What is a Credit Card?

A credit card is issued by a financial institution that lets you borrow money to make a purchase. According to a recent Experian report, the average American holds 4 credit cards. Not only are credit cards a convenient way for people to buy things using borrowed funds, but they’re also excellent for earning rewards.

What You Need to Know About Paying Credit Cards

While a credit card allows a cardholder to instantly buy things online, on the phone, or at a store, there are consequences for not paying money back.

The Cardholder Must Pay the Lending Institution Back

You, the borrower, will need to pay back anything that is purchased on a credit card. It’s not free money.

A credit card balance is the amount the cardholder owes for unpaid purchases. If you carry a balance (meaning you do not pay the full credit card balance off each month), interest charges will occur.

There Are Two Ways to Pay off Your Credit Card Debt

Not paying off a credit card each month can have disastrous effects on your financial health. You will want to choose one of the options below:

Pay your balance in full and on time (by the invoice’s due date).

Carry a balance by paying less than the full balance or the minimum payment due.

Credit Card Payment Example

Let's say you apply and get approved for a credit card online or through your bank. After a month, you've charged $1,000 on your new credit card. The bank will send you an invoice for all the purchases you made within the latest 'billing cycle' (usually a 25-30 day period).

Scenario 1: Pay in Full and on Time

To pay your balance in full and on time, you’d repay the bank the entire $1,000 you spent during the last billing cycle.

Paying in full (and on time) means you won't need to pay interest charges or late fees, assuming you don't owe any past debts on that credit card.

Many credit cards come with perks like cash-back rewards or travel points. Paying off in full each month is the best way to rack up annual rewards over time and still remain debt-free.

Scenario 2: Make the Minimum Payment

The second option is to carry a balance on your credit card and pay it back over time. For most people, this typically means paying the minimum payment due, although it could also mean paying anything less than the full balance.

Paying a fraction of the total owed for the billing cycle means you will incur charges. Unless you are on a special 0% APR introductory offer, interest will compound on the remaining balance.

