What Is an Underwriter?

Whenever you apply for a major loan or an insurance policy, your personal data will often go before an underwriter. Although you may never meet them, these specialists have a lot of control over whether you’re approved for a mortgage or life insurance policy.

You may find these financial experts at mortgage originators, loan companies, and investment companies. They do much more than secure insurance policies: Modern underwriters (and underwriting accounts) provide a guarantee of payment in the event of damages and/or fiscal losses to a number of products. They also work to assess the risks associated with loans or stock offerings, then determine if they should move forward to write the policy.

Types of Underwriters

Underwriters don’t just work on loans. In fact, these highly-trained individuals can work across sectors like insurance, debt securities, and investment banking. Even if you don’t realize it, underwriting affects many different parts of your everyday life.

Investment Underwriters

In the investing world, underwriters provide a valuable service for companies in the process of launching their IPO. Through the underwriting of shares, financial institutions provide research and guidance on the stock, ultimately becoming the sales force behind the offering. While the lead underwriters steer the project, they will often solicit co-underwriters to further extend their reach and guarantee greater success.

Equities Underwriters

Before an IPO goes public, equities underwriters are called in to work with the company to ensure success of the launch. These specific professionals will advise the company on US Securities and Exchange Commission (SEC) requirements, like registering with a stock exchange and offering stock for sale. In addition, the underwriters will offer advice on how much money they need up front, how many shares to offer, and what the offering price should be.

During the IPO process, lead underwriters take charge of the process with primary guidance. If the project is too big for their team, they may solicit help from co-underwriters.

Lead Underwriters vs. Co-Underwriters

In financial terms, the lead underwriters (or bookrunners), are in charge of organizing and executing the stock offering. During this process, they offer analysis, measure market demand for the offering, and determine the final offering price. If they are successful, they can reap up to an 8% sales commission on stock sales.

For large offerings, lead underwriters often solicit one or more co-underwriters to join the offering. Forming an underwriter’s syndicate, these co-managers will write their own analysis of the stock, and solicit sales from their book of institutional buyers. Creating the syndicate reduces the bookrunner’s risk while giving them access to clients they may not have in their networks.

Investment Banking Underwriters

Similar to investment and equity underwriters, investment banking underwriters deal in corporate and government bonds. But instead of providing the analysis behind an IPO or secondary offering, these particular writers provide vision on bond securities.

Working with a company or government body, investment banking underwriters help determine valuation, risks, and – ultimately – security pricing. From there, the investment bank will underwrite the bond, and attract buyers to the investment opportunity before it hits the open marketplace.

Debt Security Underwriters

Although debt security underwriters are responsible for determining risk, their area of expertise lies in finding quality debt securities to purchase. These specific underwriters will focus on purchasing corporate or government bonds based on the amount borrowed, bondholder credit rating, maturity date, and rate of interest.

A debt security underwriter’s primary goal is to sell the bonds at a profit to other clients. In turn, those buyers can sell off the debt on the open market, or directly to other investors. The security holders ultimately earn interest on the bond, which can make them a safe investment with guaranteed growth over time.

Insurance Underwriters

The practice of underwriting isn’t limited strictly to investments. Much like how Lloyd’s of London operates, insurance underwriters provide guidance on whether or not an insurance company should back a policy request.

When you apply for an insurance policy, the insurance underwriter will assess the risk involved in extending a plan. For car insurance, the underwriter can acquire information about your driving record (e.g. traffic tickets, accidents). They may also consider other factors, such as education, distance to work , and where you live to determine if they should insure you, and how much you should pay in insurance premiums.

Life Insurance Underwriters

Life insurance underwriters offer a similar service as those writing single policies, but specialize in life insurance products. Instead of assessing situational risk, these underwriters look across multiple risk factors that affect your life.

For example, life insurance underwriters may request information about your lifestyle and overall health. Smokers and individuals with life-altering conditions (including hypertension and diabetes) are often charged higher rates, while those who are fit and don’t require maintenance medications may get far better rates. Underwriters can also ask for additional information – such as an independent medical examination – to make a decision.

Medical Underwriters

As with other insurance products, medical underwriters work to determine the insurability of people seeking health insurance. Through this process, insurance companies conduct an investigation into an individual’s health background to learn about pre-existing conditions and overall health status.

With information about a person’s medical background, current health, and potential risks, a medical underwriter will make a decision on whether or not the insurance company should extend coverage to them. If they do, their overall health can determine their monthly premium or any exclusions due to their pre-existing conditions.

