What is Income Tax?

Income tax refers to taxes imposed by the government on individuals and businesses based on annual income. In the US, income tax is collected on taxable income by the Internal Revenue Service (IRS).

Why Does Income Tax Matter?

The US federal government uses collected funds to fund public services that extend to national defense, veterans and foreign affairs, social programs, and law enforcement. Income taxes may also be used to pay off interest on the national debt. In the US, individual income taxes are the single largest source of revenue for the federal government.

What Is Individual Income Tax?

When income tax is imposed on an individual, it may be referred to either as individual income tax or personal income tax.

Individual income taxes are imposed on a person’s taxable income, which includes both earned and unearned income. Earned income includes wages, salaries, and commissions. Unearned income includes sources like dividends, and interest.

What Is Business Income Tax?

When income tax is imposed on corporations, small businesses, and independent contractors, it may be referred to as a business income tax. Businesses pay income taxes on their earnings, which may include income received from the sale of products or services, as well as rent received by a person in the real estate industry.

Although all businesses are required to pay income taxes, different types of businesses are taxed at a different rate. C corporations pay at the federal corporate tax rate, which is a flat 21% as of 2020. All other businesses – including sole proprietorships, partnerships, limited liability companies (LLC), and S corporations – are considered pass-through entities, taxed at the individual income tax rate. In the US, individual income is taxed at different rates based on taxable income level under a system known as a progressive income tax system.

What is a Progressive Income Tax System?

The US – and many other countries – rely on what is known as a progressive or graduated income tax system. This means that different amounts of income are taxed at different percentages (or tax rates). The intent of a progressive income tax system is to distribute wealth more evenly across a population by ensuring people with higher incomes are taxed at a higher rate, while people with lower incomes are taxed at a lower rate.

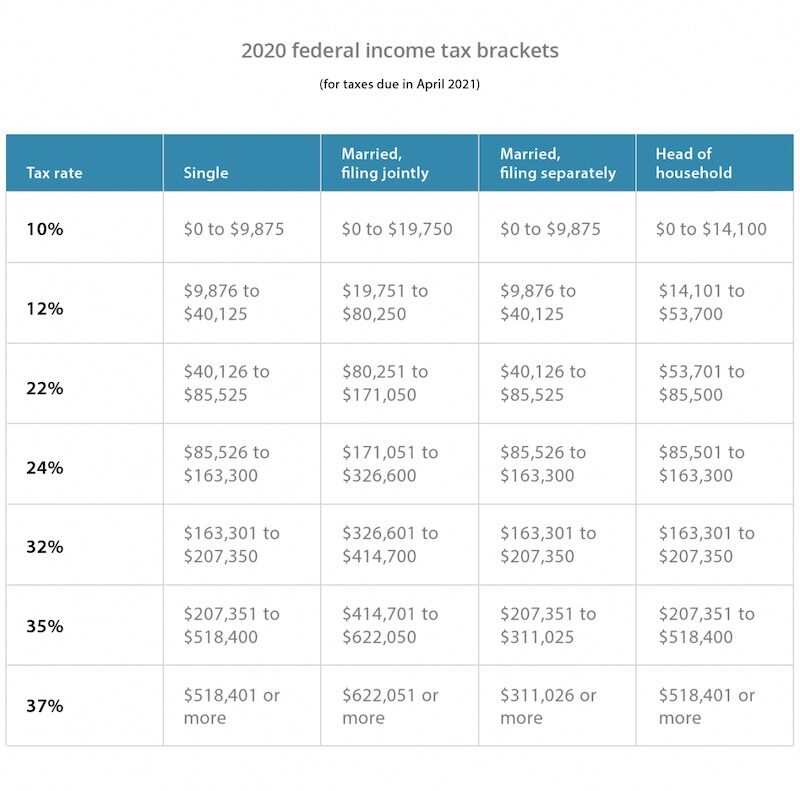

Federal Income Tax Brackets

The IRS determines the amount of tax an individual or business owes by dividing their income into tax brackets. A tax bracket is a range of incomes that the government taxes at a specific rate. As of 2020, there are currently seven federal tax brackets in the US: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Because most taxpayers fall into multiple tax brackets, their income is charged at multiple rates. When the income of a person or business exceeds the range of a lower tax bracket, the leftover amount is taxed at the rate in the next bracket (and so on) until the highest rate that applies to an individual’s taxable income is reached.

Marginal Vs Effective Tax Rate

The tax highest bracket that a person falls into based on their income is called their marginal tax rate. The actual percentage of annual income an individual ends up paying in income tax is known as their effective tax rate.