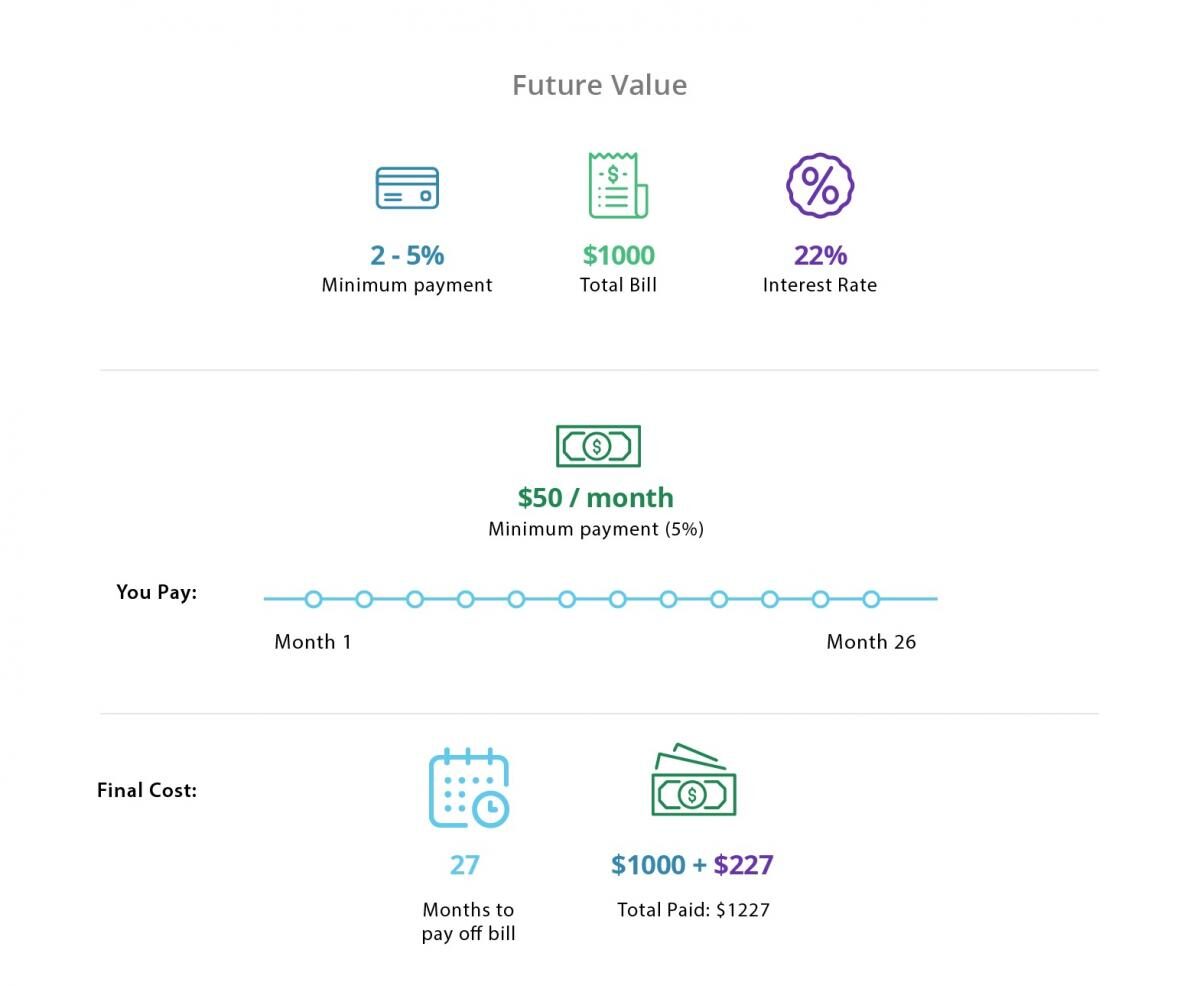

Let’s say you only pay the minimum (typically between 2% to 5%) of the total bill of $1,000. In this case, you paid $50 (5%) and the interest rate is 22%. If you continue to pay $50 each month until the balance is paid off, you will also pay an additional $227.00 in interest. This means you spent $1,000 and paid back $1,227. At this rate, it would take about 26 months to fully pay off the card.

To avoid interest and credit card debt, it’s often advisable to pay off your credit card balance in full each month (if possible). At the very least, pay off your credit card balance before the 0% APR offer goes away.

Credit Card Terminology You Should Know

Paying off a credit card balance is only one responsibility of a credit holder: It’s also the borrower’s job to know certain credit card terms.

What Is a Credit Limit?

Credit cards grant you a specific amount of money you can borrow during a given period. This is called the credit limit. The credit limit is pre-determined by the card issuer, based on the cardholder's credit score and credit history.

What Determines the Credit Card Interest Rate (i.e. APR)?

The interest rate for credit cards typically ranges between 10% to 25% but may be even more.

An individual's credit score and credit history influence the credit card's interest rate or annual percentage rate (APR). Generally, the higher your credit score, the lower APR you can qualify for.

Interest rates are not set in stone. Lenders may raise the APR if a borrower's credit score worsens or if national interest rates rise. Many card issuers offer introductory 0% APR offers for a period of time to incentivize credit card use. These will later return a much higher interest rate.

What Charges and Fees Do Credit Cards Have?

In addition to interest charges for carrying a balance, many credit cards also have the following fees:

An annual fee

Late payment fees

Fees for going over the credit limit

Cash-advance fees and,

Foreign currency conversion fees

Related: 6 steps to avoid credit card late fees

To avoid unpleasant surprises, It's important for the cardholder to read and understand the issuer's disclosure statement.

Credit Score Basics

Credit scores range from 300 to 850. The higher a person's score, the more creditworthy they are. According to Experian, a good credit score is 700 or above. An excellent credit score would be considered anything above 800. Borrowers with this kind of credit score are more likely to qualify for the best credit card offers.

To calculate your credit score, the following information is taken into account:

Payment history (35% of score)

Total amount owed by an individual (30% of score)

The length of credit history (15% of score)

New lines of credit (10% of score)

The types of credit accounts such as auto loan, mortgage, credit cards (10% of score)

The credit bureau collects and provides this information to potential lenders and creditors.

