What Is ROA?

Return on assets (ROA) is a financial ratio that can help analyze the profitability of a company. ROA measures the amount of profit a company generates as a percentage relative to its total assets.

Put another way, ROA answers the question of how much money is made (net income) from what a company owns (assets).

Investors, analysts, and managers will want to know if the company can provide a good return on assets. Return on assets is a comparison metric that can be used to examine the past performance of a company (or view similar companies side by side).

Where to Find ROA

A company’s return on assets (ROA) is calculated by looking at the net income and assets found on two financial statements. Net income can be found on the company’s income statement while assets can be found on the company’s balance sheet.

Note: The income statement and the balance sheet should be from a set period of time (such as annually or quarterly) to calculate ROA.

Why Is ROA Important?

Generally speaking, the higher the ROA, the better. For this reason, it is often more effective to compare a company's ROA to that of other companies in the same industry (or against its own ROA figures from previous periods).

A falling ROA is almost always problematic and typically means that assets aren’t providing value.

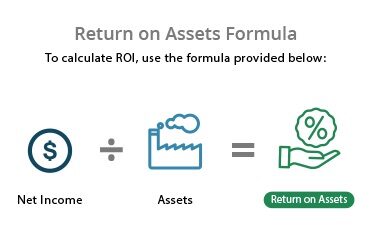

Return on Assets Formula

To calculate ROA, use the general formula provided below:

Note: Professional accountants will calculate ROA using a more complex formula known as the 'DuPont Disaggregation.'

Return on Assets Formula Example

Say that a company has $10,000 in total assets and generates $2,000 in net income. It’s ROA would be $2,000 / $10,000 = 0.2 or 20%.

What Does Return on Assets Tell You?

A good ROA indicates that a business is doing well in managing its assets.

To determine a solid ROA, you’ll want to review the average ROA in a company’s specific industry (generally, a company's ROA should be within the same range as its competitors). If the average ROA for the manufacturing industry is 7% – and a company’s ROA you’re examining is 8.2% – they’re doing well with their asset management.

If a company has a 12% ROA compared to an average of 7% within its peer group, this could mean one of two things:

They are managing those assets better to produce more income, or

The company owns outright fewer assets and instead leases or borrows additional assets. Only owned assets are reflected in ROA. In general, this means the lower the total asset value, the higher the ROA.

Remember: Though earnings capability and management are important factors, so is the method by which the company finances its assets.

How Debt Impacts ROA

A company taking on debt will likely use those funds to acquire assets. When the total value of assets increases, there should be a corresponding movement in net income. In this way, ROA can remain stable or go up. ROA is an important calculation because it accounts for debt a company may have taken on to grow.

How to Increase Return on Assets

A company can increase their ROA by another method that keeps debt off the balance sheet: leasing assets. Leased assets are not owned. Because of this, they are not reflected on the balance sheet and not counted towards total assets. By choosing to lease assets, a company can actually increase its ROA with net income.

When to Use ROA

ROA is most useful in two scenarios:

To examine a company’s past profitability and look for growth/downturn

To compare companies within a similar industry.

When ROA Shouldn’t Be Used

A marketing agency’s ROA can’t be compared to an industrial manufacturing company’s ROA because they have different asset bases. A manufacturing company is going to own more assets (e.g. warehouses, shipping containers) to create their products and parts

ROA is only one calculation for analyzing a company. Investors will use multiple metrics such as Return on Equity (ROE) before deciding to buy shares.

What Is the Difference Between ROA and Return on Equity (ROE)?

Return on Equity (ROE) is measured by dividing net income by equity. Equity is the value of total assets less total liabilities and represents the value held by shareholders. Thus, ROE is also dependent on total assets. ROE measures the return made by a company in relation to the value of the company held by shareholders.

ROE and ROA are just a few of many different parameters an investor can use to compare the quarterly performance of a company to past quarters and past years. ROE and ROA can also give an idea as to how a company is performing in relation to its peers.