What Is a Stop Limit Order?

A stop limit order is a tool that is used to help traders limit their downside risk when buying or selling stocks. To do this, it combines two other types of orders:

A stop order initiates a market order to buy or sell a security once it reaches a certain price (the stop price).

A limit order is an order to buy or sell a security at a specific price (or better).

The trader starts by setting a stop price and limit price, then submits the stop limit order. Once the security reaches the stop price, a limit order is triggered to buy or sell the security (whichever is specified by the trader) for the limit price or better.

How Do I Set a Stop Limit Orders?

For traders, stop limit orders provide more control over their transactions by establishing minimum or maximum prices for orders. The trader can do this by setting two prices: Stop price: The price that triggers the stop limit order

Limit price: The minimum/maximum price that a security will be bought or sold for

If the price of the security reaches the stop price, the limit order is triggered and automatically attempts to buy or sell the security at the limit price or better.

Types of Stop Orders

| Type of Stop Order | Explanation |

|---|---|

| Stop order (also called stop-loss order) | A stop order initiates a market order once a security reaches a certain price (the stop price). |

| Limit order | A limit order is an order to buy or sell a security at a set price or better. |

| Stop limit order | A stop limit order is a combination of a stop order and a limit order. It is an order to initiate a limit order once a security reaches a stop price. |

| Market order | A market order is an order to buy or sell a security at the best available price. |

| Trailing stop order | A trailing stop order is a stop order that moves with the market price. As the market price increases or decreases, the stop price increases or decreases by the same amount. |

How to Use Stop Limit Orders for Buying

Buy-stop limit orders are often used when a trader plans to short sell securities. Short selling is the process of borrowing a security and selling it immediately (in the hopes that the price will go down before the security must be returned to the lender). If the trader is able to buy the security back at a lower price than it sold for, the trader will earn a profit.

If the price of the security goes higher than the price it sold for, the trader will need to pay more money to obtain the security, resulting in a loss. A stop limit order helps mitigate this risk by setting a maximum amount that the trader is willing to pay for the security. The trader will set a stop price (above the current market price) and a limit price. If the security reaches the stop price, a limit order is executed and the security is bought at (or below) the limit price.

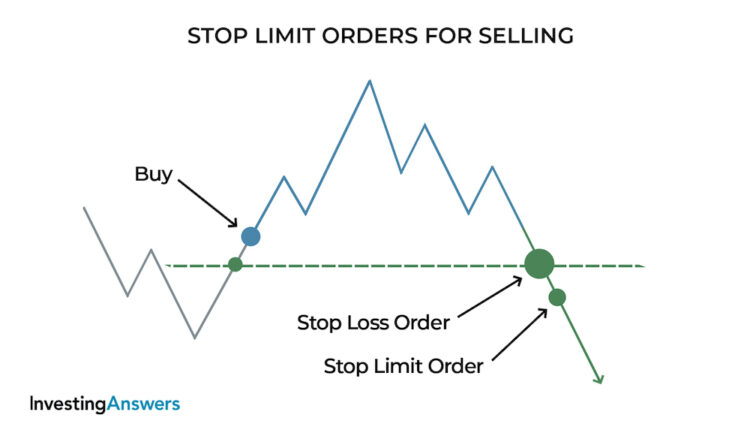

How to Use Stop Limit Orders for Selling

Sell-stop limit orders are most often used when a trader wants to limit losses or protect a profit on a security they own. To do this, the trader will set a stop price (below the current market price) and limit price. If the security falls to the stop price, a limit order is executed and the security is sold at (or above) the limit price.

When to Use a Stop Limit Order

Stop limit orders are used when traders want the most control over their transactions. This makes them useful for both buying and selling securities. Stop limit orders also help to reduce the risk for long-term investors and short sellers by controlling when orders are placed and the minimum/maximum prices that securities can be bought and sold for. This is especially useful in volatile markets where prices can fluctuate rapidly or when traders can’t constantly monitor their transactions.

Stop Limit Order Example

An investor currently owns 100 shares of Company ABC. The shares are currently valued at $50 per share, so the investment is worth a total of $5,000. The company’s financial reports are due to be released within the next week, but there are rumors that there will be bad news. The investor is going on vacation for two weeks and has no way to monitor their investment. To limit potential losses, the investor submits a stop limit order with a stop at $45 and a limit at $42.

Once the financial reports are released, the price of the stock drops to $45, triggering the limit order. Many other investors begin selling off their shares, further reducing the price of the stock. Eventually, the limit order is fulfilled at $43 per share, so the investment is now worth $4,300.

When the investor returns from vacation, s/he discovers that the stock is now trading at $33 per share. Had the stop limit order not been in place, the investment would only have been worth $3,300.

How to Place a Stop Limit Order

Stop limit orders are available on most trading platforms and brokers. Here’s how to place one:

Submit a stop limit order online or with a broker

Set two price points:

Stop: The price that triggers a limit order

Limit: The minimum/maximum price the security will be bought or sold for

Set a time frame for the stop limit order. If no time frame is specified, the order remains in place until the stop triggers or it is canceled.