How Credit Cards Affect Your Credit Score

Credit cards can help you raise or lower your credit score, depending on how you use them:

Opening and Closing Accounts

Opening a new account and keeping it in good standing can help to raise your credit score. That’s because payment history and new lines of credit are calculated into your credit score.

Every time you apply for a credit card, the issuer will run a credit check. This can cause your score to drop a few points but this is a necessary hit for opening any new account. A large number of credit card applications within a short period of time can cause your score to drop even more. It’s best to limit your number of applications to avoid this.

Closing an account means your credit utilization will change, which in turn can possibly cause your credit score to drop. Instead of closing an account, you may try cutting up the credit card or restricting its use (but keeping the line of credit open).

Carrying a High Balance

The less you utilize your credit, the more you can raise/maintain your credit score. Remember: The amount of debt you carry can cause credit scores to rise or fall. If you pay off your balance each month, you won’t have to worry about high balances (and your credit score).

Making Late Payments

Your payment history is a major part of your credit score calculation. Maintain on-time payments because any late payments are reflected in your credit report and credit score.

Types of Credit Cards

There are several types of cards suited for specific needs. The three most common types of credit cards include:

Secured Credit Cards

A secured credit card can be a good credit-building option for those with zero credit history or poor credit. They’re also the easiest credit card to be approved for.

Under this secured card arrangement, the cardholder agrees to deposit a certain amount into the card before they start using it. The deposited amount is the cardholder’s credit limit. This reduces risk for the card-issuing bank as they can collect an up-front deposit in the event the cardholder can't repay.

Cash Back Credit Cards

With a cash back credit card, you can quite literally earn ‘cash back’ for your purchases on a monthly or annual basis. Cash-back reward cards can offer between 1% to 5% back on purchases (meaning cardholders might earn between $1 to $5 for every $100 charged).

Travel Credit Cards

A travel rewards credit card allows you to earn points for your purchases on a monthly or annual basis. These points can be redeemed for things like airline tickets, hotel stays, and travel expenses.

Choosing the Best Credit Card

With so many options, it can be hard to choose the right credit card for you. There are a few tips, however, for selecting one:

If you’re building your credit, choose a secured credit card.

If you plan to carry a balance, choose a 0% APR card with a fixed APR after the introductory offer.

If you’re doing a balance transfer, choose a 0% APR card.

If you can pay off the card each month, focus on the rewards you can gain.

For more tips on choosing the best credit card, check out our article that breaks down credit card offers.

Related: Top 5 Rewards Credit Cards of 2019

How to Get a Credit Card

You must be at least 18 years old to get a credit card. Below are the basic steps for getting a credit card:

Look up your credit score to see where you stand

Choose a card that offers the most beneficial rewards for your lifestyle.

Find an introductory offer online that offers either 0% APR or a great sign up bonus.

Read all the credit terms and conditions to understand the fees, interest rates, and benefits.

Complete an application. You will need to provide proof of income.

Wait for approval. Do not apply for more credit cards until you hear back.

Once approved, set up an online account with reminders so you never miss a payment.

How Credit Card Consolidation Works

If you are in major credit card debt, you might be considering a credit card consolidation loan. When this happens, the lender will pay off your credit card debt and issue a new loan with a fixed monthly payment and interest rate. Ideally, this interest rate is lower than your credit card interest rates and your monthly payments are more affordable.

A credit card consolidation loan is a valid option for those with overwhelming debt, but you may want to consider a balance transfer first.

What Is a Balance Transfer?

A balance transfer is ideal for borrowers carrying a balance on one or more credit cards (but who may be trying to get out of debt). The cardholder may transfer and consolidate existing credit card balances onto a balance transfer card. They may be able to repay that debt at 0% interest for a period of time.

Related: The Top 4 Balance Transfer Credit Cards for 2020

A Credit Card Can Be a Great Tool – When Used Properly

Using a credit card can either help or hinder your financial position. While you can use a credit card to fund an emergency or pay for a large purchase over time, it’s important to have a plan to pay it back – and avoid major credit card debt.