When I first heard this I was shocked.

During a recent trip to Asia, I received one of the most startling tips I've ever heard.

I met up with a long-time colleague of mine named Andrew, who runs an investment firm in Singapore. This is a man who's made millions of dollars trading gold and other commodities.

He told me that right now, Chinese officials are quietly building the world's largest national reserves of gold bullion... and within the next year, the Chinese government wants to shock the markets with a surprise announcement of their pumped up holdings.

Sudden word of a buyer like China having tied up so much supply would almost certainly be a hair trigger for gold prices moving up -- and send share prices of a handful of gold producers through the roof.

And because several of these producers pay dividends, it would also give income investors a chance to take advantage of this big growth opportunity, too.

I immediately started looking into this 'Gold Rush' story... and it turns out that it's really happening.

Over the past 12 months the Chinese government has been stockpiling gold, with unprecedented quantities being bought and sold through markets in Beijing, Hong Kong and Shanghai.

Some of this buying is being reported... but the majority of it is not. The Chinese government is notoriously tight-lipped regarding their finances.

As currency expert and bestselling author, James Rickards, explains:

'If you're China, the last thing you want to do is be transparent about your gold purchases, because it will drive the price up.'

Because of this secrecy, few know that China (already by far the world's largest gold producer) has surpassed India as the world's largest gold importer for the first time in recent history.

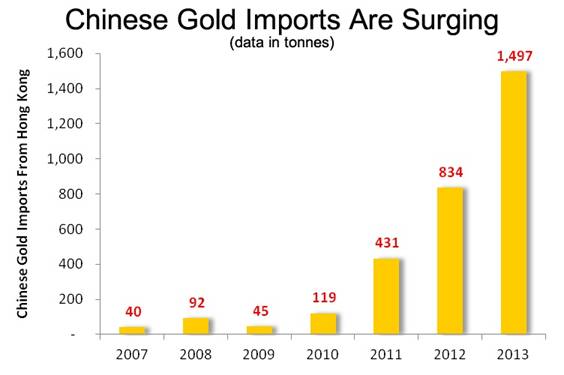

You can see what I mean in the chart below. It shows Chinese gold imports over the past 6 years and record increases over the last 3 years.

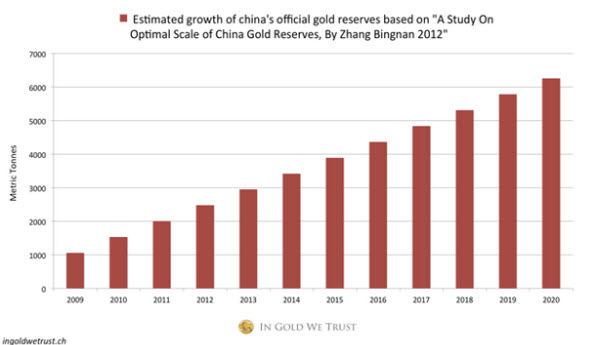

This is just the beginning. The next chart shows estimates of China's future gold reserves based on a 2012 study by economist Zhang Bingnan.

If China's gold consumption continues at this record-setting pace, China will soon own the largest gold stockpile in the world.

Since the beginning of this year, Gold has already gained 7.8%, rising as high as $1,380 per ounce.

But that's just a taste of what could be coming. The World Gold Council estimates that China's annual demand for gold could jump around 20% by 2017. And to top it off, demand for gold bars and coins alone could reach 500 metric tons by 2017 -- a rise of nearly 25% above the record level set last year.

After talking with my 'man on the ground' in Asia, and looking at every possible angle, I'm more convinced than ever that now is the time to get in.

So how can investors take advantage of one of this year's (and possibly this decade's) biggest opportunity in gold?

You could outright buy physical gold, but I've found a better way that could lead to gains that are several times larger with dividend yields that you obviously couldn't get by buying bullion.

I'm talking about investing in companies that actually mine and produce physical gold. As many in the commodities business know, in gold mining -- when we hit it, we hit it big.

And in my 15-years of experience as a resource-exploration geologist and investor I've never seen gold producers trading at such dirt-cheap valuations.

You see, copper, gold, silver -- these hard resources will never go away. It has to be found, mined and typically has to be processed in some way or another. And I believe that investing in a handful of companies that specialize in mining and processing gold is going to be one of the best ways to take advantage of this opportunity over the next 12 months.

Simply put, the gold producers I have outlined in my latest research report can produce gold at such low costs that even if the price of gold dips they still turn a profit. These companies will prosper in the current environment of rising gold prices.

And today, you can buy gold producers at some of the lowest valuations I've ever seen.

The firms I've been researching aren't risky upstarts either. For example, one of the gold producers I found already owns two of the top gold mines on the planet and carries a 5% dividend yield. Should gold return to the same prices we saw just three years ago, shares could easily soar over 218%.

Another low-cost gold producer is selling for the best price I've seen in a decade. Because its average cost to produce one ounce of gold is just over $1,071, this firm could easily gain 97% over the next 12 months as gold prices rise. It's also already paying a dividend yield over 3%.

I talk about these miners and more in my newest research video. There I'll tell you exactly what's happening in the gold market so you can be prepared for what's coming. I'll also show you the absolute best ways to get in on this opportunity before gold prices start going up. You can visit this link to see the video now.

The bottom-line is this -- physical gold is disappearing fast. And the world's largest producer and importer of gold is China. The full impact of China's unprecedented spending spree has not yet been announced, nor has it taken hold on global markets. But within the next two years you could be looking back on $1,900 per ounce as 'the time when gold was cheap.'

This article was originally published by StreetAuthority under the title: The Trigger That Could Send Gold Prices Through The Roof