What Is Net Profit?

Net profit is the amount of money that a company has after all its expenses are paid. You can think of net profit like your paycheck: It’s the money left after all taxes and benefits are subtracted.

Found on the last line of the income statement, net profit impacts the “take-home” profit of a company.

Net profit is also referred to as:

- the bottom line

- net income

- net earnings

What Does Net Profit Show?

Net profit is the source of compensation to a company’s shareholders. If a company can’t generate enough profit to compensate owners, the value of shares will plummet. If a company is healthy and growing (with increased profits), higher stock prices should result.

How to Calculate Net Profit

Calculating net profit requires deducting the following from the company’s total revenue:

Interest

Taxes

Preferred stock dividends (but not common stock dividends)

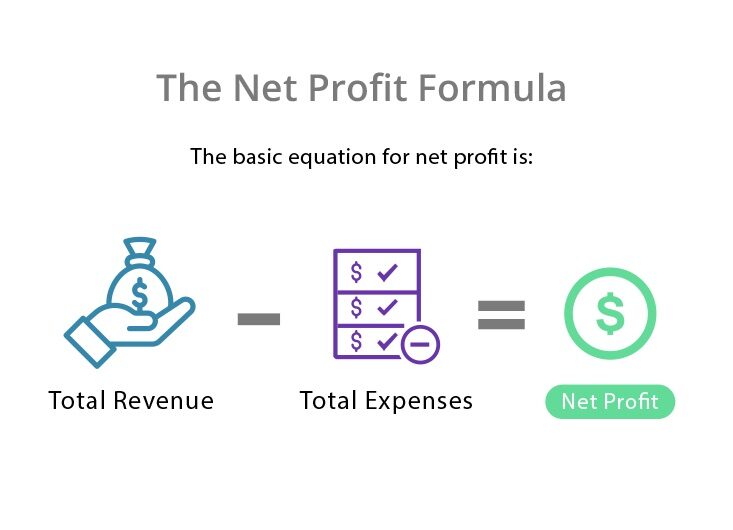

Net Profit Formula

To calculate net profit, start by reviewing two figures on the income statement: total revenue and total expenses.

Net Profit Example

Let's look at Company XYZ's income statement from the previous calendar year:

| Total Revenue | $100,000 |

| Cost of Goods Sold | (20,000) |

| Gross Profit | 80,000 |

| Operating Expenses | |

| Salaries | 10,000 |

| Rent | 10,000 |

| Utilities | 5,000 |

| Depreciation | 5,000 |

| Total Operating Expenses | (30,000) |

| Interest Expense | (10,000) |

| Taxes | (10,000) |

| Net Profit | $30,000 |

By using the formula, we can calculate net profit thusly: 100,000 - 20,000 - 30,000 - 10,000 - 10,000 = $30,000

When Do I Use Net Profit?

Shareholders can view net profit when companies publish their income statements each financial quarter. Net profit is important since it’s the source of compensation to a company’s shareholders. If a company can’t generate enough profit to compensate owners, the value of shares will plummet. If a company is healthy and growing (with increased profits), higher stock prices will result.

Since changes in net profit are endlessly scrutinized, companies will always be looking at ways to improve their net profit, either by increasing revenue or cutting costs.

Generally speaking, when a company's net profit is low or negative, a myriad of problems could be to blame. These range from decreasing sales to poor customer experience to substandard expense management.

When to Avoid Using Net Profit

Net profit varies greatly between industries so it shouldn’t be used to compare companies. In these instances, it would be more appropriate to consider net profit as a percentage of sales.

Net profit also shouldn’t be used as a measure of how much cash a company earned during a given period. That's because the net profit formula accounts for non-cash expenses like depreciation.

Note: To discover how much cash a company generates, examine the cash flow statement.

Net Profit Margin vs. Net Profit

Net profit is used to calculate net profit margin and is, therefore, a useful value metric for any company. Both are used by investors and owners to measure company success.

