What Is Pass Through Income?

Pass through income is sent from a pass-through entity to its owners. These special business structures help to reduce the effects of double taxation.

Because income isn’t taxed at the corporate level, tax liability is passed on to the owners.

Pass-Through Income Example

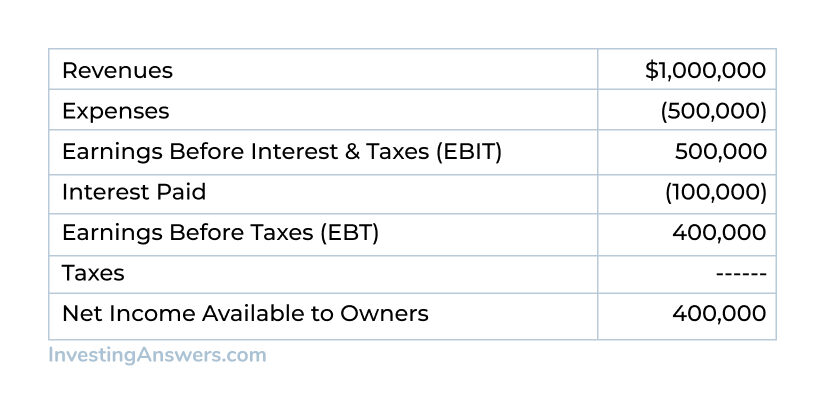

Company XYZ is a pass-through entity. It files a tax return that looks like this:

XYZ has two owners, Jane and Bill, who each own 50% of the company. XYZ sends both Jane and Bill an IRS Schedule K-1 that reports their portions of XYZ's pass-through income.

Jane and Bill each file their own tax return with $200,000 reported as income. It is important to note that Company XYZ allocates the income to Jane and Bill regardless of whether the $400,000 of net income is actually distributed.

Note: Losses are also passed through to owners, but the total available deductible is limited to the original investment amount.

Why Is Pass-Through Income Important?

Depending on a company’s operations, pass through income can make for a complicated tax situation. Occasionally, pass-through income isn’t actually distributed to shareholders, leaving the owners with a tax burden (but no cash with which to pay it).

For example, assume that Jane's tax burden ends up being 20% of $200,000 for the previous tax year. Jane owes the IRS $40,000, but XYZ did not make a distribution during the previous year. There’s also a possibility that it won’t make a distribution next year. Jane would be responsible for taxes owed on income that she didn’t actually receive.