What Is a Fixed Cost?

Fixed costs are independent expenses that companies must pay, regardless of what their business does. Because they cover expenses that help keep the business up and running, they are sometimes referred to as overhead costs.

Fixed costs do not change when goods or services produced or sold by a company move up or down. Fixed costs are not zero when production is zero.

How Do Fixed Costs Work?

Companies have both fixed costs and variable costs. Together, these make up total costs. Total costs are a part of how a company can influence their profitability.

Fixed costs vary between types of companies. For example, a manufacturer will likely have a higher overhead (fixed costs) than a mobile food truck.

What Are Typical Fixed Costs?

Fixed costs are managed with contract agreements or cost schedules. These fixed cost agreements are monitored regularly and may be adjusted over time.

Why are Fixed Costs Not Always Fixed?

Fixed costs may not change based on production or sales, but they are not ‘fixed’ in stone either. For example, rent (a fixed cost) may increase once the lease is up. Thus, the fixed cost will be adjusted.

Many cost items have both fixed and variable components. For example, management salaries typically do not vary with production. However, if production falls dramatically or reaches zero, layoffs may occur.

How to Calculate Fixed Cost

You can calculate fixed cost by:

- Reviewing company expenses on the income statement that occur regularly

- Add up these costs

The total is the fixed cost.

Fixed Cost vs. Average Fixed Cost

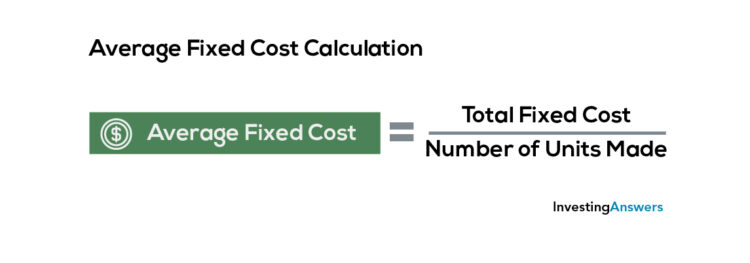

Fixed costs must be paid no matter what the company is producing or selling. Average fixed costs (AFC) are the fixed cost per unit of output.

If the company increases output, the AFC per unit will decrease. If you decrease the output, the AFC per unit will increase. Note: The fixed costs stay the same, but the amount of production changes and therefore spreads the fixed costs over more or less units.

How to Calculate Average Fixed Cost

Because fixed costs don’t change they can create economies of scale. This is a reduction in per-unit costs through an increase in production volume. This idea is also referred to as diminishing marginal returns.

Average Fixed Cost Example

Let's assume it costs Company XYZ $1,000,000 to produce 1,000,000 widgets per year. This $1,000,000 cost includes $500,000 of administrative, insurance, and marketing expenses. That $500,000 are the company’s fixed costs.

$500,000 / 1,000,000 = $0.50 average fixed cost per unit

If Company XYZ decides to produce 2,000,000 widgets next year, its total production costs may rise to about $1,500,000. However, the average fixed cost per unit will decrease because it’s spreading the fixed costs out over more units.

$500,000/2,000,000 = $0.25 average fixed cost per unit

Put another way, Company XYZ’s total costs increase from $1,000,000 to $1,500,000. However, each widget becomes less expensive to produce (and therefore more profitable) because fixed costs remained the same.

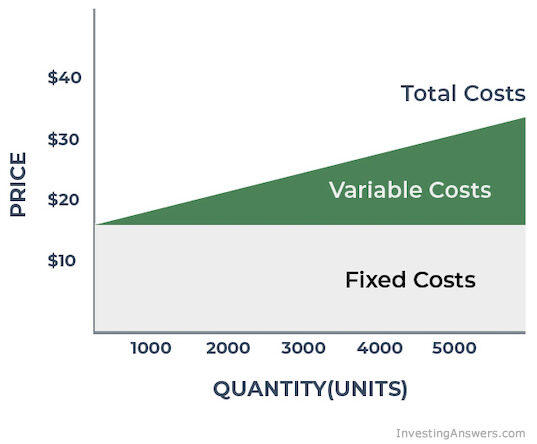

Fixed Costs vs. Variable Costs

Fixed costs must be paid by the company regardless of how much it produces or sells.

Variable costs, however, are directly related to the sales of the company. They are a direct function of production volume, rising whenever production expands (and falling whenever it contracts).

Examples of Fixed Cost vs. Variable Cost

Examples of fixed costs are rent, insurance premiums, and weekly payroll.

Examples of common variable costs include raw materials, packaging, delivery, and labor directly involved in a company's manufacturing process.

Total Cost vs. Fixed Cost vs. Variable Cost

Total cost is both the fixed cost and variable costs combined. Fixed costs typically remain stagnant until schedules or contracts change. Variable costs will change based on sales and production. This means that total costs will also change in line with these two numbers.