What is the Effective Tax Rate?

The effective tax rate is the average rate at which an individual is taxed on earned income, or the average rate at which a corporation is taxed on pre-tax profits.

Effective Tax Rate Formula

The formulas for effective tax rate are as follows:

Individual: Total Tax Expense / Taxable Income

Corporation: Total Tax Expense / Earnings Before Taxes

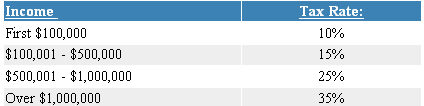

Effective tax rates simplify comparisons among companies or taxpayers. This is especially true where a progressive, or tiered tax system is in place. Those subject to progressive taxes will see different levels of income taxed at different rates. The following is a hypothetical example:

Company A

Annual Pre-Tax Earnings = $600,000

Total Taxes Paid = ($100,000 *10% + $400,000 * 15% + 100,000 * 25%) = $95,000

Effective Tax Rate = $95,000 / $600,000 = 15.8%

Company B

Annual Pre-Tax Earnings = $900,000

Total Taxes Paid = ($100,000 *10% + $400,000 * 15% + $400,000 * 25%) = $170,000

Effective Tax Rate = $170,000 / $900,000 = 18.9%

Why the Effective Tax Rate Matters

In the example above, note that both Company A and Company B are in the 25% marginal tax bracket. However, this does not provide a fair comparison of their tax exposure. In reality, Company B has much more money taxed at the uppermost rate than Company A, and has to pay nearly twice as much in taxes.

Fortunately, the difference is clearly visible in the higher effective tax rate of Company B (18.9% vs. 15.8%). Thus, effective tax rate is typically a more accurate reflection of a company's tax liability than its marginal tax rate.

It is important to note that the amount of cash tax payments that an individual or corporation actually pays out may differ materially from the amount of tax expense in a given period. This is because most companies prepare two different sets of financial statements: one for reporting purposes and one for tax purposes.