Net Operating Profit After Tax (NOPAT)

One key indicator of a business success is net operating profit after tax (NOPAT). Considered an “apples-to-apples” measure, NOPAT helps investors determine how well one company is performing versus another in the same industry, regardless of how much debt they use to buy and control assets.

Although it may appear to be an arbitrary measurement, every investor searching for a long-term opportunity should look at net operating profit after tax.

This comprehensive financial definition has compiled everything you want to know about NOPAT – and how it can help you become a smarter investor.

What Is Net Operating Profit After Tax (NOPAT)?

Simply put, net operating profit after tax measures a company’s financial performance without considering the tax savings of debt, since it looks at operating profits exclusive of interest. The goal of using NOPAT is to compare multiple companies in the same industry based solely on their earnings, regardless of differences in leverage.

Because it is considered a measurement that puts companies on a level playing field, NOPAT is instrumental in calculating a company’s economic value added (EVA) measurement. Just as EVA reflects how well executive leaders are driving their business forward by creating returns for shareholders, a strong NOPAT suggests that leaders and managers are making the right moves to create a profitable business.

Alternatively, a weak NOPAT suggests that a company may experience limited growth, based on many different factors (e.g. business decisions, market conditions).

How Does Net Operating Profit After Tax (NOPAT) Work?

For investors and debt holders, NOPAT finance is considered a cornerstone measurement of how viable a business is now and will be in the future. That’s because NOPAT looks at sales and net income growth, but ignores interest paid on debt (and any tax advantages that come with it).

What makes NOPAT finance unique is that it squarely places value on a company’s profits from its core areas of business. When making financial decisions, investors and lenders look at net income growth and net operating profit. NOPAT takes it one step further by including the effects of taxes on operating profits.

How Do You Calculate Net Operating Profit After Tax?

Calculating net operating profit after tax is relatively simple. In order to determine how a company is performing without considering its debts or leverage, users multiply their operating income (before deducting for interest expense) by one minus the tax rate.

NOPAT Formula

There are two NOPAT formulas that investors and companies can use to calculate their net operating profit after tax.

The Simple NOPAT Formula

In this formula, an investor would determine the NOPAT by reviewing a company’s income statement. The effective tax rate is the percentage amount needed for taxes, so the remainder (1 - the effective tax rate) is the portion left after allowing for taxes.

Say that a business’ effective tax rate is 20%. The net operating profit after tax would be 80% of the company’s operating profit. It would be visually represented as 1 - 0.20.

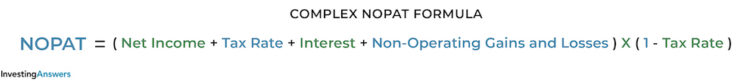

The Complex NOPAT Formula

For businesses trying to understand how they compare in the industry against publicly-traded companies, the complex formula for NOPAT is:

The longer formula includes more details of a company’s gross operations, including: tax collected, net interest earned from cash holdings or paid for debt, and gains and losses from areas outside their core business. By considering the sum of the entire operating income, company leaders can determine whether they are excelling against the competition or if there are operational areas with room for improvement.

NOPAT Example

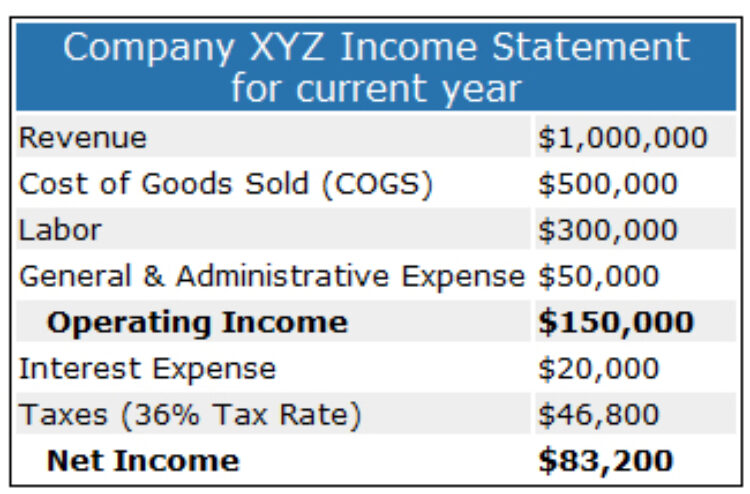

To see a NOPAT example, let’s look at the income statement of Company XYZ:

Although Company XYZ’s net income is $83,200, this bottom line number includes an interest expense of $20,000 paid on the company’s debt. To calculate the NOPAT, take the operating income ($150,000) and multiply it by the difference of 1 minus the tax rate (0.36):

NOPAT = $150,000 x (1 - 0.36)

The net operating profit after taxes is $96,000. This equals the 64% of net operating profit after the 36% tax rate.

Investors can also use NOPAT to compare two businesses in the same industry to determine which one is operating better. As a NOPAT example: Company XYZ’s main competitor is Company ABC. Both provide the same product in the same industry but have different levels of NOPAT

XYZ Company | ABC Company | |

Revenue | $1,000,000 | $2,350,000 |

Cost of Goods Sold | $500,000 | $1,175,000 |

Labor | $300,000 | $850,000 |

General & Administrative Expenses | $50,000 | $80,000 |

OPERATING INCOME | $150,000 | $245,000 |

Interest Expense | $20,000 | $150,000 |

Tax (36% Tax Rate) | $46,800 | $34,200 |

NET INCOME | $83,200 | $60,800 |

Comparing net income alone, it appears that Company XYZ is doing better. However, comparing NOPAT, Company ABC’s net operating profit after taxes is $156,800 is more than the NOPAT of Company XYZ ($96,000). An investor may take the next step of learning how Company ABC is operating more efficiently, or how they hold an offensive competitive strategy over Company XYZ.

NOPAT vs. EBIT

NOPAT and EBIT are often confused for one another. However, these two measurements have very different implications on business.

Earnings before interest and taxes (EBIT) show how profitable a company is before measuring the cost of capital (interest expense) or tax payments. EBIT is a comparative measurement to operating income because it shows how much a company is making before paying interest expenses or taxes.

On the other hand, NOPAT measures operating profits after the impact of taxes. Because taxes are a consideration, NOPAT is a better measurement of how a company is operating after expenses are taken from their net operating profit.

NOPAT vs. Net Income

Unlike NOPAT and EBIT, net income measures how well a company is doing by its bottom line. Net income is a business’s profit: revenue after costs, interest charges, and tax.

While both NOPAT and net income are important measures for investors and lenders, they are investigated for two different reasons:

1. While investors use NOPAT to determine operational efficiency and competitiveness within an industry, they will also look at net income to determine how solvent a company is.

2. Net income is important in lending decisions because it shows a company’s ability to maintain current and new debts.