Also called earnings before interest and taxes (EBIT), operating profit is defined as the profits earned from a company’s core business – after subtracting the cost of goods sold (COGS), operating costs, and any depreciation expenses.

The remaining balance after deducting these costs/expenses from the company’s operating revenue can be used for expansion, investment, and growth.

What Is the Significance of Operating Profit?

Investors compare the operating profits of companies in similar industries in order to assess their financial health and growth potential. The higher the operating profit, the better the company’s financial health – and the better its long-term prospects.

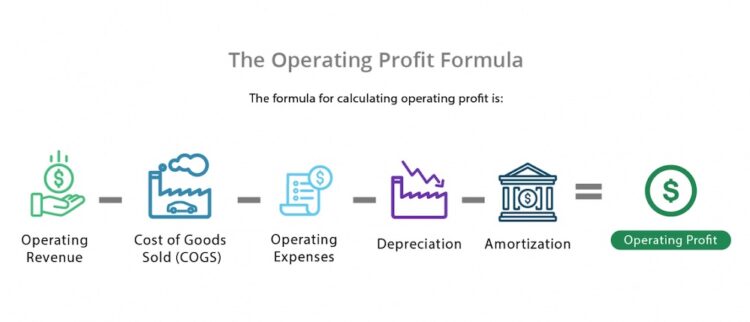

Operating Profit Formula

The formula for operating profit is fairly straightforward:

How to Calculate Operating Profit

To calculate a company’s operating profit, refer to the income statement published in the company’s annual report. The numbers needed to plug into the operating profit formula may be found as line items.

The formula components are defined as follows:

Operating Revenue

Operating revenue reflects the company’s core business. Any income that isn't related to the company’s primary business is omitted from the computation.

Cost of Goods Sold (COGS)

The cost of goods sold is the complete cost of whatever a company is selling. For a retail company, COGS is the wholesale cost of the products the company purchases to resell.

Operating Expenses

Operating expenses include any costs associated with running a business. Companies typically include salaries and wages in this figure but may also add other business-related expenses.

Depreciation and Amortization

Some businesses make substantial investments in fixed assets that will be used over several years. Instead of including the entire amount on the income statement, they divide up the cost over the asset’s estimated lifetime using depreciation and amortization.

Depreciation applies to a tangible asset (such as equipment) and amortization applies to an intangible asset (such as a patent).

