The North American Energy business has had a massive resurgence thanks to the implementation of horizontal wells combined with multi-stage fracturing. These techniques were first applied to successfully produce shale gas and have through trial and error subsequently been used to liberate oil trapped in shale and tight rocks.

North America is now almost a decade into this horizontal revolution, yet these practices have not really created any sort of impact outside of North America.

Why is that?

The answer is that everything about North America made it a perfect fit for horizontal oil and gas development.

Developing a horizontal play involves drilling hundreds if not thousands of wells that come on strong and then have sharp production declines. This is different from conventional oil and gas wells which decline at much slower rates and don't require as many wells.

The following attributes have made North America a perfect fit for horizontal development and are attributes that are generally not all present internationally:

- Infrastructure – Prior to the horizontal revolution, Canada and the United States already had in place an enormous network of oil and gas pipelines that could be utilized. Many international locations with horizontal potential have no surrounding infrastructure.

- Manpower – North America has the world's largest drilling fleet and workforce. Horizontal production is about drilling thousands of wells that produce small amounts of oil and decline quickly. Without a massive number of rigs and people these horizontal plays are a no go.

- Ownership of land rights – In North America individual landowners can lease out the rights to their property and they are financially motivated to do so. Few international locations have a similar land rights laws which significantly bogs down the process.

- Water – Multi-stage fracturing involves injecting massive amounts of water into the horizontal wells. In North American water is readily available to do this, internationally that often isn't the case.

- Geology – The successful horizontal plays in North America have one thing in common, the absence of tectonic activity. This allows for the oil and gas zones to be layered at uniform levels like a layer cake which makes targeting those zones easier and the wells more productive and predictable. Many potential international plays are located in areas that have experienced significant tectonic activity.

An International Play With Horizontal Potential

I've become very leery about investing in junior oil and gas companies that believe they have the 'next big' horizontal play, especially when that play is internationally located. Until I've seen oil or gas wells that produce at rates that offer a profitable return on the cost of drilling them, I'm inclined to view new unproven plays with a very skeptical eye.

Alvopetro (ALV.TSX, ALVOF.OTC) is an international horizontal player that I find more tempting. The management group backing this company has a significant amount of horizontal oil experience and a successful track record of 'cracking the code' on new plays.

Alvopetro was spun out of Colombian focused oil producer Petrominerales when it was acquired by Pacific Rubiales (PRE) at the end of 2013. The management team at Alvopetro is closely tied (the companies share a Chairman) to Canadian horizontal pure play Lightstream Resources (LTS.TSX) which has drilled more horizontal oil wells than almost any company in Canada.

The focus for Alvopetro is a potential horizontal oil play in Brazil. I figure that this group would not be wasting their time on a horizontal opportunity unless they felt very confident about its potential. That perks my interest.

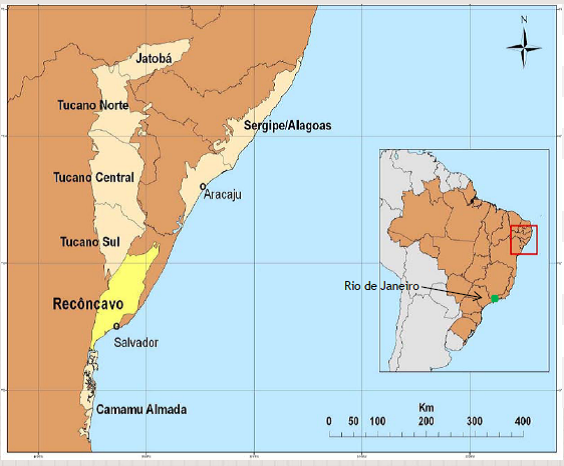

Source of image: August 2014 Alvopetro Presentation

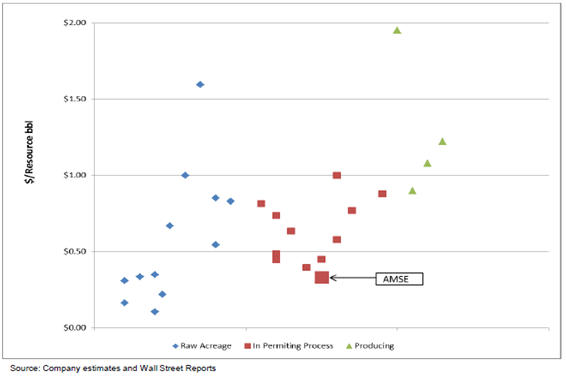

Alvopetro is focused on the Reconcavo Basin in Brazil where the company has assembled 148,000 net acres. The zone of interest on that land is called the 'Gomo' formation which Alvopetro believes exposes the company to 1.2 billion barrels of oil in place.

Having exposure to a lot of oil in the ground and having a lot of oil that can be produced profitably are two very different things. The reason that Alvopetro likes the Gomo is that it compares very favorably in virtually every way to successful North American plays like the Bakken and Eagle Ford.

Since the Reconcavo Basin has had 6,000 wells drilled into it and has produced 1.5 billion barrels of oil and gas during its conventional vertical phase of development the area has plenty of infrastructure already in place.

Alvopetro is armed with a balance sheet that has no debt and $80 million of cash so it is on strong financial footing.

Without the ties to Lightstream I likely wouldn't be very interested in this company. Having Lightstream's horizontal experience to draw on is not only a key sign about the quality of the Gomo play, it is also a big advantage when it comes to trying to figure out how to produce from it.

Nonetheless, this is an early stage company and therefore it carries with it a much higher level of risk than an established producer with predictable cash flow.

So far the horizontal game hasn't travelled well internationally. I think Alvopetro is a company with a chance to make a major breakthrough.

Actions to take --> Buy an initial position in shares of Alvopetro so that you can keep an eye on how the company progresses. If early wells are successful, you can take a larger position before the market catches onto the story.

Risks to consider: This is an early stage horizontal oil and gas company. The company has big potential, but the risk level is going to be elevated until the company starts generating significant cash flow.