What Is Operating Income?

Operating income is the amount of revenue left after subtracting operating expenses and cost of goods sold (COGS). Operating income is a measure of profitability that is directly related to a company’s operations.

Operating income is sometimes referred to as Earnings Before Interest and Taxes (EBIT) but they aren’t synonymous terms. EBIT also includes other income or expenses that aren't central to a company's business. For example, income from the firm's financial investments would be added to the operating income to determine EBIT.

Operating Income Formula

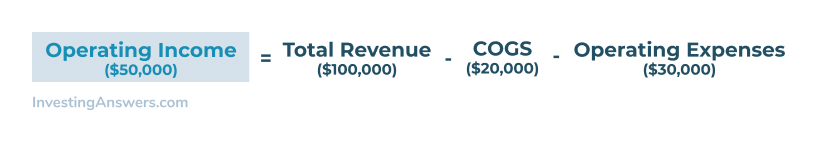

The company income statement can be used to calculate operating income. It is important to understand which expenses are included and which items are excluded. Below you'll find the operating income formula:

How to Calculate Operating Income

You will use the company income statement to calculate operating income. It is important to understand what expenses are included and what items are excluded when calculating operating income.

To calculate operating income, you must find the total revenue (gross income), COGS, and the operating expenses on the income statement. Operating expenses include:

- Labor and salaries

- Day-to-day expenses like rent and utilities

Operating income does not account for the following:

- interest expenses

- non-recurring items such as accounting adjustments, legal judgments, or one-time transactions, and

- other income statement items not directly related to a company's core business operations

Why Is Operating Income Important?

Operating income tells investors and company owners how much revenue will eventually become profit for a company.

Operating income is important because it is an indirect measure of efficiency. The higher the operating income, the more profitable a company's core business.

Several things can affect operating income, including:

- pricing strategy

- prices for raw materials, or

- labor costs

These items directly relate to daily decisions that managers make. This means operating income also measures managerial competency.

Operating Income Examples

Let’s look at two examples of operating income.

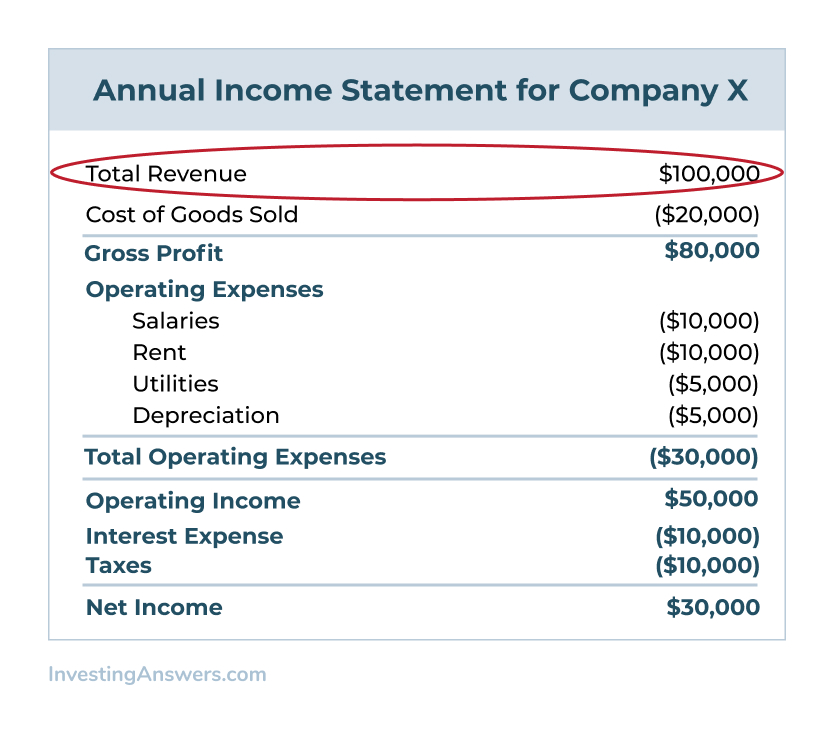

Figure 1: Company X Income Statement

Using the Income Statement for Company X and the formula found above, we can calculate the operating income:

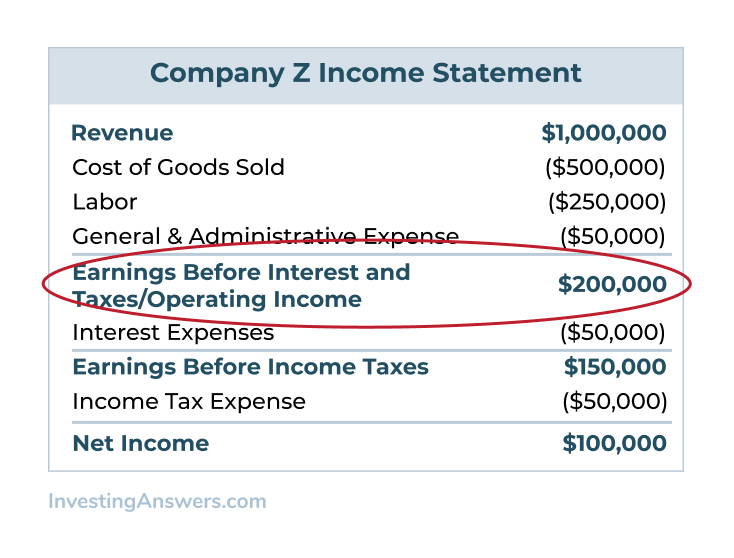

Figure 2: Company Z Income Statement

Using the Income Statement for Company Z (and the formula above), we can calculate Company Z's operating income as:

$1,000,000 (Revenue) - $500,000 (COGS) - $250,000 (Labor) - $50,000(General Admin Expenses) = $200,000 (Operating Income/EBIT)

Operating Income vs Net Income

Both operating income and net income can be found on the company income statement. While operating income subtracts COGS and operating expenses from the total revenue, net income subtracts COGS, operating expenses, interest, and taxes from the total revenue.

Net income is also referred to as “the bottom line” because it’s the last entry on an income statement. Net income accounts for all expenses while operating income only accounts for expenses related to operations. Look again at the income statement for Company X: The net income is $30,000, while the operating income is $50,000.

Operating Income vs EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Both EBITDA and operating income (which is the same as EBIT for a company without non-operating income or expenses) are measures of profit. Each measure of operating profitability excludes certain financial decisions, tax environments, and accounting decisions. EBITDA shows earnings (income) before interest, taxes, depreciation, and amortization. Operating income shows income after operating expenses have been paid.

Operating income, EBIT, and EBITDA provide investment analysts with useful information for evaluating a company’s operating performance. These numbers remove variables that may be unique from company to company and enable financial experts to analyze operating profitability as a singular measure of performance. Such analysis is particularly important when comparing similar companies across a single industry because of varying capital structures or tax environments.

It is also important to note that some industries have higher labor or materials costs than others. For example, a construction company will likely have higher material costs, whereas a law firm will likely have higher labor or salary costs. That’s why comparing operating income and EBITDA is most meaningful for comparison among companies within the same industry.