What is Above-the-Line Deduction?

An above-the-line deduction is a tax deduction that reduces adjusted gross income.

How Does Above-the-Line Deduction Work?

For example, let's assume that John Doe had $100,000 of total income for 2012. He begins to fill out his IRS Form 1040. Because he paid alimony and had some moving expenses, he can deduct those items 'off the top' and the deductions lower that income to, say, $80,000. That $80,000 is John Doe's adjusted gross income (AGI) -- the income on which the IRS will assess income taxes and determine John's eligibility for other tax deductions. For example, because his AGI is below $85,000, John is eligible to deduct more of his medical expenses and the interest on his student loan. Those deductions may not have been available to people with AGIs above, say, $95,000.

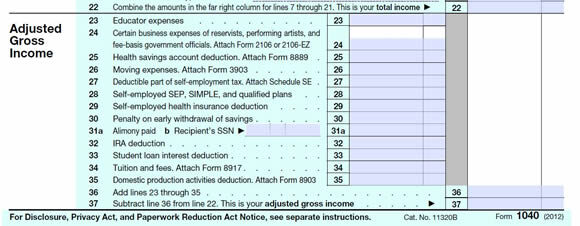

There are several kinds of above-the-line deductions, as this snapshot from a 2012 IRS Form 1040 shows.

Why Does Above-the-Line Deduction Matter?

Above-the-line deductions reduce taxable income, making them very useful to taxpayers. Because adjusted gross income determines one's eligibility for many other tax breaks and credits, they can 'trigger' a host of other deductions for the taxpayer, making them in a sense more valuable than 'regular' tax deductions.