Mortgage Underwriters

Mortgage underwriters investigate qualifications regarding home loans. Their goal is to assess the risk that a bank, credit union, or other loan originator may face when extending a loan to buyers.

To determine these risks, mortgage underwriters can acquire information about your credit history (e.g. your credit score, debt-to-income ratio, spending habits). Based on your credit file and information submitted, the underwriter will ultimately decide if you have enough cash flow to pay off the loan, or if you present a risk in paying it back.

What Happens When an Underwriter Approves a Loan?

Underwriting is primarily used in the mortgage world when home buyers take out six-figure loans to finance new properties. Before a loan can be processed and approved, however, your financial information goes through the hands of underwriters. These professionals assess your financial history, current earnings, current debts, and the property itself to ensure that everything is in order.

If the underwriter is satisfied by your detailed credit history and the property value, they can approve your home loan. This is usually one of the final steps before closing on a mortgage.

Can Underwriters Deny Loans?

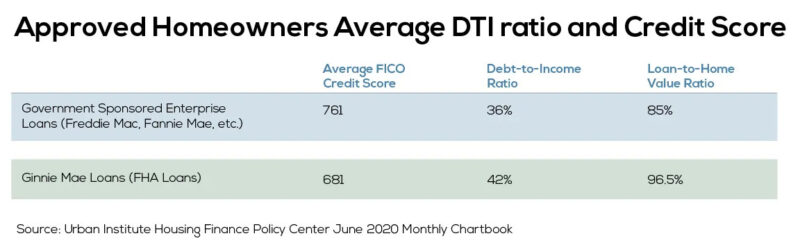

Just as underwriters have the power to approve loans, they can also deny loans as well – even if you are pre-approved. According to The Urban Institute’s June 2020 Housing Finance Policy Center Monthly Chartbook, approved homeowners typically have a good credit score, moderate debt-to-income ratio, and put between 3.5% and 15% down on their home.

Although applicants can get a pre-approval letter from a loan officer based on their credit score and consumer report, it isn’t final until the underwriter completes their analysis. If an underwriter has a reason to believe an applicant can’t make their monthly payment, they can deny the loan.

Why Underwriters Deny Loans

There are three key reasons why underwriters deny loans, and they all have to do with your credit history. First, if you have a low credit score due to high credit card balances, accounts sent to collections, or repossessions, you may be looked at as a high-risk borrower. Second, if your debt-to-income ratio is too high because you are close to maxing out credit cards, the remainder of your paycheck may not be enough to cover a home loan. Finally, if you don’t have a down payment – or have to borrow from family or retirement accounts to make the down payment – you may be denied

No loan is ever complete until the underwriter can confirm (through your financial information) that you can pay for a loan. If something in your financial background gives them pause, then you can be denied.

Why Are Underwriters Important?

For financial institutions, underwriters are some of the most important team members involved with loan decisions. Mortgage underwriters assess all the documents a homeowner submits, including proof of income, tax returns, and any assets and liabilities they may have. With a full picture of one’s financial life, the underwriter determines whether the applicant can afford the loan amount they request.

Financial underwriters investigate companies seeking an initial public offering (IPO) to see if they can reasonably raise the amount of money they are seeking. This analysis sheds light on a new stock offering for investors and provides the clarity needed to make the right decisions for their portfolios.

In short, underwriters work to provide checks and balances to loans and certain investments. Their decisions help to regulate the marketplace and ensure qualified transactions move forward. Through research and analysis, they keep unnecessary risk away from lenders, bank stakeholders, or investors looking into new stock options.

What Is an Underwriter Syndicate?

In some situations, a single underwriter may not have enough time or resources to handle a single investment or insurance project. To spread out the risk, multiple banks or financial institutions may form an underwriter syndicate, a temporary group assigned to analyze and decide on the financial project.

In the world of IPOs and secondary offerings, the underwriter syndicate analyzes the stock, purchases portions of the offering, and ultimately sells them to their book of clients. This reduces risk for the bookrunner, while the stock sale gains exposure to a number of qualified institutional and retail clients.

In the insurance world, however, an underwriter syndicate is a group of insurers who come together to back high-value properties or high-risk insurance liabilities. A famous example of an underwriter syndicate can be found at the Lloyd’s of London insurance exchange. Individuals and companies come to Lloyd’s seeking an insurance policy which may be backed by one (or several) underwriters in the association.