The Fed is trapped and bluffing.

While the market worries about the Fed reducing the size of its monthly bond purchases, I predict the exact opposite will continue to happen for at least through next December after the mid-term elections. The most powerful central bank in the world will actually increase spending.

And because of that, two companies in one forgotten sector could see triple-digit gains in coming months, and they're already sporting rare yields as high as 7.1%. I'll share specific details on these investments in a moment.

First, here's why I think the Fed is trapped and bluffing...

As the Fed continues to threaten the market with its stated desire to taper, global economic growth projections continue to decline. Just last week, The Organization for Economic Co-operation and Development (OECD) downgraded its global growth projection for 2014 from 3.1% to 2.7%.

It begs the question, if the Fed was unable to pull the trigger on a taper when the global economy was projected to grow 3.1%, how is it going to taper now that the global economy is showing signs of weakness?

The answer is... it can't. The Fed has to keep the money spigot wide open or risk interest rates spiking, the U.S. stock market crashing, and the global economy falling into a deep recession.

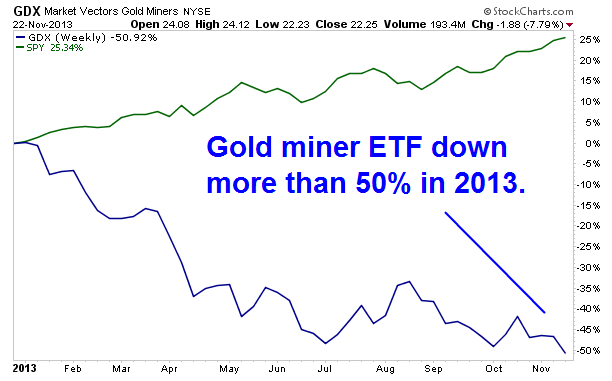

That's why I'm bullish on precious metals miners. The group has suffered huge losses as the market has anticipated the Fed tapering in 2013. Just take a look at the big decline below in the Market Vectors Gold Miners ETF (NYSE: GDX).

But as I'm about to show you, right now could be the perfect time to buy.

Warren Buffett said that the time to buy is when there is 'blood in the streets.' Gold mining stocks have certainly taken a beating this year. But if the Fed continues its antics, two stocks could see triple-digit gains in the near future... and they're already yielding as much as 7.1%.

Gold Resource Corp (NYSE: GORO)

Gold Resource is a junior gold and silver miner based in Colorado with mining activities and interests located in Mexico. The company's market cap of just $273 million will likely create more volatility, but also carries the potential to deliver big gains in a bull market.

Much like other miners, Gold Resource has had a tough year, with shares down 67%. While that's produced losses for recent investors, it has also lifted its dividend yield to 7.1%, more than twice the 10-Year Treasury yield of 2.7%.

Is that high yield (driven by falling shares) sustainable?

There's no question the company's third-quarter payout ratio of 238% is elevated relative to its peers and average of 105% in 2012. But here's the upshot. That ratio is based on financial results from last quarter, when gold and silver prices fell sharply due to speculation the Fed would taper.

If the Fed increases its monthly bond purchases -- which I think it will be forced to do -- we should see price gains in gold and silver. And that would have a huge impact on sales, earnings and operating cash flow, pushing Gold Resource's payout ratio back to normal levels.

In the meantime, Gold Resource's current yield of 7.1% is a rare window to lock in a high yield while most of the market looks backwards and incorrectly anticipates a Fed taper.

IAMGOLD Corp. (NYSE: IAG)

IAMGOLD is more than five times the size of Gold Resource, with a market cap of $1.6 billion. Not only is the company much larger than Gold Resource, it's also much more global, headquartered in Ontario with mining operations in Africa and South America. While that carries increased political risk, it also provides IAMGOLD with more production diversification across a larger number of mining assets and regions.

This is another miner that has struggled in 2013, with shares down 64% on the year. That has IAMGOLD carrying a dividend yield of 5.9%.

That gave IAMGOLD a payout ratio of 46% in the third quarter. Although that is above its average of 29% from 2012, it is well within the range of a sustainable payout ratio. But much like Gold Resource, any upward movement in gold and silver prices will have a big impact on IAMGOLD's financial results and could support both dividend and share price growth.

IAMGOLD also looks like a deal. Its forward P/E (price-to-earnings) ratio of 11 times is a sharp discount to its 10-year average of 21 and peer average of 24. If shares traded with the same valuation as its peers, IAMGOLD would jump to $9.60, a 118% increase from current levels.

Risks to Consider: The Fed continues to suggest it will taper the monthly bond purchases it has used to stimulate the economy for the last five years. Although I don't believe that is going to happen because it would have a devastating effect on the economy, fewer segments of the market would be harder hit than precious metals.

Action to Take --> For investors looking to make an aggressive play on precious metals, Gold Resource and IAMGOLD offer big-time, leveraged exposure. If the Fed keeps pumping its magical money machine, both stocks are in position to deliver big gains. In addition to potential capital gains, investors buying now will lock in high yields that are more than twice the 10-Year Treasury note. That provides Gold Resource and IAMGOLD investors with a compelling combination of growth and income.