Homeownership is a cornerstone of the American Dream. A home is a valuable asset for most people, and mortgages (or home loans) make buying one possible for many Americans.

What Is a Mortgage?

A mortgage is a loan for which property or real estate is used as collateral. It’s an agreement between the borrower and the lender. The borrower receives money from the lender to pay for a home, and then makes payments (with interest) over a set time span until the lender is paid in full.

A mortgage loan is a long-term loan. Typically, a borrower will choose a loan term between 5 and 30 years. Some institutions offer a 50-year term loan, but the longer it takes to pay off a mortgage, the higher the interest rate.

Lenders take a risk every time they provide these loans. There is no guarantee that the borrower will be able to pay in the future. Borrowers also take a risk in accepting these loans, as failure to pay will result in a total loss of the asset and reflect negatively on their credit score.

Who Applies for or Receives a Mortgage?

Mortgage loans are usually obtained by home buyers who don’t have enough cash on hand to buy a home. They are also used to borrow cash from a bank for other projects, using a house as collateral.

Mortgages are not always easy to secure, since rates and terms are dependent on an individual's credit score, assets, and job status. The lender will have strict requirements because it wants to ensure that the borrower is able to make payments. Failure to repay allows a bank to legally foreclose and auction off the property to cover its losses.

Types of Mortgages

There are several types of mortgage loans. Buyers should assess what is best for their own situation before entering into one. Below are the 5 most common types of mortgages:

Conventional Mortgage

A conventional mortgage is not backed (insured) by a governmental agency. Instead, Fannie Mae or Freddie Mac – government-sponsored enterprises – back most US conventional loans. They have strict guidelines for home loans, and conventional mortgages which follow these guidelines are called conforming loans.

A conventional loan can be used for a primary residence or any investment properties and typically have a fixed interest rate. You can secure a conventional loan for 10-, 15-, 20-, or 30-year term. A 30-year, fixed-rate conventional mortgage is a common choice.

Conventional mortgages are considered a ‘stable’ loan by prospective sellers. That’s because a conventional loan requires that the borrower have consistent income, healthy credit, verified assets, and a down payment of at least 3%.

Adjustable-Rate Mortgage

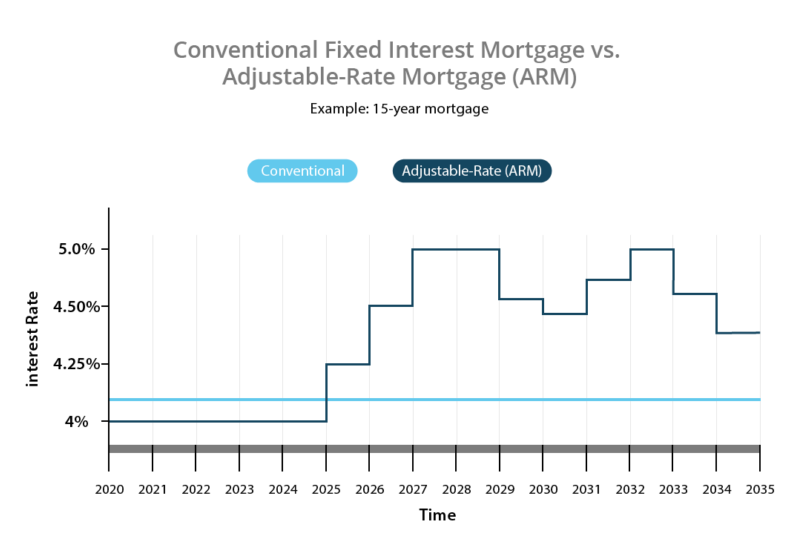

Adjustable-rate mortgages (ARM’s) have interest rates that fluctuate (according to the market) throughout the life of the loan. Adjustable-rate mortgages often start with a low fixed rate for a period of time, then change to a variable rate. This variable interest rate can change monthly or annually. Thankfully, adjustable-rate mortgages have a cap on interest increases.

Because payments fluctuate, ARM’s are risky and you need to be willing and financially able to pay more when the market shifts.

Jumbo Loan

A jumbo loan is a type of non-conforming conventional mortgage. This means the home will cost more than federal loan limits. In 2020, the Federal Housing Finance Authority raised conforming loan limits to a max of $510,400. In high-cost living areas, the conforming loan limit is $765,600. Jumbo loans exceed this cap.

Jumbo loans have a rigorous approval process since they are riskier mortgages for lenders.

VA Home Loan

VA home loans are backed by the U.S. Department of Veterans Affairs. VA mortgages are available to veterans, active-duty military members, and their immediate families. VA loans don’t require a downpayment and offer low interest rates. These home loans do, however, require appropriate income and credit for approval.

