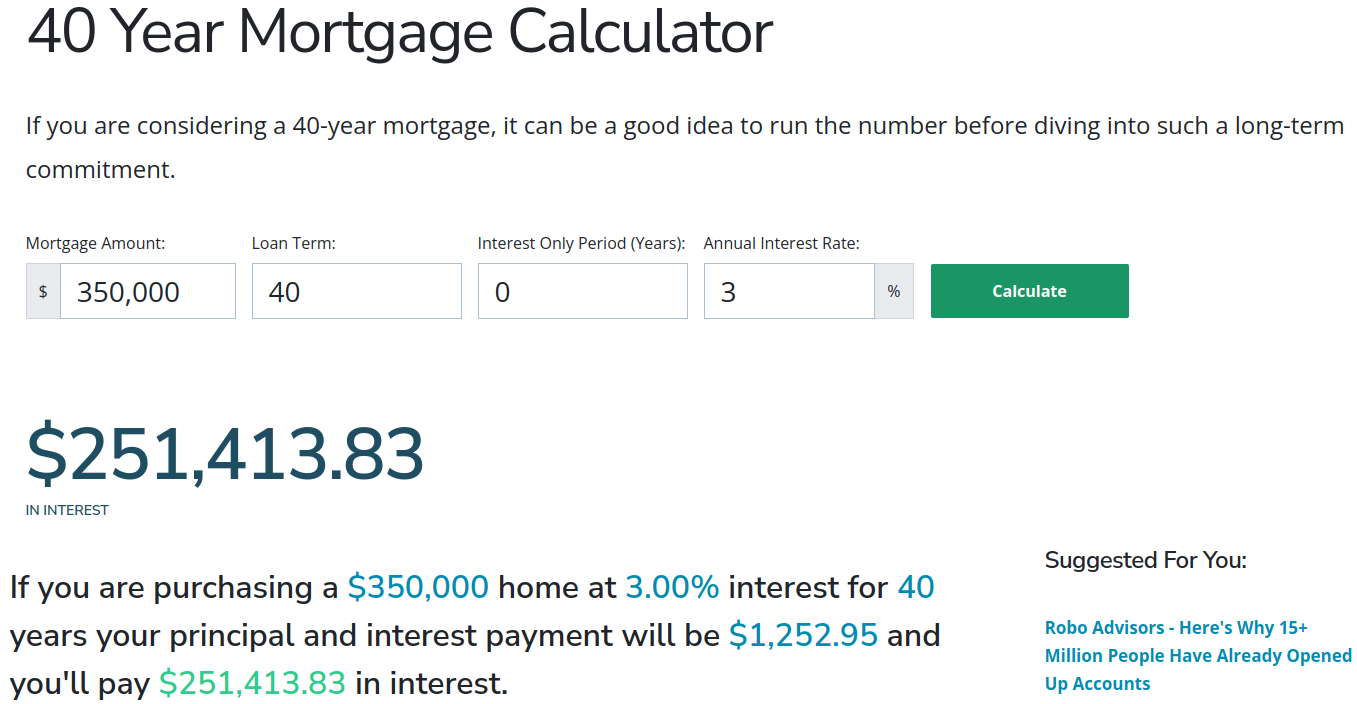

Example of calculator results

For example, let's say you are purchasing a $350,000 home at 3% interest for 40 years. Your principal and interest payment will be $1,232.86 and you'll pay 241,621.21 in interest.

Compare that to a traditional 30 year mortgage. With a 30 year mortgage, your principal and interest payment would be $1,456.80 and you'll pay $174,336.57 in interest.

So you can see that the 40 year mortgage gives you a smaller monthly payment but you'll pay quite a bit more in interest over the life of the loan. Only you can say if that trade off is worth it.

Benefits of a 40 Year Mortgage

Most 40-year mortgages are fairly straightforward. A longer loan term allows the principal repayment to be stretched out. With that, the monthly payments will be more affordable than a 30-year mortgage with the same principal amount and interest rate.

As a buyer, a 40-year mortgage can give you access to home opportunities that would otherwise be beyond your financial reach. If you are struggling to find a home in your price range with a traditional 30-year mortgage, a 40-year mortgage could give a much-needed boost to your buying power.

