What Is Current Ratio?

The current ratio is a commonly-used financial ratio. It tells investors and analysts whether a company is able to pay its current liabilities with its current assets (typically within a 12-month period).

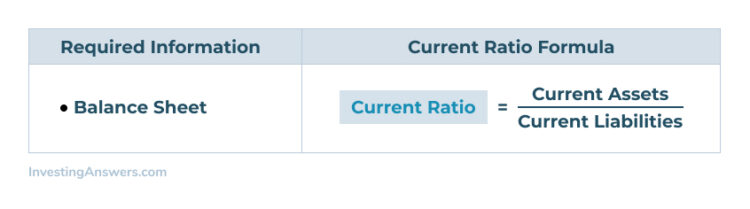

Current Ratio Formula

To calculate current ratio, you’ll need the firm’s balance sheet and the following formula:

Current Ratio Example

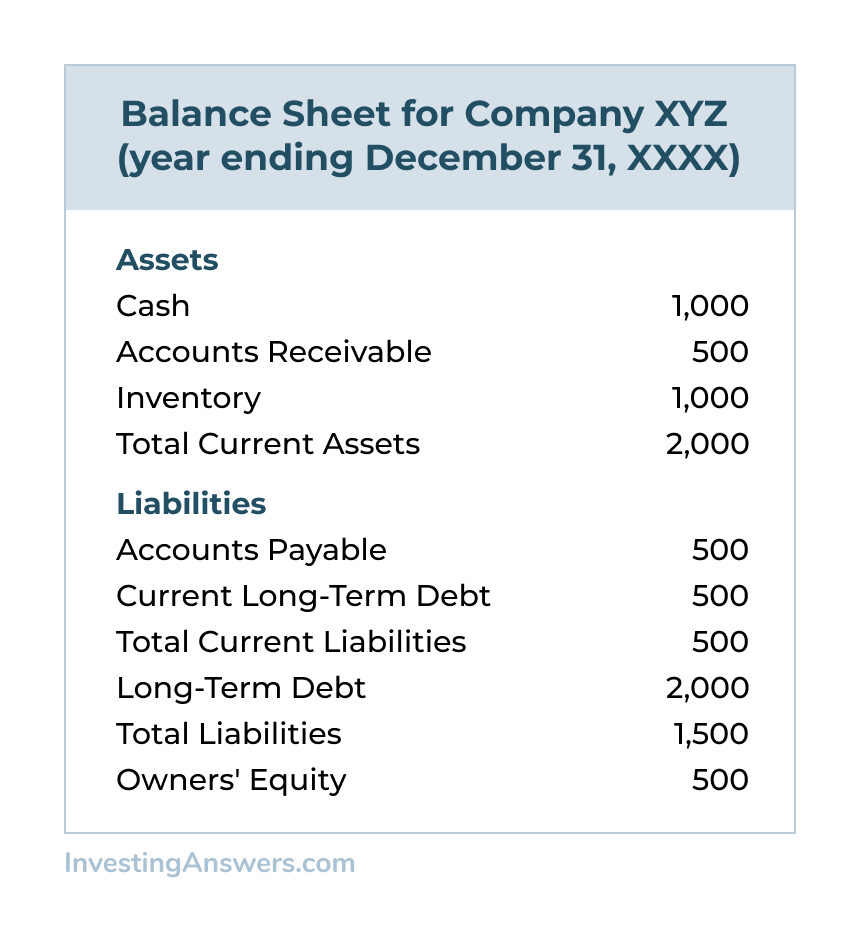

Let's look at the balance sheet for Company XYZ:

We can calculate Company XYZ's current ratio as: 2,000 / 1,000 = 2.0

At the end of 2020, Company XYZ had $2.00 in current assets for every dollar of current liabilities. This means that Company XYZ should easily be able to cover its short-term debt obligations.

What Does a Higher Current Ratio Mean?

A company with a current ratio of between 1.2 and 2 is typically considered good. The higher the current ratio, the more liquid a company is. However, if the current ratio is too high (i.e. above 2), it might be that the company is unable to use its current assets efficiently.

A higher current ratio indicates that a company is able to meet its short-term obligations. In the example above, if all of Company XYZ's current liabilities were due on January 1, 2021, the firm would be able to meet those obligations with cash.

What Does a Current Ratio Increase Mean?

An increase in current ratio can mean a company is 'growing into' its capacity.

It’s important to remember, however, that major purchases that prepare for upcoming growth – or the sale of unnecessary assets – can suddenly and somewhat artificially change a company's current ratio.

What Does a Decreasing Current Ratio Indicate?

Generally, a decrease in current ratio means that there are problems with inventory management, ineffective or lax standards for collecting receivables, or an excessive cash burn rate.

If a company’s current ratio falls below 1, the company likely won’t have enough liquid assets to pay off its liabilities. While a decreasing current ratio indicates poor financial health, it doesn’t necessarily mean that the company will fail.

Why Is Current Ratio Important?

Tracking the current ratio and other liquidity ratios helps an investor assess the health of a company. More specifically, investors will understand how the company is able to cover its short-term debts (compared to its industry competitors).

Comparing Current Ratios Between Industries

Comparison of current ratios is generally most meaningful among companies within the same industry. Therefore, the definition of a 'high' or 'low' ratio should be made within this context.

For example, if Company XYZ is a retail company, it would only make sense to compare its current ratio with other retail companies (not a construction company).