What Is Value-Added Tax (VAT)?

VAT is the most common type of consumption tax and currently used in more than 160 countries, including each member of the EU. The notable exception to this rule is the US.

Value-Added Tax Meaning

For products or services, VAT is collected on a product’s value as it moves through production. This begins with the initial purchase of raw materials and ends with the final retail sale.

What Is Value-Added?

The “value-added” can be defined as the enhancement a business offers a product or service to increase the product’s value or price.

For example, consider value-added in the different stages involved in producing cupcakes:

- A flour manufacturer may purchase wheat from a farmer. The flour manufacturer adds value by turning the wheat into flour.

- A baker purchases flour from the flour manufacturer. The baker adds value by baking the flour into cupcakes.

- Next, the baker sells these cupcakes to a supermarket. The supermarket adds value by making these cupcakes available to customers, providing customer service, and making the shopping experience convenient.

How Is VAT Collected?

Within countries that enforce a VAT, each supplier, manufacturer, distributor, retailer, and consumer all pay a VAT on the goods or services they purchase. VAT is collected by the sellers and paid to the government in taxes – typically through the credit (or credit-invoice) method.

Under the credit method, VAT is assessed on the goods or services offered at each stage of the supply chain. Businesses pay VAT on their purchases and collect VAT on their sales.

In theory, the VAT charged and paid by the same business should balance out. Since the final purchase price includes all of the taxes charged at different stages of the supply chain, the end customer ultimately bears the burden of paying the VAT.

The credit system requires every business to track sales invoices showing that VAT is collected and paid. At the end of the accounting period, a business adds each set of invoices and sends them to the government. If the VAT collected exceeds VAT paid, the business would pay the difference to the government. Alternatively, if VAT paid exceeds VAT collected, the business is entitled to a refund of the difference.

How VAT Is Collected on Imports and Exports

As a general rule, imported goods are subject to the same VAT rate as the country of import. Import VAT is typically collected at the border. Similarly, for exports, VAT is rebated at the border. Exporters receive a credit on the VAT on the goods they are exporting but do not collect a VAT themselves.

The VAT system can help prevent extra taxes as goods travel through different countries en route to customers. The system also ensures that customers are only charged the tax rate enforced in their own country, no matter where the goods were made.

How to Calculate Value-Added Tax

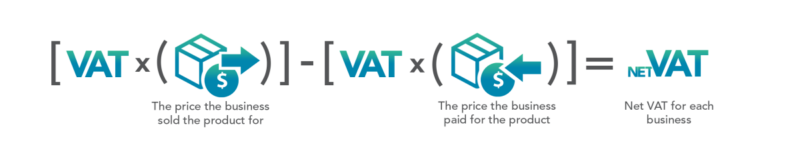

You can calculate the net value-added tax payment rendered by each business along the supply chain with the following equation:

Value-Added Tax Example

Let’s say a country has a VAT rate of 10%. The VAT could be applied to different stages of a cupcake’s supply chain as follows:

1. A flour manufacturer buys wheat from a farmer for €8.00, plus a VAT of €0.80 for a total of €8.80. The flour manufacturer pays the farmer €8.80, and the farmer will remit the €0.80 to the government in taxes at the end of the accounting period.

10% x €8.00 = €0.80

2. A bakery buys flour from the manufacturer for €10.00, plus a VAT of €1.00 for a total price of €11.00. The bakery pays €11.00 to the flour manufacturer. Although the VAT is €1.00, the flour manufacturer only remits €0.20 to the government, which is the total VAT at this stage (minus the previous VAT charged by the farmer).

[10% x €10.00] - [10% x €8.00] = €0.20

3. The bakery sells a dozen cupcakes to the supermarket for €15.00, plus a VAT of €1.50 (total of €16.50). Although the VAT is €1.50, the bakery only remits €0.50 to the government, which is the total VAT at this stage (minus the previous €1.00 in VAT charged by the flour manufacturer).

[10% x €15.00] - [10% x €10.00] = €0.50

4. The supermarket sells cupcakes to shoppers for $€21.00, plus a VAT of €2.10 for a total price of €23.10. The supermarket remits €0.60 to the government, which is the total VAT at this stage (€2.10) minus the previous €1.50 charged by the cupcake shop.

[10% x €21.00] - [10% x €15.00] = €0.60

In this example, the government gets €0.80 from the farmer, €0.20 from the flour manufacturer, €0.50 from the cupcake shop, and €0.60 from the supermarket. That’s a total of €2.10 on the retail sale for a 10% VAT.

What Are Normal VAT Rates?

More than 160 countries around the world impose a VAT, and in most of them, the rate typically falls between 5% and 25% on consumer goods.

