What is Red?

Red is slang for loss. Losses are the negative amount remaining after all costs, depreciation, interest, taxes, and other expenses have been deducted from total sales. The formula for profit is:

Total Sales - Total Expenses = Profit

When expenses exceed sales, a company is “in the red.”

How Does Red Work?

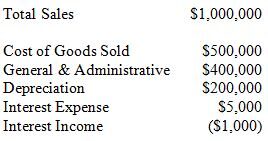

Here is some information about Company XYZ for last year:

Using the formula and the information above, we can calculate that Company XYZ's profit was:

$1,000,000 - $500,000 - $400,000 - $200,000 - $5,000 + $1,000 = -$104,000

This means that Company XYZ lost $104,000 last year. It was “in the red.”

Why Does Red Matter?

Philosophically speaking, being in the red is bad. Being in “the black,” which means a company is profitable, is what motivates industry, entrepreneurship and innovation. It is the very thing that enables people to feed themselves, clothe their families, create jobs and set money aside for the future.

Profit is one of the most analyzed numbers a company can produce, and it plays a part in many other financial measures. It is also important to understand that changes in accounting methods can greatly influence whether a company is in the red, and these changes may have little to do with a company's actual operations.

In the retail industry, companies are often in the red until the fourth quarter, when Christmas shopping begins. This is the source of the term “Black Friday.”