What is a Minor Downtrend?

A minor downtrend is a corrective movement in the market -- lasting less than three weeks -- that goes against the direction of a secondary uptrend.

How Does a Minor Downtrend Work?

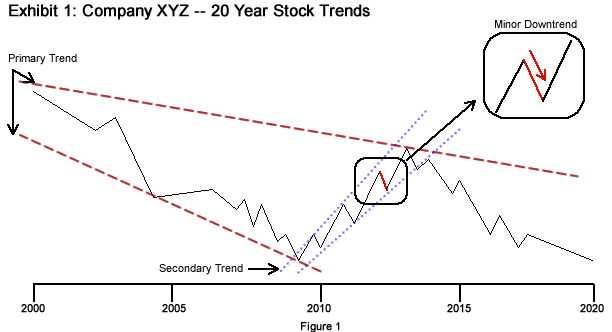

The minor trend is the last of the three trend types in Dow Theory -- the other two types are primary and secondary trends. Because minor downtrends (and minor trends, generally) exist over such a short time period, they don't redefine market movement. Due to this short-term nature, minor trends and minor downtrends are not considered a primary focus of Dow theorists.

Minor downtrends generally occur within the secondary uptrend, which typically lasts from one-third to two-thirds of the primary trend's movement. An example of a minor downtrend is interpreted in Figure 1 below:

Why Does a Minor Downtrend Matter?

When analyzing Dow Theory trends, it is a challenging task for investors to predict the length of minor downtrends, as they create considerable noise within primary and secondary trends. If investors get distracted by a minor downtrend, it can lead to irrational trading.

Minor downtrends should be placed into the context of the overall secondary uptrend until all indicators and evidence suggests that the trend has reversed.

Read on to learn Top Tools for Successful Technical Analysis.