The stock market is quickly closing in on new highs despite looking overvalued. The S&P 500's Shiller price-to-earnings (P/E) ratio is now over 25 -- around 52% above its historical average of 16.5. Investors looking for clues in the CBOE Volatility Index (VIX) aren't getting much useful information. Just this month, the index has ranged from an alarming high of 21.44 to a deceptively safe low of 13.57.

The best defensive-oriented investors can hope for is to have a company with an essential product or service that's not tied to the overall economy be in short supply. When the price of oil rises, it may hurt consumers, but it also helps lift the stock price of companies like Exxon Mobile (NYSE: XOM).

But it's not oil that consumers are suddenly craving. The demand for chicken is the catalyst that could drive one company's stock price higher no matter what the stock market does.

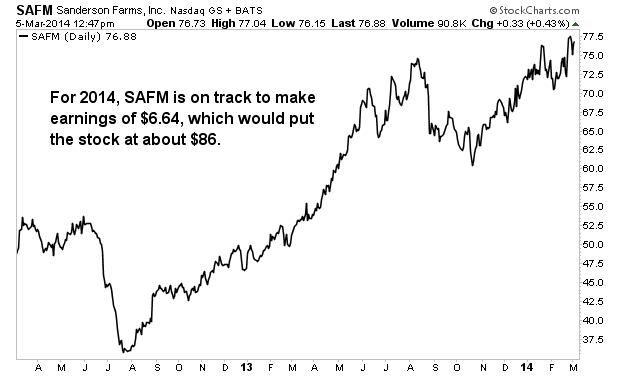

Sanderson Farms (Nasdaq: SAFM) is a $1.6 billion food company that specializes in poultry.

Thanks to Americans becoming more health conscious, chicken sales are on the rise. Fast-food companies like McDonald's (NYSE: MCD) have expanded their menus to include more chicken products while sales of chicken wings alone grew 11% in 2012 to $8 billion, according to GuestMetrics. The industry has limited breeder stock available until late 2014, according to Sanderson Farms' most recent earnings report, which should benefit the company and give it greater pricing power. This factor was seen last year when it raised prices by about 9.5% and expanded operating margins to 7.7%.

The company's biggest competitor is Tyson Foods (NYSE: TSN), a $13 billion powerhouse that is also experiencing success. While the stock is up almost 70% in the past year, it doesn't quite measure up to Sanderson Farms. The company trades at a much higher 15 times earnings compared to Sanderson Farms, which trades at a P/E of just 10. Tyson also has long-term debt liabilities of $1.9 billion with cash and cash equivalents of $825 million, while Sanderson Farms only has long-term debt of $38 million and cash holdings of $58 million.

Earnings for the first-quarter FY2014 came out on Feb. 25, which revealed a huge increase in net income compared to last year -- $28.9 million versus a loss of $6.9 million. Management also announced an extension to 2017 for a repurchase plan of up to 1 million shares, giving investors some downside protection. Sanderson increased its dividend payout close to 20% in September of last year to $0.20 a share for a yield of 1%.

Warren Buffett's recent shareholder letter explains why the 1986 purchase of a farm made sense. He points out that it's the future productivity of an investment that investors should be interested in and not just a quick score. Buffett further makes a point of writing, 'Whatever the chatter, corn would keep growing in Nebraska and students would flock to NYU.' The same principle can be applied to Sanderson Farms; no matter what happens in the stock market, people are still going to buy chicken and eat dinner.

Risks to Consider: The commodity prices of feed ingredients and chicken are subject to supply and demand influences and may not move in a correlated fashion. In addition, unexpected weather could negatively impact the price of grain, corn, and soybeans, which are primary ingredients in chicken feed.

Action to Take --> The stock trades cheaply at just 10 times earnings with earnings per share (EPS) growth of 36% over the past five years. For 2014, the company is on track to make earnings of $6.64, which would put the stock at about $86 -- a 14.5% discount from current price levels.