Many investors follow the Dogs of the Dow, a well-known trading strategy that is intended to buy value stocks. Originally, the Dogs of the Dow strategy consisted of buying the 10 highest-yielding stocks in the Dow Jones Industrial Average and rebalancing the portfolio once a year.

Every January, a new list of Dogs would be compiled and changes made to the portfolio to reflect them. Most years, at least some of the stocks remain on the list, and turnover is relatively low.

Since the Dogs of the Dow strategy was first published, a number of variations have been developed.

One of the variations of the strategy is to buy only the five lowest-priced stocks from the list of the 10 highest-yielding stocks. This is the approach Amber Hestla detailed last month. She suggests using call options to lower the purchase cost and increase the potential gains from the strategy.

The stocks she identified as Dogs of the Dow using this strategy are Cisco (Nasdaq: CSCO), Intel (Nasdaq: INTC), Pfizer (NYSE: PFE), AT&T (NYSE: T) and Microsoft (Nasdaq: MSFT).

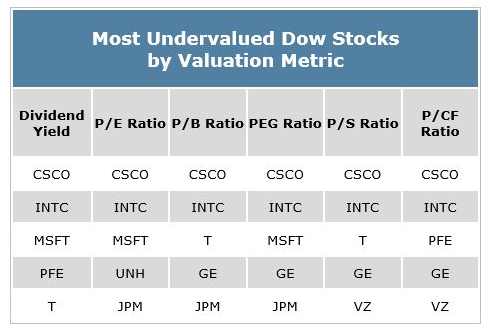

The Dogs of the Dow strategy limits the definition of value to dividend yields. There are other ways to define value, so we started with the list of Dow stocks and narrowed it down to the 10 with the lowest valuation ratio in each category. We then selected the five lowest-priced stocks from that list.

The table below summarizes what we found when applying different valuation tools that included the price-to-earnings (P/E) ratio; the price-to-book (P/B) ratio; the PEG ratio, which compares the P/E ratio to the earnings growth rate; the price-to-sales (P/S) ratio; and the price-to-cash flow (P/CF) ratio.

In addition to the stocks found with the dividend yield screen, we also identified JPMorgan Chase (NYSE: JPM), UnitedHealth Group (NYSE: UNH), General Electric (NYSE: GE) and Verizon (NYSE: VZ) as undervalued.

In addition to using any of the lists, investors could also buy the stocks identified as undervalued in the most categories. There is a great deal of overlap on the six different lists, with CSCO and INTC being undervalued by each measure. GE appears on four of the six lists, while MSFT, T and JPM are on three lists.

While income investors might want to consider the traditional approach to the Dogs of the Dow, deep value investors might want to select the stocks with multiple buy signals. Combined buy signals could increase the odds of success. We also prefer using the PEG ratio to find value stocks. To find the PEG ratio, you divide the P/E ratio by the growth rate of earnings per share. Stocks with a PEG ratio below 1 are usually considered to be undervalued.

Most value investors simply look for stocks with low P/E ratios, with 'low' being defined in static terms: Low P/E ratios might be below 12, or below the market average for all stocks. But the PEG ratio recognizes that fast-growing stocks often deserve higher P/E ratios.

A stock with a P/E ratio of 30 that is growing earnings at 30% a year would have a PEG ratio of 1, just like a stock with a P/E ratio of 10 that is growing earnings at 10% a year. Most value investors would ignore the stock with a P/E ratio of 30, but the PEG ratio highlights the fact that the high P/E stock is undervalued.

Action to Take --> There are a number of ways to define value, but they all point to CSCO and INTC as buys. Investors should round out their top five using the valuation method they would normally use to select stocks.