We’ve included a table showing VAT tax rates in major countries as of May 2020 below. Note: VAT rates often change. We advise you to inquire with representatives from the country in question for the most current rates.

VAT Refunds

In certain countries that collect a value-added tax (including the members of the EU, China, and Australia) foreign visitors on tourist visas may be eligible for refunds on qualifying purchases.

Though rules vary, VAT refunds are typically obtained for certain types of unused consumer goods in their original packaging (and that have been purchased in the visited country). The VAT refund amount that visitors can claim depends on the VAT percentage charged by the visited country, as well as the way the refund is obtained.

For countries with more complicated VAT refund processes – including those in the EU – agencies and luxury retailers may offer customers a partial refund in-store. Otherwise, VAT refunds are generally processed at the departure airport.

Origins of the Value-Added Tax

The concept of a VAT was separately introduced in the early 20th century by German businessman Wilhelm Von Siemens and American businessman Thomas S. Adams. Siemens saw the VAT as a way to resolve issues with the German’s gross turnover and sales tax system. Adams, however, proposed a VAT as an improved alternative to corporate income tax.

In 1954, France became the first nation to implement the VAT on a large scale to improve earlier turnover tax. In an effort to harmonize taxation systems, VAT was adopted by many governments as a superior alternative to sales tax. In the EU, many member countries eliminated or replaced other sales taxes with VAT while continuing to impose separate corporate income taxes.

Value-Added Tax vs. Sales Tax

Value-added taxes and sales taxes are two types of consumption taxes. Both are regressive taxes, meaning that they are imposed on everyone at the same rate regardless of income.

The primary difference lies in how they are collected. VAT is collected on the value added at every stage of production, not just the point of sale. At every step of the supply chain, each buyer is responsible for paying the same VAT rate on their profits and deducting previous taxes paid during the previous stage.

Sales tax, however, is collected only at the final retail sale stage, and on the total value of goods or services purchased. Sales tax is funded completely by the consumer at the final retail stage (rather than being accumulated over the different parts of the production and consumption cycle).

Sales Taxes in the United States

In the United States, sales taxes are not collected by the federal government. Rather, sales taxes are imposed by individual states (or counties) on purchases carried out within their borders. Sales tax rates often vary, with many states allowing exemptions on sales tax on certain items or services.

Benefits of Value-Added Tax

As a strategy to fund the growing US deficit, many advocates have pushed for a nationwide VAT. This new VAT tax would likely be added on top of existing state sales taxes.

Possible benefits of introducing a nationwide VAT tax include:

Improved efficiency

Unlike our current income tax system, VAT doesn’t require taxpayers to file yearly tax returns and offers fewer opportunities for deduction loopholes, misreporting, and tax evasion. A VAT could serve as an efficient alternative to the United States’ current income tax system.

Self-Enforcing

A VAT is self-enforcing, which encourages compliance. Under the VAT system, it is in a business’s financial interest to report purchases to a tax authority in order to claim credit for them. In the example above, the bakery was encouraged to inform the government when it purchased ingredients (so it could deduct the cost from its tax base).

Online Sales Solution

Online retailers are usually required to charge their state’s sales tax on items within their state, but not on products sold to customers outside their state. However, many states do require that online retailers collect and pay tax on sales to buyers living within their states if sales exceed certain thresholds. Because thresholds are generally quite high, however, this tends to affect larger businesses.

An argument for nationwide VAT is that it might help to prevent lost online sales tax and streamline the internet sales tax system by imposing one consumer tax across all states.

Increased Federal Revenue

For the federal government, a VAT could generate a substantial, constant flow of revenue for a relatively low tax rate.

Problems with the Value-Added Tax

Some critics warn of the potential drawbacks of introducing a VAT to the US. Possible issues might include:

Regressiveness

A VAT tax is imposed uniformly and ends up taking a larger portion of income from lower-income consumers. The current income tax system is a progressive tax system designed to take a larger portion of taxes from higher-income earners.

Costly New Tax Collection System

Introducing a VAT tax in the US would require establishing a new tax collection administration. Businesses would be required to establish procedures to calculate, collect, and pay VAT. The required time, energy, and resources that businesses invested in enforcing new VAT collection procedures – combined with the new VAT rate increase itself – would be reflected in higher prices in goods and services for consumers. Ultimately, establishing a VAT system in the US would be a more costly undertaking than increasing rates of an existing tax, like income tax or payroll tax.

Discover More About Tax Rates at InvestingAnswers

Other than VAT, progressive taxes and flat taxes might sound complicated. But with InvestingAnswers’ expertly reviewed definitions, you’ll have a fantastic grasp on these concepts in no time.