It's not so common anymore for shares of PepsiCo (NYSE: PEP) to make sizable moves, but they did Wednesday when the beverages and snacks giant reported second-quarter performance.

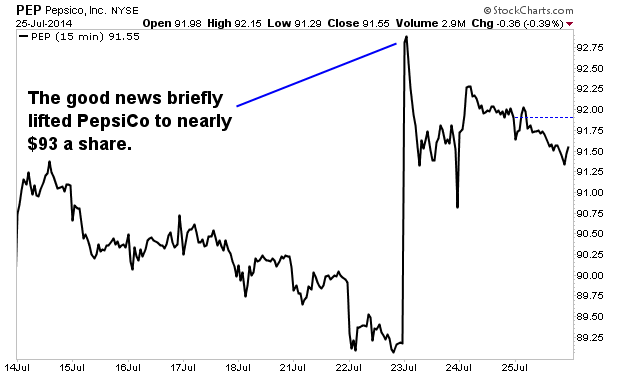

After investors learned PepsiCo had soundly beaten on earnings and slightly exceeded expectations for sales, shares quickly popped more than 3%. They finished the day nearly 2% higher and are now up almost 11% in 2014, versus about an 8% gain for the S&P 500.

That's right -- perennial underperformer PepsiCo is beating the market.

Thus, investors may be wondering: After many years of solid but ordinary performance, has PepsiCo managed to shift into a higher gear and become a growth stock once again? Can shareholders now expect it to consistently deliver market-beating returns going forward?

I don't think so.

Despite PepsiCo's outperformance so far this year, growth investors probably shouldn't get overly excited about the stock and they'd be prudent to keep its second-quarter performance in perspective. For instance, while earnings per share (EPS) came in at $1.32 after adjusting for charges and topped the consensus estimate of $1.23 by 7%, they were still a mere penny higher than in 2013's second quarter, when PepsiCo earned $1.31 a share. That's less than a 1% improvement. Similarly, sales were up a mere half percentage point year-over-year to $12.9 billion.

However, this was enough to create some excitement among analysts, like those at Stifel, who promptly upgraded PepsiCo to 'buy' from 'hold' and set a price target of $106. Management has adopted a rosier outlook, too, and now forecasts EPS growth of 8% for 2014, up from the 7% it previously projected. It also reiterated plans for $5 billion in share repurchases and $3.7 billion in dividend payments this year.

These are all positives, to be sure. But they don't suggest PepsiCo is kicking off an exceptionally fast growth phase, and neither does the firm's longer-term performance.

PepsiCo Growth And Profitability Metrics, 2008-Present

As you can see, growth has typically been respectable but modest -- certainly nothing like you'd expect from a superstar.

It might be even more modest if not for emerging markets. In 2013, for instance, PepsiCo's best-performing foreign segment -- Asia, the Middle East and Africa (AMEA) -- saw operating profits rise 57% from the previous year, to $1.2 billion. The Latin America Food group improved operating profits an impressive 17% last year, also to about $1.2 billion.

Still, I wouldn't count on emerging markets to transform PepsiCo into a fast-growth stock. Weakening volumes and sales in developed countries will likely blunt the profitability of emerging markets, and this headwind is apt to worsen as consumers continue to resist the sugary carbonated drinks and high-fat snacks PepsiCo still relies upon so heavily. (The Frito-Lay North America segment, for example, generates more than 20% of total sales.)

What's more, emerging markets often don't deliver much better top-line results than developed markets, and in some cases they even lag. Last year, for instance, sales actually fell 2% in the AMEA group to $6.5 billion but rose 4% in Frito-Lay North America to $14.1 billion. In Latin America Foods, revenues were strong but far from exceptional, rising 7% to $8.4 billion.

With faster top-line growth so hard to come by domestically and internationally, PepsiCo will have to rely a lot on other factors, especially cost controls, to buoy profits. The firm has been doing a very good job in this area, managing to hold annual operating costs steady at around $25 billion or so for the past several years. Also, the company is on track to achieve its goal of $1 billion in productivity savings this year, management notes.

This certainly helps, but cost-cutting really isn't a viable long-term growth strategy. The fact that it's so crucial for PepsiCo is just another sign rapid growth isn't in the company's future.

Another sign is PepsiCo's lack of any clear catalysts for much faster growth, such as a unique new product that could disrupt the beverages market the way Monster Beverage Corp. (Nasdaq: MNST)has. Since 2008, that company has more than doubled sales and nearly quadrupled earnings with its popular line of energy drinks.

One unlikely catalyst may be the intervention of hedge fund manager/activist investor Nelson Peltz. He has been pushing PepsiCo to divide its snack and beverage businesses into separate firms and/or merge with packaged foods manufacturer Mondelez International (Nasdaq: MDLZ), another slow-growth firm with annual revenue of $35.2 billion and some very well-known brands (such as Oreo, Nabisco and Tang).

I especially like the idea of a spin-off because, as Peltz argues, it would create two leaner companies, with the snacks business probably having higher sales and margins and the beverages business being more cash flow- and dividend-oriented. However, PepsiCo management has steadfastly resisted Peltz so far.

Risks to Consider: As a food and beverage manufacturer, PepsiCo is highly vulnerable to increasing commodity costs.

Action to Take --> Don't buy PepsiCo in hopes of fast growth based on a surprisingly good second quarter and the stock's outperformance this year. In general, PepsiCo is a still a slow-growth firm that will have to struggle mightily just to achieve modest gains in sales and profits. Its main attractions will continue to be a solid dividend (currently $2.62 a share for a yield of 2.9%) and a relatively stable stock price. At around 35%, upside for the stock during the next five years is somewhat limited, but may be attractive to conservative investors.