What Is Net Profit Margin?

Net profit margin is a metric that indicates how well a company can transform its revenues into profits. Net profit margin is the percent of revenue remaining after all operating expenses, interest, taxes, and preferred stock dividends have been deducted from a company's gross or total revenue.

How to Calculate Net Profit Margin

Before finding the net profit margin, you will need to calculate the gross profit margin, using information from the company’s income statement.

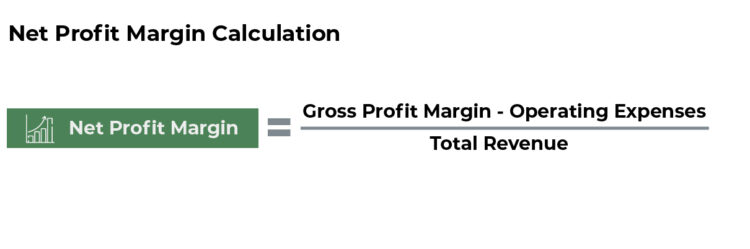

Net Profit Margin Formula

You can calculate net profit margin using the following formula:

Example of Calculating Net Profit Margin

Let’s assume that you’re thinking about investing in a local business, Shop ABC. You want to be sure it is a profitable investment. The owners provide you with the income statement for analysis.

Step 1: Find the Gross Profit Margin

Gross Profit Margin = Total Revenue - Cost of Goods Sold (COGS)

Total Revenue

If Shop ABC has $1,000 in revenues for the month of June and the cost of goods sold is $700, they would have a gross profit of $300 and a gross profit margin of:

$1,000 - $700

$1,000 =0.30 or 30%

Shop ABC has a gross profit margin of 30%.

Step 2: Take Operating Expenses Into Account

Next, you must find the operating expenses which might include rent, inventory, marketing, payroll, and any other expenses incurred in the normal course of doing business. You can find these figures on the company’s income statement. In the example of the Shop ABC, let’s assume the expenses add up to $200.

Step 3: Calculate Net Profit Margin

Using the following formula (along with the metrics from Step 1 and Step 2), you can calculate the net profit margin:

Net profit margin = Gross profit - Operating expenses

Total Revenue

Net profit margin = $300 - $200 = $100

$1,000 $1,000 = 0.10 or 10%

Net profit margin is 10%

Interpreting the Example

That’s considerably less than the gross profit margin of 30%. If you were thinking of investing in Shop ABC, you’d want to see the net profit margin to assess how well it is managing the operating expenses. For example, if it has a large amount of interest on loans, this will increase the operating expenses and decrease the net profit margin (making it a less appealing investment).

Net margin for specialty retail is around 3%, with general retail margins at 2.4%. Shop ABC is indeed a healthy business and a potentially good investment given net profit margins of 10%. This is substantially higher than industry benchmarks.

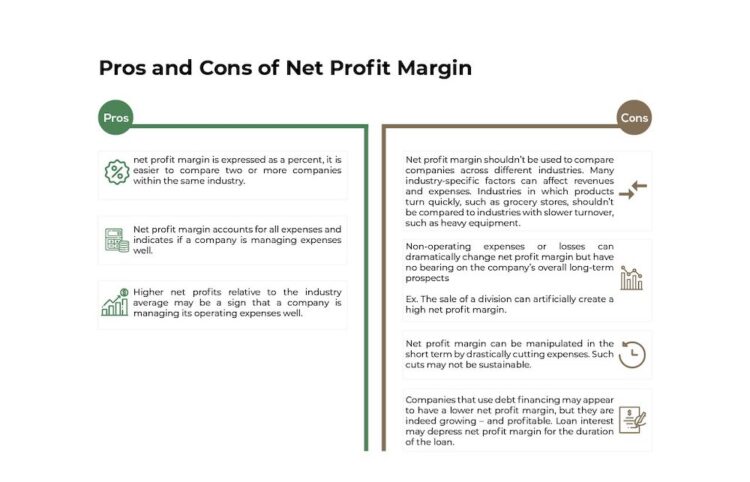

Increasing sales don’t always equate with increased profits. That’s why net profit margin is so important: It expresses the profitability of every sale. Investors and analysts use it to determine if they’ll invest in a company because it provides a clearer picture of a company’s profitability.

What Happens When Net Profit Margin Decreases?

Decreasing net profits are a symptom of sluggish sales, perhaps forcing lowered prices, or higher operating expenses, or a combination of these factors. If faced with a decreasing net profit margin, companies may choose one or more of the following actions:

Cutting Expenses

Because net profit margins include operating expenses, companies often start by cutting operating expenses. For example, they may refinance loans to obtain lower interest rates, which can cut operating expenses and improve net profits.

Increasing Gross Sales Revenues

A second strategy may be to increase total gross sales. Companies might attempt to reinvigorate their sales departments or run extensive marketing and advertising campaigns to kindle more interest among consumers.

Raising Prices

A third tactic may be to increase the prices of their goods. Increasing prices may enable them to sell the same volume but with higher gross sales revenues.

Which Action Generates Higher Net Profit Margins the Fastest?

Companies improve net profit margin through any one or combination of activities that include cutting operating expenses, increasing sales volume, or increasing prices. Companies usually try to cut expenses first since it’s easier to slash expenses than to increase sales.

Increasing the gross sales figure means the company has to either sell more goods or raise prices on those goods. However, customers may balk at paying higher prices or the company may not be able to sell more items within a given time period.

Conversely, cutting expenses is within the company’s control and an easier (and surer) method of improving net profits. As long as gross sales remain constant or increase – and COGS remains constant or decreases – reducing operating expenses is a solid plan to improve net profit margin.

What Does Net Profit Tell You About a Company?

Shareholders look at net profit margin closely because it shows how good a company is at converting revenue into profits available for shareholders. Net profit margin tells you how well a company is able to achieve profits from sales (as well as manage its operating expenses).

Net profit margin is often used to compare companies within the same industry in a process known as 'margin analysis.' Net profit margin is a percentage of sales, not an absolute number. It can be extremely useful to compare net profit margins among a group of companies to see which are most effective at converting sales into profits. Companies with a higher net profit margin than others within the same industry are thought to have a competitive advantage.

Net Profit Margin vs. Gross Profit Margin

Gross profit margin and net profit margin are both expressed as a percentage of revenue. However, gross margin only takes the cost of goods sold (COGS) into account. Because it doesn’t account for operating expenses, taxes, or interest (all of which can quickly erode a company’s overall profits), gross profit margin is a less accurate gauge of a company’s profitability than net profit margin.

Net Profit Margin vs. Operating Profit Margin

Analysts look at both net profit margin and operating profit margin as part of their review of a company’s liquidity, leverage, profitability, and solvency. However, the two metrics measure different aspects of a company’s financial health.

Net profit margin looks at the percentage of profit available after all of the company’s operating expenses are taken into consideration. Operating profit margin calculates the profit margin from the company’s core business.

Neither one or the other is a “better” analysis. Rather, it is the context in which the numbers are viewed that is critical. There are times when understanding operating profit margin is more important than net profit margin.

Example of Net Profit Margin vs. Operating Profit Margin

Let’s say a company has an extraordinary windfall from a side business. A soft drink manufacturer’s core business is producing and selling beverages. Operating profit margin takes into account only the revenue generated from the sales of soft drinks. Net profit margin may take into account other events, such as a gain on the sale of a large bottling plant.

In this case, an analyst wants to understand both margins to judge the health of the core operation versus the profitability of the company. By digging further into the company’s income statement and calculating both net profit margin and operating profit margin, the analyst can form a clearer understanding of the overall profitability and potential of investing in the soft drink company.