An article by StreetAuthority's David Sterman recently caught my attention.

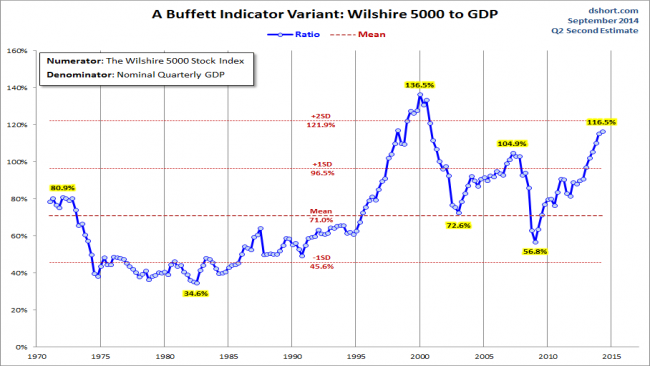

It highlighted an indicator that I haven't looked at for a while -- it measures the market cap of the Wilshire 5000 relative to gross domestic product of the United States. It is one of Warren Buffett's favorites, has been incredibly prescient in detecting changes in the market and is now flashing a sell signal.

The measure, shown in the chart below, is simple and intuitive. When the value of the stock market surpasses the value of the economy, it indicates that investors are paying a premium for assets.

Going back to the last two market busts, when the indicator crosses the 100% threshold, the 12-to-18 month outlook has not been promising.

This threshold was breached in March of last year and now signals stocks are about 15% overvalued.

While the indicator defied all reason to reach nearly 137% before the 2000 selloff, it only made it to 105% before the last market bust. With the Federal Reserve set to raise rates next year, and global growth not picking up the slack, 2015 could bring the correction we have so long avoided.

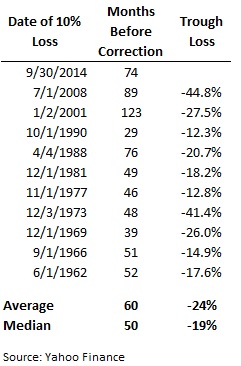

Since 1950, market corrections -- defined by a 10% decline over a 12-month period -- have occurred every 61 months on average and every 53 months if you exclude the 123-month bull run of the 1990s. Our last 10% correction was 74 months ago and may be well overdue.

Before you panic and sell out of stocks completely, things may not necessarily be heading towards a crash. FactSet Research forecasts earnings growth of 11.5% in 2015, ahead of this year's 7.5% estimated growth. Corporate balance sheets are still flush with cash at $1.35 trillion, up 6.9% in the second quarter and M&A activity continues to support premium prices.

Europe is just ramping up its own easy money policies with a quantitative easing program and a bank loan program. Japan still has at least a year to go on its own central bank asset plan. The Fed has been skittish in the past and has come to the market's aid when asset prices sell off on an end to easy money, this could again be the case if things get too bad next year.

Look For Quality Names And High Yields To Weather The Storm

Instead of a shift in your allocation away from stocks, the answer is more likely a shift in the stocks you own.

The Home-Grown Play: Avoid emerging markets and instead look for U.S. based-stability. The dollar has rallied into its longest weekly run since 1967 and could continue on bets that the Fed will raise rates. This is bad news for emerging market countries that need investment inflows.

A stronger dollar is not necessarily good for all U.S. companies either. Look for those with most of their business domestically like AutoZone, Inc. (NYSE: AZO), a holding in Nathan Slaughter's Total Yield portfolio.

AutoZone is one of America's largest specialty retailers of parts and supplies to keep vehicles running smoothly. While the chain of more than 5,000 stores competes with discount retailers on everyday consumables like oil and antifreeze, AutoZone stands apart in its supply of harder-to-find parts.

The company booked $9 billion in sales last year, nearly a fifth of the $47 billion spent on car repair over the period. While the industry has grown sales by a stable 3% for more than a decade, AutoZone has grown at a 5.1% pace to gain market share. The company sells 50% more belts, batteries and hoses than their closest competitor.

That market dominance translates to safety even in the event of economic weakness or a drop in the stock market. While the shares do not pay a dividend, an AZO is engaging in an aggressive share buyback program. Nathan has a buy-under price of $535 and a target price of $580 per share on AutoZone, a 13% upside from the current price.

The Yield Play: Master limited partnerships (MLPs) should continue to produce attractive profits and cash yields as the U.S. energy revolution develops.

Thanks to the boom in shale production, the United States is the world's #1 natural gas producer and one of the world's top producers of oil. Besides strong production growth for at least the next few years, partnerships enjoy a special tax advantage that makes them a very efficient way to hold assets. Not only do you enjoy yields that are up to four times those found in the general market, but much of the distribution is tax-deferred many years down the road when you sell the units.

Breitburn Energy Partners L.P. (Nasdaq: BBEP) is a top pick in Nathan Slaughter's High-Yield Investing portfolio. Units in the MLP pay a sustainable 9.4% distribution on a monthly basis for a great way to smooth out your income from quarterly payers. The units have provided a total return of 8.7% since they were added in February 2014 and still offer 30% upside to fair value on top of the distribution.

Breitburn Energy is one of the few MLPs that operate upstream assets, producing oil and gas from the Permian Basin of West Texas to the plains of Wyoming. The partnership began with a relatively small asset base when it became publically traded in 2006, but has grown fast through acquisitions. The company now operates 5,600 wells throughout nine states and produced 8.3 million barrels of oil equivalent last year.

The 'Forever Stock' Play: Look for quality names that you can hold forever like Top 10 Stocks' Starwood Hotels & Resorts Worldwide, Inc. (NYSE: HOT). These best-of-breed stocks may take a hit with the rest of the market but are likely to outperform on superior fundamentals and competitive advantages. Even as shares fall, investors can be confident that the long-term potential remains intact.

Starwood is a management company that holds some of the world's most recognizable hotel brands, including Westin, Sheraton and St. Regis. The company owns 1,175 properties in nearly 100 countries and is able to charge a premium price for its luxury service.

The company is unique from others in the industry in that it is transitioning to an operator of assets model, as well as simply holding the brand names. Three-quarters of the firm's 2013 revenue, more than $4 billion, came from property management and other services.

Starwood switched to a quarterly dividend this year, which yields nearly 5% on an annual basis. Beyond the strong dividend, the company has an aggressive buyback program and has returned a combined $1.06 billion to investors over the last four quarters, representing nearly 7% of its $15.4 billion market cap.

Risks to Consider: Few investments will be completely immune to a stock market correction and the best thing you can do is stay calm and sell as losses mount. Look for quality names and industries with an economic tailwind, like those above, and be ready to pick up shares at a discount.

Action to Take --> After a five-year bull market, indicators are flashing red and you should position for a correction over the next twelve months. Increase your cash holdings and take safety in Forever Stocks and industries/sectors that will hold up relatively well.

One of the best types of stocks to hold during a market correct are companies with the highest 'Total Yield' score. This is calculated by combined a stock's dividend yield, stock repurchases and debt reduction. Not only has the strategy returned an average of 15% per year since 1982, but it's outperformed the S&P during the 'dot-com' bubble and the 2008 financial collapse too. To learn more about his 'Total Yield' investing strategy, click here.

This article originally appeared on StreetAuthority.com: 3 Investments To Survive the Coming Correction