What is Refinancing?

Refinance refers to the replacement of a debt with new debt bearing different terms.

How Refinancing Works

Financing involves borrowing a specific amount of money over a length of time at an agreed-upon interest rate. Payments on the debt are divided between interest and principal. If circumstances change, for example, the length of time needed to repay the debt is longer and the lender agrees, the loan may be refinanced. This will extend the term and lower the period payments (because they are extended over a longer period of time). If interest rates change, the debt may also be refinanced using a lower interest rate.

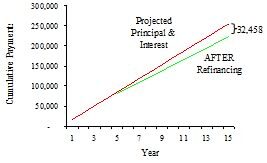

For example, the $150,000 loan below is shown with a term of 15 years at 8% per year. By year 5, the market interest rate drops to 5%. When the loan is refinanced over the balance of the term, for example, the savings in principal and interest payments on the loan will be over $32,000.

Refinancing may also convert an adjustable rate mortgage to a fixed-rate mortgage, reducing the interest rate risk to the borrower.

Why Refinancing Matters

Refinancing may be restricted on debts containing 'call provisions,' requiring a penalty payment in the event of a refinancing. In addition, a refinancing usually requires a closing and transaction fee that may be expensive. As a result, it is important to calculate the present value (the value in today's dollars) of the savings and compare it to the closing costs of the refinancing.