FHA Mortgage

An FHA mortgage is a fixed-rate mortgage that’s insured by the Federal Housing Administration (FHA). An FHA loan is still issued through a bank or lender and may come in a 15- and 30-year term. These loans carry stringent requirements and can only be used for a primary residence.

The benefit of these loans is the flexibility they offer borrowers. You have the option of a low down payment, low closing costs, and easy credit qualifications. This makes them a good option for low-income borrowers or first time home buyers.

Other, Less Common Mortgage Options

Less common types of mortgages include the Interest-only mortgage, USDA mortgage, and balloon mortgage. Take the time to dig into your choices. Talk with your realtor for current comps on the properties in the area you’re hoping to buy, as this will help inform your choice for a mortgage as well. For each mortgage type, be sure that you fully review eligibility requirements, terms, and interest rates.

Mortgage Interest Rates

Like any other financial product, mortgages change depending on the supply and demand of the market. For that reason, banks may offer low and high interest rates at different times.

A fixed interest rate will remain the same throughout the life of the loan. An adjustable-rate will change, depending on the market. In that case, the mortgage payment can also change as often as month to month, but more commonly every year to three years. It depends on the adjustment period.

Variable interest rate mortgages often start with a lower interest rate (compared to a fixed interest rate mortgage). Just because an interest rate starts with a lower variable rate, that doesn’t mean it’s the better option. For consistent mortgage payments, the lowest fixed interest rate you can secure is typically better.

How Refinancing Can Provide Lower Interest Rates

If a borrower has a high interest rate and rates have dropped, she can sign a new agreement with a new lower interest rate. This process is called 'refinancing”, which allows you to obtain a new mortgage with a lower interest rate.

How to Calculate Your Mortgage

A mortgage payment is typically made up of the following components:

Principal -the initial size of the loan (the amount borrowed, typically the price of the home, less the downpayment)

Interest - the percentage of your principal paid to the lender for use of its money

Taxes

Home Insurance

You may also have private mortgage insurance wrapped into the payment, depending on your loan type and down payment.

When reviewing mortgages, you need to be able to calculate what this monthly payment will be. Investing Answers has a tool that will make this much easier.

How to Choose a Mortgage Lender

Finding the right lender takes time and effort, but the result of a smooth closing process – and a mortgage that works for you – will be worth it in the end. Below are a few tips for choosing a lender:

Get Familiar with Your Own Financial Health

Your lender will need to know a lot of personal financial information. It’s best if you know this beforehand, as it will guide you to the best mortgage type (and lenders who offer those mortgages). For example, if you have a low credit score, you might want to look for lenders who offer FHA loans.

You should know your:

Credit score

Asset values

Current income

Debt-to-Income ratio

Shop Around for Lenders

Even if you’re asking for the same product, like a 30-year fixed-rate conventional loan, you will get different rates and terms from each lender. You want to find the lowest interest rate from a lender with great customer service and a history of closing loans on time. Get multiple quotes before signing anything.

You can choose to search for individual lenders at a local bank, credit union, or even an online lender. You can also look into mortgage brokers who gather your information and look at mortgage options from multiple lenders to find you the best deal. It’s important to note that not all lenders work with brokers.

Your credit score will take a hit when you get multiple quotes. It’s not as bad as you may think. According to the Consumer Finance Protection Bureau (CFPB), multiple checks from a mortgage lender made within a 45-day window will only be counted as a single credit pull.

Don’t Be Afraid to Ask Questions

You’re not just shopping around for a lender: You’re conducting an interview. Ask your mortgage broker or lender for all the details surrounding the loan, including:

Types of mortgages they offer

Eligibility requirements

Down payment options

Interest rates

Amortization schedule

Loan origination fees

Discount points

Loan rate lock

Mortgage Insurance

Closing costs

While you’ll probably have even more questions, this is a solid place to start an interview.

Related: Closing on a Home? This Sneaky Lender Trick Could Cost You Thousands

If you follow these steps and educate yourself on mortgages, you’ll hopefully sidestep buyer’s remorse entirely.

Pros and Cons of Mortgages

A home is considered an asset. Over time, as you pay off your loan and market prices increase, you can build equity (and potentially make money if you choose to sell it).

Mortgage interest is also tax-deductible. The amount of money you paid in interest can be taken off your annual taxable income, which is a nice tax break for homeowners.

A mortgage can be an extremely positive thing, but it’s a major financial responsibility that shouldn’t be downplayed. Jumping out of a mortgage isn’t like breaking a lease on an apartment. It’s a serious commitment and a large chunk of debt that you’ll need to pay every month. If you don’t, you’ll lose your asset and your credit will decline.