What is a Primary Uptrend?

When financial assets and markets -- as with the broader economy -- move in an upward direction for extended periods of time, it is known as a primary uptrend, or “bull market.”

How Does a Primary Uptrend Work?

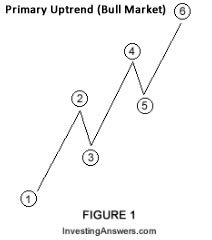

A primary uptrend is when each successive advance of the primary trend peaks and troughs higher than the one preceding it, and can last from several months to several years. This is illustrated in Figure 1 below.

Within a primary uptrend, several secondary reactions may occur against the trend, lasting for a few days, weeks or even months, but they don't necessarily change the definition of the overall trend.

In the stock market, for example, prices may drop precipitously, even during a powerful uptrend, for several weeks at a time. This is known as a 'correction.' If the uptrend is still in place, a rally will then ensue.

If a rally movement doesn’t succeed in breaking through the previous high, and the market subsequently declines to fall below a previous low, the movement has switched from a primary uptrend to a primary downtrend.

Why Does a Primary Uptrend Matter?

It is difficult for investors to precisely time primary uptrends because markets often rise higher than most investors and analysts anticipate -- and sometimes fall lower than they could possibly fathom.

Most investors are counseled to never bet against a primary uptrend. Trends can last for long periods of time, so as a general rule, investors should not buck the trend, which is akin to swimming against the tide.

[Keep track of changes in the economic environment and help protect yourself against any sudden or dramatic shifts in the years ahead by reading: The Death of Pensions: 5 Emerging Trends That Will Affect Us All.]