What Does Cost of Capital Mean?

Cost of capital can best be described as the ability to cover both asset and liability expenditures while generating a profit.

A simpler cost of capital definition: Companies can use this rate of return to decide whether to move forward with a project. Investors can use this economic principle to determine the risk of investing in a company.

What Is Cost of Capital in Financial Management?

Cost of capital is the return (%) expected by investors who provide capital for a business. Once this cost is paid for, the remaining money is profit. Since it generates a specific number that determines profitability, it’s used to determine the hurdle rate. Since it generates a specific number that determines profitability, cost of capital is also used to determine the hurdle rate.

Why Is Cost of Capital Important to Investors?

For investors, cost of capital is the opportunity cost of making a specific investment. It represents the degree of perceived risk, as well as the rate of return that can be earned by putting money into an investment.

Investors want to put money into companies that exceed the cost of capital, thus generating returns that are proportionate with the risk. The cost of capital is used to compare different investments with equal risk.

In a nutshell, the cost of capital is the rate of return required to persuade the investor to make an investment.

Why Is Cost of Capital Important to Companies?

Cost of capital can help companies analyze whether it should invest more assets – and when it might see a return on this investment.

Two Elements of Cost of Capital

To minimize their cost of capital, companies tend to look for the optimal amount of equity and debt. It’s relatively simple to find the cost of debt for a company since it’s the interest rate paid (on loans/bonds) by the company.

The cost of equity refers to a shareholder’s demanded return. This percentage is based on the market, which demands a certain amount in exchange for owning the asset and bearing that risk.

Cost of capital accounts for both the cost of equity and cost of debt (to finance business activity).

How to Calculate Cost of Capital

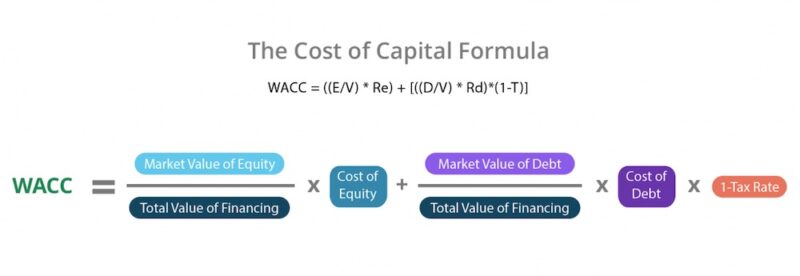

Cost of capital involves debt, equity, and any type of capital. Accountants and financial analysts use the Weighted Average Cost of Capital (WACC) formula to calculate cost of capital.

Cost of Capital Calculator

This isn’t a straightforward formula, so consider using a cost of capital calculator or downloading an Excel WACC calculator.

Is Cost of Capital the Same as WACC?

While these terms are often used interchangeably, it’s important to note that WACC refers to the formula and specific calculation. Cost of capital, however, is a general term used to describe the outcome of this equation.

Cost of Capital Example

Cost of capital is all about making sure a company is profitable for both company owners and investors. When given the choice between two investments of equal risk, company owners/investors will determine the cost of capital and generally choose the one which provides a higher return.

Let's assume Company XYZ is considering whether to renovate its warehouse systems or buy equally risky bonds.

The renovation will cost $50 million and is expected to save $10 million per year over the next 5 years. Alternatively, Company XYZ could use the $50 million to buy 5-year bonds in Company ABC (which are expected to return 12% per year).

The renovation is expected to return 20% per year ($10,000,000 / $50,000,000). In this case, the expected return is a risk. The renovation is the better use of capital because the 20% return exceeds the 12% required return Company XYZ could have gained by investing in Company ABC.

Common Mistakes When Reviewing Cost of Capital

Analysts commonly make the mistake of equating cost of capital with the interest rate on that money.

Cost of capital isn’t dependent upon how and where the capital was raised. Cost of capital is dependent on the use – not the source – of funds.