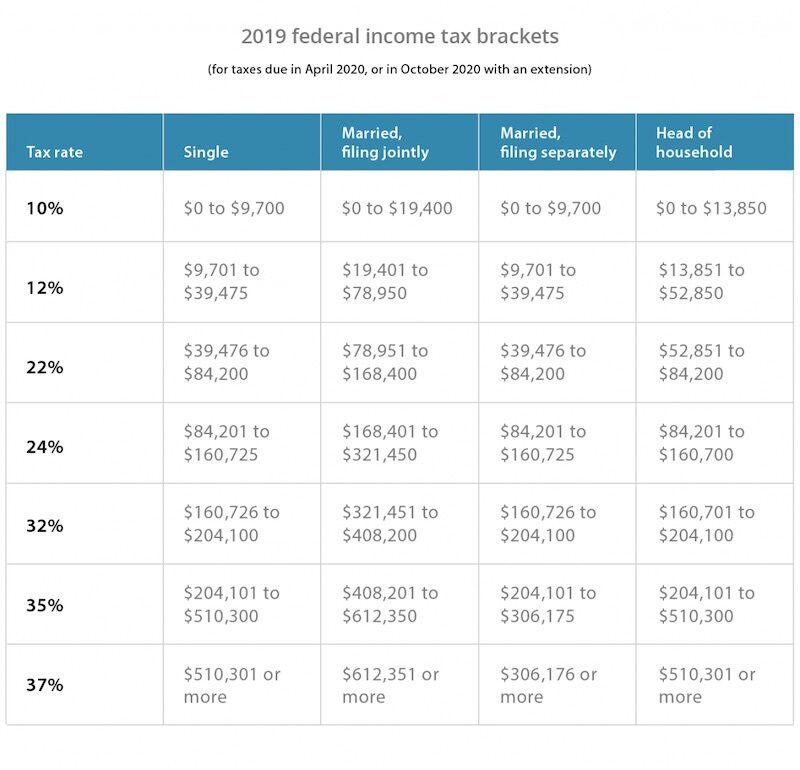

Federal Income Brackets for 2019

We’ve included a table of federal income brackets for 2019 taxes to be filed by July 2020.

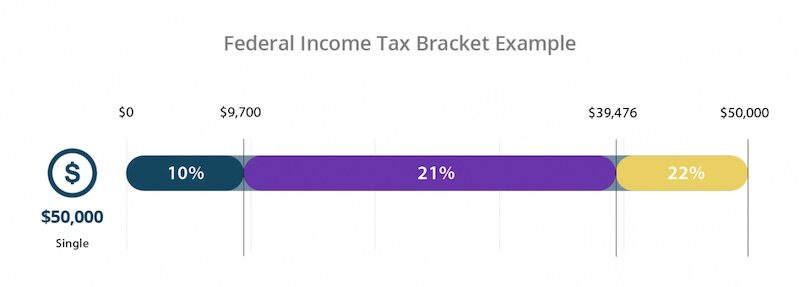

Example of Federal Income Tax Brackets

To understand how federal income tax brackets work:

Assume you are single and report $50,000 as taxable income for the 2019 tax year (for taxes due in July 2020). This would place you into the 22% tax bracket, though this does not mean you are taxed at 22% for your entire income.

Instead, the first $9,700 of your income is taxed at 10%.

The next $9,701 and $39,475 of your earnings are taxed at 12%.

The remaining $39,476 through $50,000 of your earnings are taxed at 22%.

The total amount of tax you owe could be calculated as follows:

(10% of $9,875) + (12% of $29,774) + (22% of $2,315.28) = $6,858.28

In this example, you would owe $6,858.28 in federal income taxes for 2019 before deductions.

Since you fell into the 22% tax bracket, you would have a marginal tax rate of 22%. However, because you actually owed $6,858.28 in federal income taxes (or around 14% of your total income), you would have an effective tax rate of 14%.

How Are Income Taxes Collected?

Most American employees pay taxes throughout the year via their paychecks. Employers are legally required to withhold money from employee paychecks for income taxes. Employers also use information supplied on an employee’s W-4 to determine how much to withhold from each paycheck.

Things may be slightly different, however, for independent contractors and small business owners. These individuals must make income tax contributions themselves in the form of quarterly or estimated tax payments. These are submitted every three months.

When taxpayers file a tax return with the IRS, they determine whether they owe additional money or if they have overpaid on their taxes during the previous tax year. Those who have overpaid receive the money back in the form of a tax refund.

Federal Versus State Income Tax

Much of the rules we’ve discussed – including the federal income tax brackets – are imposed by the US federal government. Federal income tax laws apply to all American taxpayers.

In addition to federal income tax, many individuals and businesses in the US must pay a state income tax. States rely on revenue from income taxes to fund public services like public schools, health care, transportation, corrections, and low-income assistance.

As with federal income taxes, state income taxes are imposed on a percentage of taxable individual or business income. However, the rate and structure of state income taxes vary significantly from one state to the next. In fact, not all states choose to levy state income taxes.

Which States Have No Income Tax?

Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not collect state income taxes. In addition, New Hampshire and Tennessee do not collect taxes on earned income like salary, wages, and commission. Instead, these two states only collect income taxes on interest and dividends.

Which States Have a Flat Income Tax System?

