What is Immunization?

Immunization is a dedicated-portfolio strategy used to manage a portfolio with the goal of making it worth a specific amount at a certain point, usually to fund a future liability. Immunization is one of two kinds of dedicated-portfolio strategies (cash-flow matching is the other).

How Does Immunization Work?

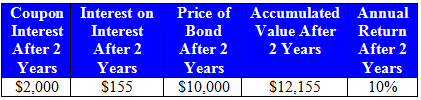

To understand the immunization strategy, first remember that although bond prices fall when interest rates rise, the rate at which the investor can reinvest his coupon payments increases (the opposite is also true: when rates fall, prices rise but the reinvestment rate falls). For example, let’s assume an investor purchases a $10,000 bond at par. The bond has a 10% coupon paid semiannually and matures in three years. If market yields stay at 10%, the following would occur at the end of the first two years:

As the table shows, the investor would receive $2,000 in coupon payments, which he would reinvest as he receives them at the market rate of 10% per year, earning him another $155. When the coupons and the interest on interest are added to the bond principal, the accumulated value of his investment is $12,155, for a 10% annual return.

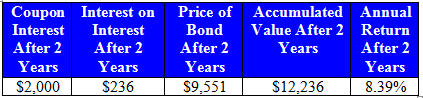

Now consider what happens if market yields increase, say to 15%, right after the investor purchases the bond.

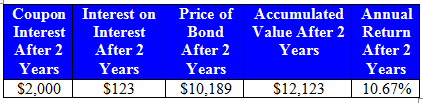

The higher reinvestment rate increased the amount of interest the investor earned on the coupon payments. However, the price of the bond fell more than enough to offset this gain. The net result was a decrease in total return. Now compare this to what would have happened if reinvestment rates fell to 8% instead.

In this example, the low reinvestment rate reduced the interest earned on the coupon payments. But the bond price rose, offsetting some of this loss. The net result was an increase in total return. Thus, the yin-yang relationship between interest rates and bond prices also creates a tradeoff between reinvestment risk and interest rate risk.

The trick to immunization therefore is to find bonds where the change in interest on interest exactly offsets the change in price when rates change. This can be done by setting the duration of the portfolio equal to the investor’s time horizon and making sure the initial present value of the bond equals the present value of the liability in question. In our previous example, we assumed the investor intended to hold the bond for two years, presumably because he intends to use the money to fund some obligation. Thus, to immunize the portfolio, the investor should set the duration to two years. Six months later, the investment horizon will be 1.5 years, and the investor should rebalance the portfolio’s duration to equal 1.5 years, and so on. The intended result: an income portfolio that has an assured return for a specific time horizon regardless of changes in interest rates.

Why Does Immunization Matter?

A dedicated-portfolio strategy, and immunization in particular, is most appropriate when an investor needs to fund a future liability. When executed well, it can provide terrific returns (and tremendous peace of mind) to investors. But immunization is not without risks. It requires investors to calculate and time future liabilities, which isn’t always easy or accurate. Immunization also assumes that when interest rates change, they change by the same amount for all types of bond maturities (this is called a parallel shift in the yield curve). This, of course, rarely happens in the real world and it therefore makes duration matching more difficult. Thus, the immunization strategy does not ensure the expected return when interest rates change (this deviance is called immunization risk).

One way to control immunization risk is to invest solely in zero-coupon bonds that have maturities matching the investor’s time horizon. Portfolios with high immunization risk, on the other hand, include high-coupon securities that mature at regularly spaced intervals over the course of the portfolio’s time horizon (this is called laddering). This constant maturing means frequent reinvestment, which means a high sensitivity to changes in interest rates and thus high immunization risk.