What is Shareholders' Equity?

Shareholders equity is a measure of how much of a company's net assets belong to the shareholders.

How to calculate Shareholders' Equity

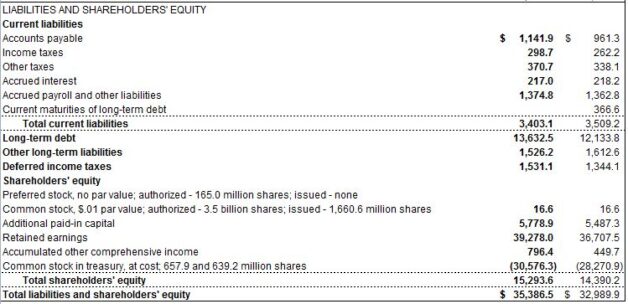

Shareholders equity is found on the balance sheet. It has five primary components:

- Par Value of shares

- Additional Paid in Capital

- Retained Earnings

- Accumulated Other Comprehensive Income

- Treasury Stock

It typically looks like this:

Par Value of Shares

Let’s assume Company XYZ decides it needs to raise $10 million in equity to build a new factory. It does this by issuing 1 million shares of new stock at $10 per share.

The company records the receipt of $10 million of cash on the asset side of its balance sheet after the offering is complete. It also records the additional corresponding equity on the balance sheet. However, it breaks that $10,000,000 up into two line items: the par value of the stock and anything over the par value of the stock.

Additional Paid in Capital

Traditionally, companies assign an arbitrary par value of $0.01 to each new share of stock. Anything over that, $9.99 in our example, is recorded as additional paid in capital (APIC). Also called capital in excess of par value, it is a measure of how much money investors have pumped into the company since inception in return for equity.

Retained Earnings

Retained earnings are the sum of a company’s profits, after dividend payments, since the company’s inception. They are also called earned surplus, retained capital or accumulated earnings.

Let’s assume XYZ Company has been around for five years. During this time, it reported the following net income:

Year 1: $10,000

Year 2: $5,000

Year 3: -$5,000

Year 4: $1,000

Year 5: -$3,000

Assuming XYZ Company paid no dividends during this time, XYZ’s retained earnings equal the sum of its net profits since inception, or, in this case, $8,000. In subsequent years, XYZ’s retained earnings will change by the amount of each year’s net income, less dividends.

The retained earnings statement summarizes changes in retained earnings for a fiscal period, and total retained earnings appear in the shareholders’ equity portion of the balance sheet. This means that every dollar of retained earnings means another dollar of shareholders’ equity or net worth.

Accumulated Other Comprehensive Income

Accumulated other comprehensive income is earnings that are not reported on the income statement. These earnings generally aren't realized, meaning they're just earnings on paper. They almost always are for pension liabilities, unrealized gains or losses that the company made for the sake of investing rather than for the sake of operating those investments, foreign currency transactions and hedging activity. The rules for what goes in here are in Statement of Financial Accounting Standards #130, Reporting Comprehensive Income.

Treasury Stock

Treasury stock is stock repurchased by the issuer that is intended for retirement or resale to the public. It represents the difference between the number of shares issued and the number of shares outstanding.

Treasury stock appears at cost or at par value in the shareholders equity section of the balance sheet and thus appears as a contra equity account, or a 'negative' in the shareholders equity section. It is important to note that if and when a company decides to resell treasury stock, there can be no income statement recognition of gains or losses on treasury stock transactions. That is, if the company profits (or loses) from the resale of treasury shares, it simply records an increase in cash and a corresponding decrease in shareholders' equity.

Why does Shareholders' Equity matter?

It is important to understand that shareholders equity does not represent surplus cash or cash left over after the payment of dividends. Rather, shareholders equity demonstrates what a company did with its profits and capital -- it is the amount the owners (the shareholders) have invested in the business since its inception. These reinvestments are either asset purchases or liability reductions.

Shareholders equity somewhat reflects a company’s dividend policy, because it reflects a company’s decision to either reinvest profits or pay them out to shareholders. Ultimately, most analyses of shareholders equity focus on evaluating which action generated or would generate the highest return for the shareholders.

It is important to note that because retained earnings represent the sum of profits less dividends since inception, older companies may report significantly higher shareholders equity than identical younger ones. This is why comparison of shareholders equity is difficult but generally most meaningful among companies of the same age and within the same industry, and the definition of 'high' or 'low' should be made within this context.

Remember too that when a company hits the skids and has to liquidate, the bondholders and other lenders get first dibs on the cash. This gives them far more influence over what happens during bankruptcy proceedings, mergers and other high-stress situations. It's also not uncommon for bondholders to convert their debt to equity (thus becoming shareholders) and becoming 'the boss.' By virtue of disclosing who the lenders are and how much they're owed, shareholders equity illustrates the magnitude of the pecking order.