The budget deficit dilemma should serve as a nice warm up to a different deficit dilemma likely to hit the headlines in the coming years: The Oil Deficit.

Petro-Problems

The pending petro-problems are highlighted in the 2011 International Energy Agency's World Energy Outlook report released on November 9, 2011.

The contents of the report should have been at least newsworthy enough to overshadow Kim Kardashian's latest indiscretions. But that wasn't the case.

The report revealed that by 2035, the world will need 47 million barrels of oil per day just to compensate for a decline in existing oil fields.

In other words, similar to the New York Yankees, we have a roster of over-the-hill oil fields that simply can't produce the numbers they used to. But the story doesn't end there.

An additional 13 million barrels of oil per day are needed in order to meet the expected increase in future global demand.

In total, that's a 60 million barrel per day deficit -- or the equivalent of roughly six new Saudi Arabia's -- needed in the next 25 years. That's a lot of oil.

Drawing on the baseball analogy, Saudi Arabia is the A-Rod of oil fields. So where are we going to find six 'once in a generation' oil fields in the next quarter century? Where, indeed?

Crude Reality

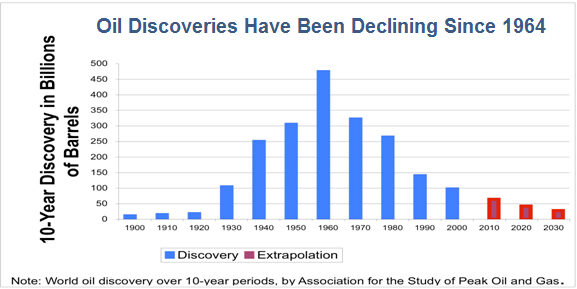

Covering the 60-million-barrel gap seems unlikely considering the decline in production of existing oil fields as well as the trend in global oil discoveries. Check out this chart:

As you can see, global oil discoveries peaked in the 1960s and have declined every decade since; a surprising fact given all the lip service paid to recent 'huge' discoveries.

But even the new oil finds come at a greater cost because all the 'low hanging fruit' is gone. Consider the Shaybah oil field in Saudi Arabia. Before they could actually retrieve the oil, workers had to build a road to access a field, remove 100 million cubic feet of sand, and construct a 400-mile long pipeline. And that's all before any drilling could begin!

These trends suggest the world is in the early stages of an 'oil deficit crisis.' Production simply can't keep pace with demand, and even if it does, it will certainly come at a high cost to consumers. Oil industry vet T. Boone Pickens agrees. He's the one who said, 'This is one emergency we can't drill our way out of.'

With rising demand and dwindling supply, something's gotta give. Enter the laws of economics.

Rising Prices

When demand exceeds supply, rising price always settles the score. Simply put, the era of cheap oil is over. A sentiment echoed by Petrobras (NYSE: PBR) CEO Jose Sergio Gabrielli at Platts Global Energy Outlook Forum.

Nobody can say for sure where oil prices will be in 2035, but the U.S. Energy Information Administration ventured a guess: $146 a barrel.

And that is a non inflation-adjusted number. Just imagine the future price per barrel if the dollar takes a dive.

[InvestingAnswers Feature: Why a Dollar Isn't Always Worth a Dollar]

So if you're convinced high oil is here to stay, the American way is to figure out how to profit from it.

The Investing Answer: One of the most popular plays on rising oil prices is alternative energy stock. But in my mind, alternative energy investing involves taking unnecessary risk.

In all likelihood, the next big alternative energy breakthrough won't come from 'Biofuels, Inc.' but rather a major oil company investing in biofuels like Exxon Mobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP), ConocoPhillips (NYSE: COP) or Royal Dutch Shell (NYSE: RDS-B). The best part is if big oil's foray into alternative energy fails, they can fall back on their main moneymakers: oil and natural gas.

Speaking of natural gas, there's a lot to like about Chesapeake Energy (NYSE: CHK). Currently, natural gas is the most suitable oil alternative and Chesapeake has a lot of it. Right now its share price so undervalued that if you were to buy the company today, you'd essentially get its unproved natural gas reserves for free. That's like buying a slice of cake and getting the rest of the cake at no charge. Sounds like a good opportunity to buy low to me.