Net profit margin tells you how much of a company’s revenue translates to profit after expenses are paid. It’s a ratio of net income and is relative to revenue. More simply, the net profit margin turns the net profit (or bottom line) into a percentage.

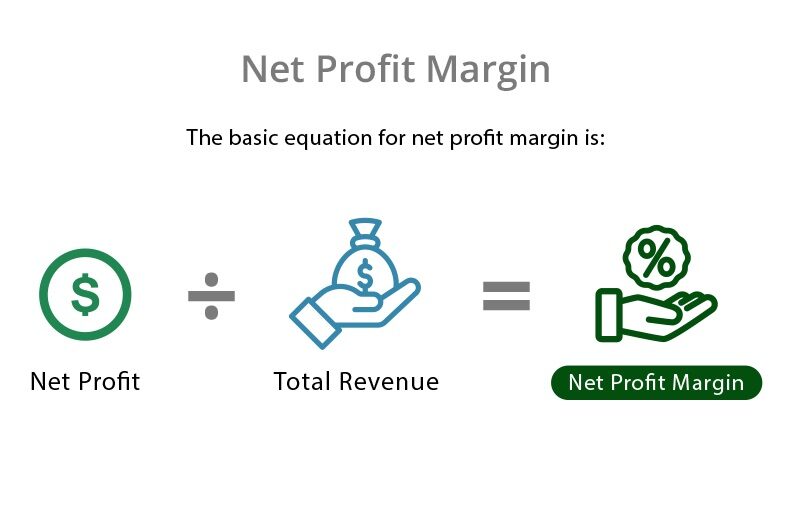

Net Profit Margin Formula

Using the above formula, Company XYZ's net profit margin would be $30,000/ $100,000 = 30%.

Why Net Profit Margin Is Important

There are two main reasons why net profit margin is useful:

1. Shows Growth Trends

Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period of time. For example, looking at a period of 5 years can show growth trends within the company.

2. Provides a Better Reference for Profitability

The net profit (which is represented by a dollar amount) can be vastly different between large and small companies. By providing a percentage, net profit margin provides a better reference for comparing the profitability of different companies.

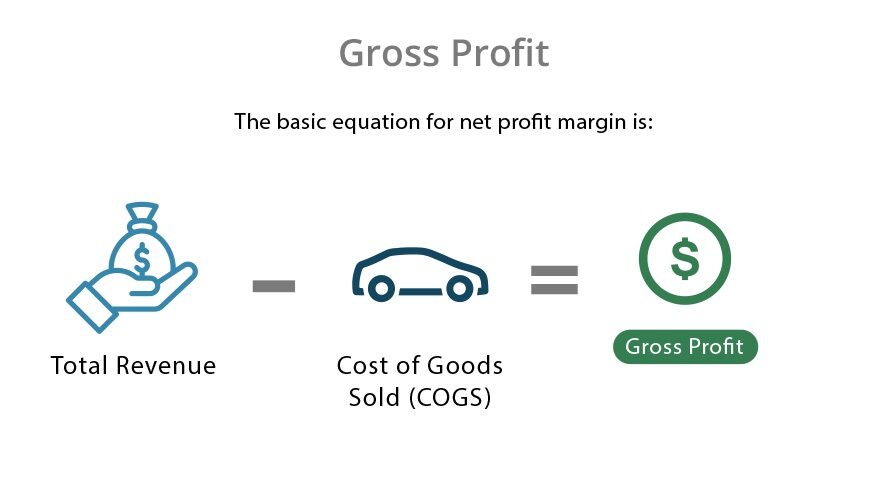

Gross Profit vs. Net Profit

Gross profit shows core profitability before overhead costs. This number can provide motivation for lowering expenses or raising the cost of goods sold (to improve profitability).

If you refer back to the income statement for Company XYZ, the gross profit was $80,000 and the net profit was $30,000. The difference between net profit and gross profit is what you'll subtract from the total revenue.

When considering the overall financial health of a company, net profit is arguably a better figure to review, specifically because it takes all expenses into account. However, both figures should be reviewed when comparing companies within the same industry.