Operating Profit Examples

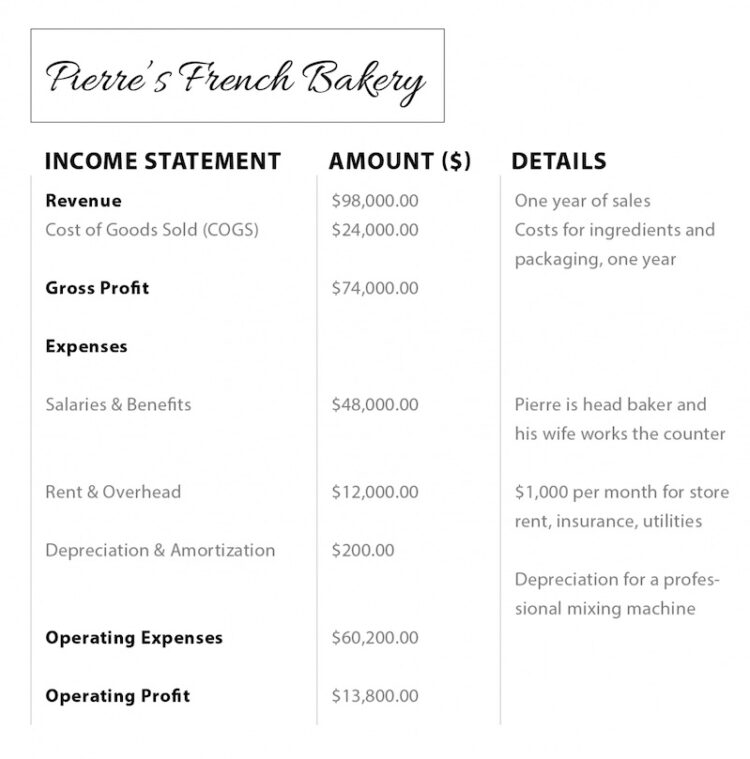

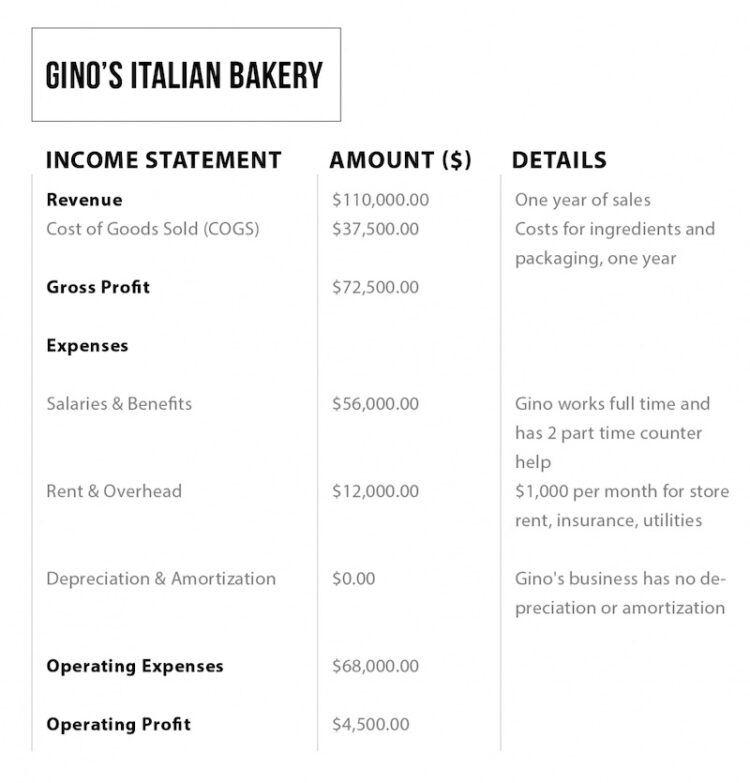

Imagine two businesses in the same industry. Both companies seek private investment and provide their income statements to potential investors for evaluation.

Pierre’s Bakery and Gino’s Italian Bakery offer retail sales of bread, pastries, and other treats. Their income statements look like this:

Gino had a higher gross profit, however, when you take all other costs into account, Pierre’s bakery had a better operating profit. This is a more revealing measure of profit because it includes all the operating expenses (not just the costs of the goods themselves).

If an investor were to choose between Pierre’s French Bakery or Gino’s Italian Bakery, Pierre’s offers better potential due to its greater operating profit.

Net Operating Profit vs Operating Profit

Net operating profit and operating differ in that net operating profit takes interest and taxes into account (operating profit does not).

Benefits of Operating Profit

The largest advantage of using operating profit as a comparison metric between companies is that it omits certain expenses (such as taxes and interest) from the final figure. If you compare companies in varying tax jurisdictions or debt levels, it’s much easier to assess the profitability of operations.

Operating profit also focuses on the company’s core business and omits any extraneous business revenue from its formula. For example, if a retail company sells a parcel of real estate, the proceeds are not included in operating profit because it would give a distorted view of the profitability related to the company’s business operations.

Disadvantages of Operating Profit

Operating profit, however, omits expenses that tell the entire story about a company’s financial health (e.g. interest and tax expenses). This is important since these expenses can significantly reduce a firm’s profits.

Consider two businesses in the same industry: Pierre and Gino have equal operating profits, but Pierre’s Bakery is in New York and Gino’s Bakery is in Virginia (where taxes are lower). Gino’s bakery is actually in a better financial position. Merely looking at operating profit misses crucial factors when considering a company’s potential health.

Operating Profit Over Time

Small businesses can react dramatically to both opportunities and challenges. A spike in the cost of ricotta cheese for cannolis can make Gino’s operating profit drop as his cost of goods increases. A celebrity might stroll into Pierre’s bakery, take one bite of his famous chocolate eclair, post a picture on Instagram, and Pierre could see sales spike due to the increased exposure. Each of these situations is temporary but can have a dramatic effect on annual operating profit.

Time smooths out the typical jumps and dips in a small business’ income and expenses. Gino may need time to find a new supplier and ultimately reduce his COGS below his original figure. Pierre may invest heavily in eclair production, only to find that interest in eclairs was temporary, driven solely by the celebrity endorsement.

No single metric can provide a complete answer to an investor’s questions, nor should one year’s numbers be used to make any final investment decision. A thoughtful, comprehensive approach that takes the numbers into account – and the story behind them – is one of the best ways to evaluate the prospects of a company.

Learn More:

What Does COGS Mean?

Why Falling Gross Margins Don’t Always Spell Trouble

Financial Statement Analysis for Beginners