What is EBITDA Margin

EBITDA margin is a measurement of a company's EBITDA (its earnings before interest, taxes, depreciation, and amortization) as a percentage of its total revenue.

EBITDA Margin Formula

The formula for EBITDA margin is:

EBITDA Margin = EBITDA / Total Revenue

A widely-used financial ratio, EBITDA margin provides investors with a better understanding of how much cash profit a company brought into its business in a given time period relative to its total revenue.

How to Calculate EBITDA Margin

The formula for EBITDA is:

EBITDA = EBIT + Depreciation + Amortization.

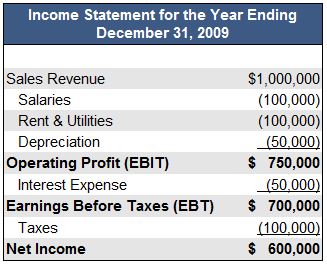

Let's take a look at a hypothetical income statement for Company XYZ:

To calculate EBITDA, we find the line items for EBIT ($750,000), depreciation ($50,000) and amortization (n/a) and then use the formula above:

EBITDA = 750,000 + 50,000 + 0 = $800,000

Using this information and the formula above, we can calculate Company XYZ's EBITDA margin as:

EBITDA Margin = $800,000/$1,000,000 = 80%

Why EBITDA Margin is Important

EBITDA provides investors with a way to evaluate a company's performance without having to factor in financing decisions, accounting decisions or tax environments. In turn, EBITDA margin provides more insight than a net income margin because the EBITDA margin minimizes the non-operating effects that are unique to every company. This gives investors a way to focus on operating profitability as a singular measure of performance. Such analysis is particularly important when comparing similar companies across a single industry, or companies operating in different tax brackets.

However, EBITDA margin can also be deceptive when applied incorrectly. It is especially unsuitable for firms saddled with high debt loads or those that must frequently upgrade costly equipment. Furthermore, EBITDA margins can be trumpeted by companies with low net income in an effort to 'window-dress' their profitability. That's because EBITDA will almost always be higher than reported net income.

Also, because EBITDA isn't regulated by GAAP, investors must rely on a company to decide what is, and is not, included in the calculation. There's also the possibility that a company may choose to include different items in their calculation from one reporting period to the next.