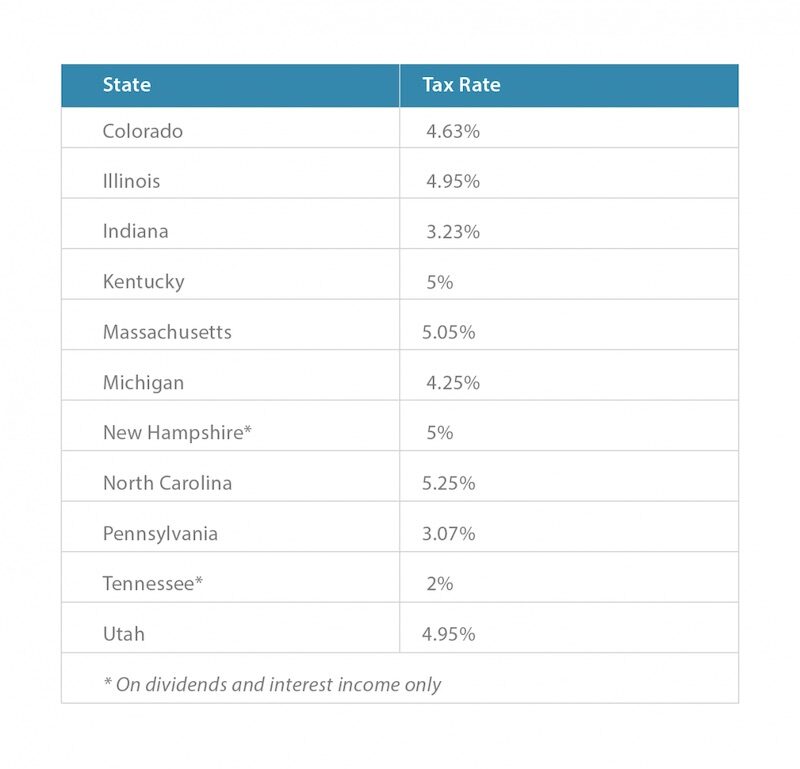

States that collect state income taxes enforce either a progressive or flat income tax system.

In a flat income tax system, a single tax rate is imposed on all taxpayers. This means that everyone is taxed at the same tax rate, no matter their income level.

As of 2019, there are 11 U.S. states that follow this kind of system:

Which States Have a Progressive Income Tax System?

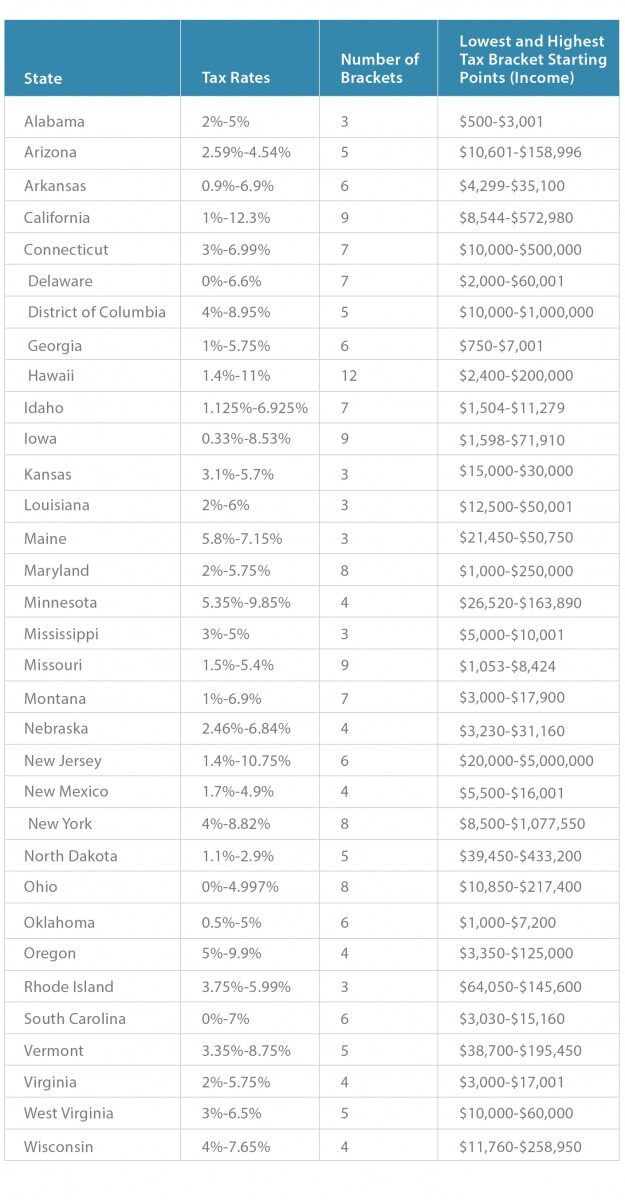

The remaining states – along with the District of Columbia – have a progressive income tax system. As with the federal government’s progressive tax system, state progressive taxes enforce a higher tax rate on higher-income earners. For example, the highest tax rate in Connecticut is 6.99%, but this only applies to incomes of over $500,000.

How to Save Big on Your Income Taxes

While federal and state income taxes serve an essential function, it’s vital to ensure you aren’t overpaying. By employing certain strategies, you’ll be able to avoid errors, cut your tax bill, and retain more of your income. Get tips for saving on your income taxes.