What Are Net Assets?

Net assets are what a company owns outright, minus what it owes. Put another way, net assets equal the company assets (economic resources) minus liabilities (what is owed to someone else). For individuals, the concept is the same as net worth.

Net assets are virtually the same as shareholders' equity because it’s the company’s monetary worth.

How to Interpret Net Assets

Net assets provide a rough guide for the value of company resources. Typically, the higher a company's net asset value, the higher the value of a company.

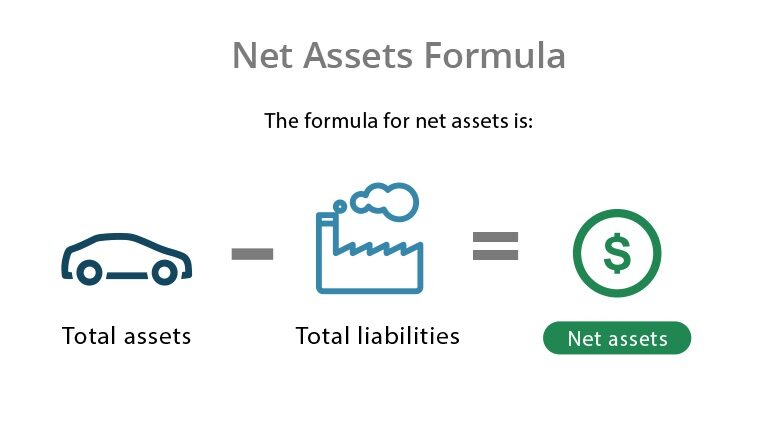

Net Assets Formula

You can find the figures for the net assets formula on the company balance sheet:

Net Assets Calculation

Let's assume that Company Z's balance sheet reported $10,500,000 in assets and $5,000,000 in total liabilities. The company's net assets would be:

$10,500,000 - $5,000,000 = $5,500,000 (Net Assets)

Note: Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). Net assets are not equal to the cash a company would have remaining if it sold everything.

Different Net Asset Calculations

To understand the variations with assets, there are several calculations. Each one provides different information regarding a company’s financial health. Below are some common ways to look at net assets within a company:

Net Operating Assets

A net operating asset (NOA) is a specific number that reflects operational value. It tells you which operating assets currently make the company money. Operating assets include elements like patents, inventory, equipment, and buildings.

NOA Formula

To calculate NOA, you’ll need to reorder the balance sheet. This calculation separates operations from financing activities like investments:

Net Fixed Assets

Net fixed assets show asset depreciation (ie. reduction of value over time). Fixed assets are purchased for the long term and are part of tangible assets. These can include buildings and equipment which will eventually need to be replaced or repaired.

Net fixed assets are useful for a company to keep track of what may need to be replaced in the future. If this number is low – but the total fixed asset number is high – the fixed assets will need attention.

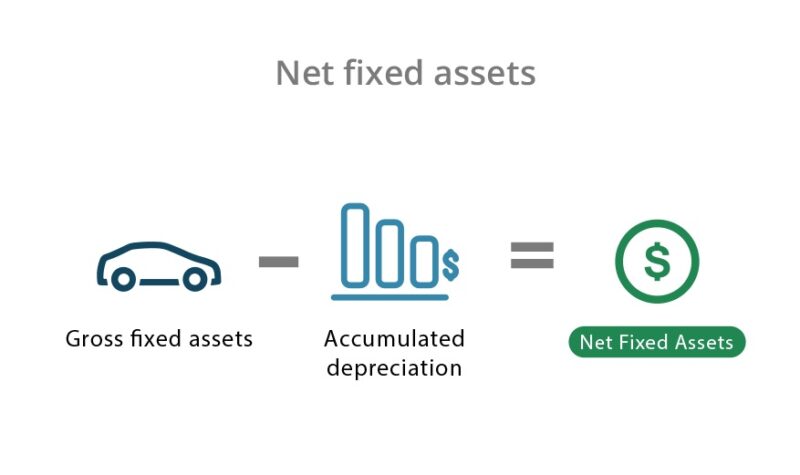

Basic Net Fixed Assets Formula

At its most basic level, net fixed assets equal gross fixed assets minus accumulated depreciation:

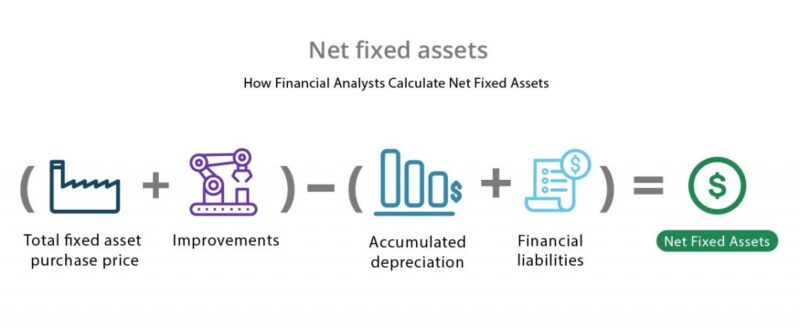

How Financial Analysts Calculate Net Fixed Assets

Financial analysts should calculate net fixed assets with a more complex formula (that includes any improvements and liabilities).

Net Tangible Assets

All companies have both tangible and intangible assets. Tangible assets are physical and can be sold (made liquid) for a predicted price. These include fixed assets and inventory while intangible assets include things like patents and brand ownership.

Net tangible assets provide a number that is focused only on the physical assets of a company. In some industries (like manufacturing), this will be especially important. In others (like the medical or scientific fields), net tangible assets may be much lower than intangible assets. This is a major reason why the entire balance sheet needs to be considered when analyzing a company.

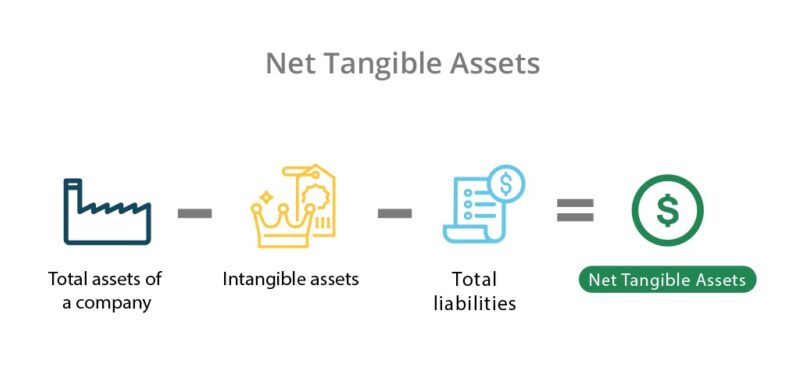

Net Tangible Assets Formula

Since tangible assets make up the majority of most companies’ balance sheets, it's a good metric to understand.

Unrestricted Net Assets

Unrestricted net assets are donations made to non-profit organizations. As long as it’s legitimate, the company can do what it needs to with this money. Non-profit organizations in the US report their net assets (without donor restrictions)on a Statement of Financial Position. This is similar to a balance sheet at for-profit companies.

While unrestricted assets are still in conversational use, the technical term was replaced with ‘net assets without donor restrictions' in 2018.

Why Net Assets are Important

Assets should provide a company with consistent returns. Net assets illustrate the assets owned by a company, as well as any debt that a company has.

Companies with negative net assets are usually in financial trouble. One solution is to sell off assets to generate cash and pay off debts. Another is to renegotiate debt to lower payments or principals.

Firms can file for Chapter 11 bankruptcy which would allow them to restructure their debts. If none of these tactics are successful, a firm with negative net assets will eventually end up in Chapter 7 bankruptcy.