What is Market Price?

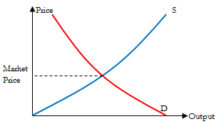

Market price is the price of an asset or product as determined by supply and demand.

How Does Market Price Work?

In the broadest sense, an item's market price lies at the point of intersection between the available supply of the good or service and market demand for it. Any shift in the supply or demand affects an item's market price. If demand is held constant, a decline in supply results in a rise in its market price and vice versa. Likewise, if supply is held constant, a rise in the demand for an item results in a rise in its market price and vice versa.

Why Does Market Price Matter?

The market price is the price at which a good or service is bought and sold most efficiently. However, in the real world, there is a great deal of enthusiasm for policies that impact market prices. Rent control laws in New York City, production quotas adopted by OPEC nations and trade barriers enacted by national governments are all example of policies that affect market prices in the real world.