Most people would be thrilled to collect a healthy 18% dividend every year.

Use your nest-egg to buy $500,000 worth of a stock with that kind of yield, and you could get a $22,500 dividend check in the mail every three months -- that's $90,000 annually -- year after year.

Double-digit 'high yielders', as these stocks are popularly nicknamed, certainly aren't fantasy.

But invest in the wrong one -- such as in a company who can't afford to keep paying its lofty dividend to shareholders -- and you could lose your shirt.

In fact, investors who ignored one key rule in choosing a high yielder have faced losses in the double-digits -- sometimes in a matter of days -- after a company has been forced to cut its unsustainable dividend.

The rule is simple. Always be sure that a company's earnings are able to support its dividend payment.

The First Glaring Red Flag -- A Runaway Dividend Yield

Frontier Communications (NASDAQ: FTR) provides telephone, Internet and cable services in rural areas and small cities.

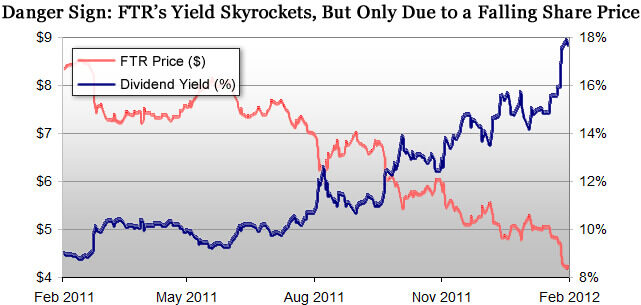

At the time, the company was paying an annual dividend of $0.76 per share. At a share price of $4.26, that made for an eye-popping dividend yield of 17.8% ($0.76/$4.26 = 17.8%).

But I also noticed a glaring red flag: Frontier's dividend yield had nearly doubled from 9.1% in February 2011 to the 17.8% just a year later.

Before I go on, remember that a stock's dividend yield can only increase under two conditions:

a.) The company raises its dividend payment, or

b.) The stock price falls.

Frontier hadn't raised its quarterly dividend payment from $0.19 per share in years -- so it wasn't for the first reason. That only leaves the second.

Through 2011, Frontier's earnings per share (EPS) had fallen 35% from $0.23 per share to $0.15 per share.

Shareholders who feared that the company's EPS could no longer cover the dividend payment bailed out of FTR, driving down its price 40.2% from February 2011 to February 2012. As a result, its dividend yield skyrocketed:

The point is simple but important: A drastically falling stock price (along with an extremely high yield) can be the first warning sign of an unsustainable dividend.

A Closer Look -- Using the Payout Ratio to Determine Sustainability

To find Frontier's payout ratio, simply take the company's $0.76 annual dividend and divide by its $0.15 earnings per share. Up until last month, FTR's payout ratio was 500% -- five times more payout than what it earned.

[Note: You can easily find a company's payout ratio on Yahoo Finance -- here's Frontier's.]

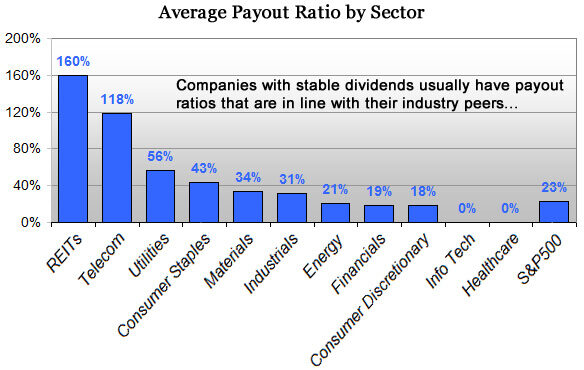

A payout ratio that is on par with or below that of its industry average is less likely to face a dividend cut. The lower the ratio, the lower the risk.

You can use this chart as a payout ratio comparison guide:

Most companies (save for REITs and telecoms) have a payout ratio below 80% -- usually sustainable enough to support dividend payments. But Frontier's payout ratio of 500% was obviously much higher than its industry average (500% vs. 118%) -- a ratio that high is just asking for a dividend cut.

And dividend cuts can lead to big losses.

Not only will you stop receiving the income you were used to, but share prices can fall dramatically once shareholders are no longer interested in holding the stock with a shrunken dividend.

Case in point: By the middle of last month, Frontier was finally forced to slice its dividend nearly in half from $0.76 per share to $0.40. As a result, the stock had a selloff and the stock price fell 10% in just two weeks.

The same thing happened last year to World Wrestling Entertainment (NYSE: WWE). A sinking stock price quickly pushed the stock's dividend yield past 11%.

Weak earnings forced the company to chop its dividend by 66% in April of last year. The cut caused share prices to fall 9% in just one day.

The Investing Answer: While high yielders can certainly be tempting, many aren't worth the risk. As a rule of thumb, it's unusual to find stocks (outside of REITS or MLPs) that offer long-term, sustainable yields over 10%.

There are better, less risky options out there if you want to earn healthy and reliable dividend yields. For example, when we dig through piles of data looking for the next dividend-growing 'forever' stock, we look for companies who have had a lengthy history of earnings growth and strong free cash flow growth -- both indicate the company will be able to comfortably support its dividend payments to shareholders.

Automatic Data Processing (NASDAQ: ADP) for example, has raised its dividend every year since 1974. If you bought shares in ADP just three years ago, your 'yield on cost' would be nearly 6% and your shares would have appreciated a whopping 64% in price.