Drawbacks of a 40 Year Mortgage

A 40-year mortgage is typically associated with higher mortgage rates than 30-year mortgages. Even without the higher interest rate, a longer loan term means that you’ll likely be paying more in interest over the lifetime of your mortgage when you choose a 40-year mortgage. It may also extend beyond your working years, which will mean making mortgage payments in retirement.

Additionally, many 40-year mortgages aren’t your traditional fixed-rate mortgage. Not only are they more difficult to find, you may find 40-year mortgage loan options that offer an interest-only period during which you’ll make regular payments without building any equity in your home.

Or you could find an adjustable-rate 40-year mortgage with an interest rate that could fluctuate dramatically over the lifetime of your loan. The uncertainty of these nontraditional mortgage arrangements could put a strain on your finances.

40 Year vs. 30 Year Mortgages

The loan term you choose for your mortgage will have a significant impact on the amount of interest you pay over the course of the loan. Although you may enjoy the lower monthly mortgage payment that comes with a 40-year option, the slow build of equity and more expensive interest payments could take a toll on your financial future.

Let’s compare the total cost of a 40- year vs. a 30-year mortgage. As an example, let’s say that you are borrowing $250,000 to close on a home.

On the one hand, you could choose the 30-year mortgage with a 3.00% interest rate that leads to a monthly payment of $1,054.01 and a total loan cost of $379,443.63. On the other, you could choose a 40-year mortgage with an interest rate of 3.25%, leading to a monthly payment of $931.35 and a total cost of $447,049.48.

As you can see, the total cost of the 40-year mortgage is dramatically higher. But a lower monthly payment could make the 40-year mortgage a better choice for your budget.

40 Year Mortgage Rates

Are you considering a 40-year mortgage? Let’s take a look at the mortgage rates available in your area.

How to Get a 40 Year Mortgage

In the past, a 40-year mortgage has been relatively difficult to obtain. That’s because they were considered non-qualifying mortgages. Essentially, that means that 40-year mortgages were unable to be sold on the secondary mortgage market easily. This means the bank that issued the mortgage had to hold it for the entire term. With that, few lenders were willing to offer these types of loans.

However, a recent announcement made by Ginnie Mae could increase the popularity of these loans. The announcement has allowed for an extended term of up to 40 years for mortgages to be sold on the secondary market. This change is being made as a part of a plan to help homeowners stay in their homes with a lower monthly payment. With this change, more lenders may be willing to work with homeowners seeking a 40-year mortgage.

When looking for a 40-year mortgage, you’ll need to shop around for the right lender. Although the recent Ginnie Mae announcement may lead to more lenders offering this type of loan, at the moment, you will find relatively limited options. With that, you will need to consider a wide range of lenders to find the right option for you.

Where to Find a 40 Year Mortgage

Want to find a 40-year mortgage? It can be more challenging than finding a traditional 30-year loan. You will need to expand your search to find the right lender for a 40-year mortgage.

A few places to look are mortgage brokers, online lenders, local banks and credit unions. If you struggle to find a good option, consider speaking to a housing counselor at your state or local HUD office.

Alternatives to a 40 Year Mortgage

Not convinced that a 40-year mortgage is right for you? That’s okay! There are other options available to make your home buying experience more affordable.

One option is to pursue a 30-year conventional mortgage instead of a 40-year mortgage. When you take some time to run the numbers, you might find that the difference between the two monthly payments is very similar. Likewise, you could pursue an FHA loan, USDA loan, or VA loan with a 30-year term and less stringent borrower qualifications.

Finally, you could consider paying discount pointsat closing to ensure lower monthly payments that fit into your budget.

Ask An Expert: Is a 40 Year Mortgage a Good Idea?

As with most financial decisions, a 40-year mortgage is not the right fit for all situations. However, the longer term could be a good compromise for the homeowner whose cash flow is constrained. However, it would not be wise to use a 40-year mortgage to increase your home budget. In addition, only those who have the discipline to save the difference in payments between 30 and 40-year mortgages should consider the longer term option.

If you decide to move forward with a 40-year mortgage, take the time to run the numbers on the total cost of the loan. Although the total cost will almost certainly be higher than a 30-year mortgage, it could be worth considering for your situation along with 15 and 20 year options.