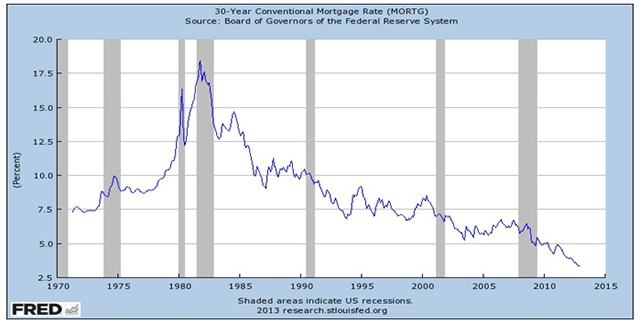

- Rates are still near their all-time lows. Period. Had I written this article a year ago, I would have said the same thing. Rates had just dipped below 4%, and it seemed insane to think they would go even lower. Yet here we are. That said, when the Fed publishes a report saying that rates have likely hit a floor, I certainly listen. So if you've been holding out for lower rates, you may want to stop. Chances are very good that the time to act is now.

- Every $1 you save on mortgage interest grows your total net worth. If you have a $300,000 mortgage, you can save $62,248 in interest expense over the life of your loan by lowering your rate from 4.5% to 3.5%.

Provided you save that money and don't spend it, you increase your net worth by at least the same amount. You would have to earn almost 8.8% a year on a $5,000 investment to grow your wealth by the same amount over 30 years, requiring you to invest in some pretty risky assets.

- This is an opportunity to diversify away from real estate. For most investors, myself included, the family home is our largest investment. And as we all learned five years ago, you probably don't want all your eggs in one basket of real estate.

If you have a $300,000 mortgage, you can save $172.93 a month on mortgage payments, improving your cash flow and increasing the amount of money you can invest in stocks, bonds or even cash.

- Don't forget that a mortgage is a tax shelter. Even though marginal rates didn't go up for most people, those in the highest income bracket did get dinged. If you're one of those high-income earners, it makes more sense than ever to shelter some of that income with a mortgage.

- Fixed-rate debt is one of the best hedges against inflation. Unlike commodities or precious metals, a house provides economic value. Either it gives you a place to live or it gives you a property to rent out to others.

Rents tend to keep up with inflation. So, if inflation goes up by 5% to 6% a year and your home is financed at a 3.5% fixed rate, you should be able to collect higher and higher rents even though your monthly mortgage payment stays the same. The rest goes in your pocket. The same cannot be said for gold, silver, corn or other commodities.

Sara Glakas is director of marketing for Texas Private Asset Management, an Austin-based investment planning firm. She has an MBA with a concentration in corporate finance and she is the former president of InvestingAnswers.com.